Page 211 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 211

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – UNI

Universal Partners Ltd. Visual International Holdings Ltd.

UNI VIS

ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL ISIN: ZAE000187407 SHORT: VISUAL CODE: VIS

REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016 REG NO: 2006/030975/06 FOUNDED: 2006 LISTED: 2014

NATURE OF BUSINESS: Universal Partners is a permanent capital NATURE OF BUSINESS: Visual is a property development company,

investment holding company. Universal Partners seek investments in which requires development funding and “patient” money. Due to

high-potential,growthbusinesses,withafocusontheUnitedKingdom,and industry developments, the banking sector had been reticent to provide

Europe. Twenty percent of the company’s funds may be allocated to other development loans and also to provide end user finance to Visual’s target

regions. The company’s experienced leadership team is recognised for its segment. However, although the approval processes took longer than

strong track record of managing and growing successful businesses. expected, the Company finally generated revenue during the current year

Universal Partners provide growth capital to high quality businesses that from the development of The Marine, Strand. With City of Cape Town

meet their investment criteria. The company adds value by drawing on their approval of the building plans for Stellendale Junction and construction of

extensive experience to offer strategic direction to the companies they Phase 1, known as They Knysna finally underway, Visual is now getting

partner with. Universal Partners are patient investors with a permanent back to business.

capital structure and are committed to achieving the best long-term The securing of development funding for its other property developments

outcomes for both the businesses they invest in and for their investors.

SECTOR: AltX will be a key initiative in the 2024/2025 years.

NUMBER OF EMPLOYEES: 0 SECTOR: AltX

DIRECTORS: Chan F (ne, Mau), KurnauthTN(ne), Page N (ind ne), NUMBER OF EMPLOYEES: 3

Rubenstein D (ne), Spellins G (ind ne, UK), Ooms M (Chair, ind ne), DIRECTORS: Matlholwa L (ne), Vorster T (ind ne),

Joubert P (CEO), Vinokur D (CFO) Richards Dr R (Chair, ind ne), Robertson C K (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Kadalie R (Acting CFO)

Glenrock Lux Pe No2 S.C.SP. 18.52% MAJOR ORDINARY SHAREHOLDERS as at 20 Dec 2024

Glenrock Lux PE No1 S.C.SP. 15.59% CKR Investment Trust 39.34%

Peresec Nominees Ltd. 13.76% RAL Trust 18.85%

POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene, Transflora Properties (Pty) Ltd. 7.52%

Mauritius, 72201 POSTAL ADDRESS: PO Box 3163, Tyger Valley, 7536

MORE INFO: www.sharedata.co.za/sdo/jse/UPL MORE INFO: www.sharedata.co.za/sdo/jse/VIS

COMPANY SECRETARY: Intercontinental Trust Ltd. COMPANY SECRETARY: Light Consulting (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd. DESIGNATED ADVISOR: AcaciaCap Advisors (Pty) Ltd.

AUDITORS: Grant Thornton AUDITORS: LDP Inc.

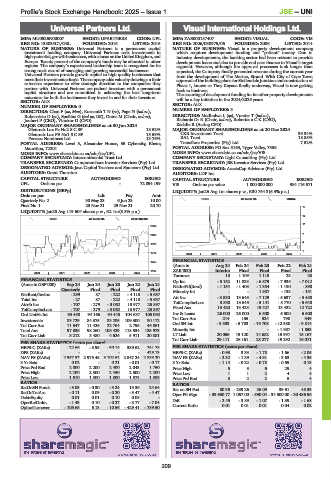

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

UPL Ords no par - 72 894 199 VIS Ords no par value 1 000 000 000 984 116 671

DISTRIBUTIONS [GBPp] LIQUIDITY: Jan25 Avg 1m shares p.w., R30 764.3(6.3% p.a.)

