Page 213 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 213

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – VUN

Vunani Ltd. We Buy Cars Holdings Ltd.

VUN WEB

ISIN: ZAE000163382 SHORT: VUNANI CODE: VUN ISIN: ZAE000332789 SHORT: WEBUYCARS CODE: WBC

REG NO: 1997/020641/06 FOUNDED: 1997 LISTED: 2007 REG NO: 2020/632225/06 FOUNDED: 2020 LISTED: 2024

NATURE OF BUSINESS: Vunani is an independent black-owned and NATURE OF BUSINESS: In the early 2000s, brothers Faan and Dirk van

managed diversified financial services group with a robust operational der Walt observed that for individual consumers, selling an older vehicle in

platform that supports an innovative and fully integrated range of products the South African market was a lengthy and difficult process. They

and services. The company is owner-managed by professionals who have a established the WeBuyCars brand in 2001 to provide vehicle ownerswith a

passion for entrepreneurship and has solidified its position as one of the quick, easy and trusted solution to sell their vehicles. The Company

country’s leading boutique providers. recognised a gap in the market to facilitate efficient vehicle sales which it

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services was able to achieve through formalising the preowned motor vehicle

NUMBER OF EMPLOYEES: 386 market. The ability of customers to efficiently sell or buy a vehicle or to sell

DIRECTORS: Anderson N M, GoldingMJA(ne), Khoza B M, their vehicle to a reputable, trusted company, quickly grew the customer

Macey J (ind ne), MazwiNS(ind ne), Mthethwa S (ne), Nzalo G (ind ne), base of WeBuyCars.

Jacobs L I (Chair, ind ne), Dube E G (Group CEO), Mika T (CFO) SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 NUMBER OF EMPLOYEES: 0

Bambelela Capital (Pty) Ltd. 49.20% DIRECTORS: AmoilsKB(ne), KrugerNAS(ld ind ne), Mathews B (ne),

Geomer Investments (Pty) Ltd. 18.60% Mendelowitz M (ne), RoosWT(ne), Totaram S (ne), van der Walt D J,

POSTAL ADDRESS: PO Box 652419, Benmore, 2010 Holtzhausen J A (Chair, ne), van der Walt A S (CEO), Rein C J (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/VUN MAJOR ORDINARY SHAREHOLDERS as at 15 Nov 2024

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. Coronation Asset Management 29.75%

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. I VDW Holdings 25.10%

Public Investment Corporation (SOC) Ltd.

10.41%

SPONSOR: Vunani Sponsors MORE INFO: www.sharedata.co.za/sdo/jse/WBC

AUDITORS: BDO South Africa Inc.

COMPANY SECRETARY: PJC Vorster

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

VUN Ords no par value 500 000 000 161 155 915 SPONSORS: Pallidus Capital (Pty) Ltd., PSG Capital (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: Deloitte, PwC Inc.

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 14 9 Jul 24 15 Jul 24 9.00 WBC Ords no par val 10 000 000 000 417 312 804

Interim No 13 21 Nov 23 27 Nov 23 9.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jan25 Avg 98 553 shares p.w., R179 970.3(3.2% p.a.) Ords no par val Ldt Pay Amt

Final No 1 3 Dec 24 9 Dec 24 25.00

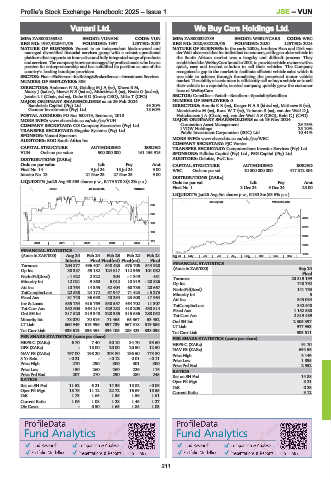

GENF 40 Week MA VUNANI

LIQUIDITY: Jan25 Avg 5m shares p.w., R160.3m(63.5% p.a.)

80 Day MA WEBUYCARS

263

226

4265

190

3678

153

3092

116

2020 | 2021 | 2022 | 2023 | 2024 |

2505

FINANCIAL STATISTICS

1918

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 Apr 24 | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

Interim Final Final(rst) Final(rst) Final

Turnover 204 377 496 407 548 423 676 705 544 928 FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 24

Op Inc 38 387 55 182 124 617 112 965 101 082 Final

NetIntPd(Rcvd) - 1 622 2 322 304 - 1 349 451 Turnover 23 319 199

Minority Int 12 021 9 860 5 012 10 919 - 20 826 Op Inc 748 792

Att Inc 10 764 14 355 52 404 60 785 20 667 NetIntPd(Rcvd) 141 753

TotCompIncLoss 22 538 24 172 57 947 71 423 - 5 273 Minority Int 5

Fixed Ass 31 740 36 690 40 294 23 508 17 964 Att Inc 343 084

Inv & Loans 685 754 616 769 530 557 464 702 11 307 TotCompIncLoss 342 648

Tot Curr Ass 352 603 364 214 429 282 418 205 430 814 Fixed Ass 1 152 588

Ord SH Int 317 520 319 348 328 385 315 686 280 052 Tot Curr Ass 2 819 489

Minority Int 78 070 70 516 71 465 65 367 53 452 Ord SH Int 2 305 397

LT Liab 660 949 619 996 597 739 567 318 519 686 LT Liab 977 953

Tot Curr Liab 333 613 336 454 334 105 288 423 338 098

Tot Curr Liab 903 511

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 6.70 7.40 30.10 34.70 33.60 HEPS-C (ZARc) 91.70

DPS (ZARc) - 18.00 20.00 20.50 12.50 NAV PS (ZARc) 694.56

NAV PS (ZARc) 197.00 198.20 203.80 196.50 173.80 Price High 3 149

3 Yr Beta - 0.21 - - 0.12 0.01 - 0.11 Price Low 1 895

Price High 270 290 300 301 300 Price Prd End 2 952

Price Low 150 260 260 226 116 RATIOS

Price Prd End 207 270 290 280 245 Ret on SH Fnd 14.88

RATIOS Oper Pft Mgn 3.21

Ret on SH Fnd 11.52 6.21 14.36 18.82 - 0.05 D:E 0.25

Oper Pft Mgn 18.78 11.12 22.72 16.69 18.55 Current Ratio 3.12

D:E 1.73 1.65 1.55 1.56 1.61

Current Ratio 1.06 1.08 1.28 1.45 1.27

Div Cover - 0.50 1.65 1.85 1.03

211