Ords no par Ldt Pay Amt

Quarterly No 2 30 May 23 6 Jun 23 10.00 REDS 40 Week MA VISUAL

Final No 1 23 Nov 21 29 Nov 21 20.70 17

LIQUIDITY: Jan25 Avg 119 604 shares p.w., R2.1m(8.5% p.a.)

14

GENF 40 Week MA UPARTNERS

11

2500

7

2239

4

1979

1

1718 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

1457

(Amts in Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

1197 ZAR’000) Interim Final Final Final Final

2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 13 1 109 1 115 23 23

FINANCIAL STATISTICS Op Inc - 5 152 11 833 - 6 579 - 7 935 - 7 012

(Amts in GBP’000) Sep 24 Jun 24 Jun 23 Jun 22 Jun 21 NetIntPd(Rcvd) - 1 154 - 1 408 - 1 354 - 1 190 - 890

Quarterly Final Final Final Final Minority Int - - 1 987 - 133 - 151

NetRent/InvInc - 299 87 - 222 - 4 118 - 5 637

Total Inc - 27 87 - 222 - 4 118 - 5 637 Att Inc - 3 830 13 645 - 7 129 - 5 637 - 5 488

Attrib Inc - 707 - 279 - 3 062 13 977 25 897 TotCompIncLoss 3 830 13 645 - 5 141 - 5 770 - 5 640

TotCompIncLoss - 707 - 279 - 3 062 13 977 25 897 Fixed Ass 13 420 13 423 13 427 13 432 12 722

Ord UntHs Int 93 458 94 166 94 445 104 637 105 092 Inv & Loans 26 000 26 000 6 500 6 500 6 500

Investments 83 729 84 375 83 205 109 300 80 112 Tot Curr Ass 214 155 324 790 349

Tot Curr Ass 11 647 11 426 22 764 2 795 45 861 Ord SH Int - 9 533 - 5 703 - 19 708 - 12 580 - 9 814

Total Ass 97 836 98 260 108 429 118 534 125 973 Minority Int - - - - 1 987 - 1 853

Tot Curr Liab 3 212 3 480 4 624 5 911 20 881 LT Liab 20 056 19 120 14 682 15 997 15 167

Tot Curr Liab 29 111 26 161 25 277 19 292 16 071

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 22.66 - 8.95 - 90.14 389.62 741.78 PER SHARE STATISTICS (cents per share)

DPS (ZARc) - - - - 425.13 HEPS-C (ZARc) - 0.93 3.33 - 1.78 - 1.66 - 2.05

NAV PS (ZARc) 2 957.57 2 975.48 3 102.62 2 847.24 2 883.20 NAV PS (ZARc) - 2.32 - 1.39 - 4.91 - 3.63 - 4.35

3 Yr Beta 0.02 - 0.21 - 0.01 - 0.17 3 Yr Beta - 1.14 - 0.22 - 0.78 - 0.69 0.13

Price Prd End 2 000 2 200 2 400 2 043 1 750 Price High 5 3 6 29 4

Price High 2 200 2 500 2 450 2 500 2 200 Price Low 1 1 2 4 4

Price Low 1 610 1 800 1 800 1 573 1 389 Price Prd End 3 2 2 5 4

RATIOS RATIOS

RetOnSH Funds - 3.03 - 0.30 - 3.24 13.36 24.64

RetOnTotAss - 0.11 0.09 - 0.20 - 3.47 - 4.47 Ret on SH Fnd 80.35 - 239.26 26.09 39.61 48.33

Debt:Equity 0.01 0.01 0.10 0.08 - Oper Pft Mgn - 39 630.77 1 067.00 - 590.04 - 34 500.00 - 30 486.96

OperRetOnInv - 1.43 0.10 - 0.27 - 3.77 - 7.04 D:E - 2.45 - 3.89 - 1.07 - 1.39 - 1.68

OpInc:Turnover - 105.65 6.13 - 10.56 - 429.41 - 789.50 Current Ratio 0.01 0.01 0.01 0.04 0.02

209