Page 215 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 215

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – WOO

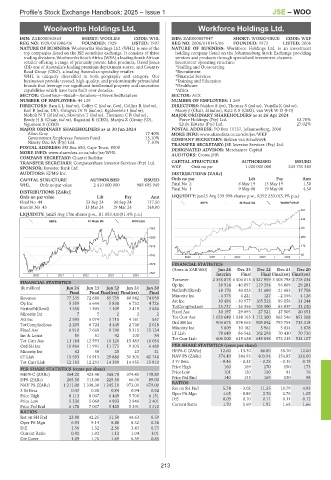

Woolworths Holdings Ltd. Workforce Holdings Ltd.

WOO WOR

ISIN: ZAE000063863 SHORT: WOOLIES CODE: WHL ISIN: ZAE000087847 SHORT: WORKFORCE CODE: WKF

REG NO: 1929/001986/06 FOUNDED: 1929 LISTED: 1997 REG NO: 2006/018145/06 FOUNDED: 1972 LISTED: 2006

NATURE OF BUSINESS: Woolworths Holdings Ltd. (WHL) is one of the NATURE OF BUSINESS: Workforce Holdings Ltd. is an investment

top companies listed on the JSE securities exchange. It consists of three holding company listed on the Johannesburg Stock Exchange providing

tradingdivisions,WoolworthsSouthAfrica (WSA)aleadingSouthAfrican services and products through specialised investment clusters.

retailer offering a range of primarily private label products, David Jones Investment operating structure:

(DJ) one of Australia’s leading premium department stores, and Country *Staffing and Outsourcing

Road Group (CRG), a leading Australian speciality retailer. *Recruitment

WHL is uniquely diversified in both geography and category. Our *Financial Services

businesses provide trusted, high-quality, and predominantly privatelabel *Training and Education

brands that leverage our significant intellectual property and innovation *Healthcare

capabilities which have been built over decades. *Africa

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers SECTOR: AltX

NUMBER OF EMPLOYEES: 44 129 NUMBER OF EMPLOYEES: 1 269

DIRECTORS: BamLL(ind ne), Colfer C (ind ne, Can), Collins R (ind ne), DIRECTORS: Naidoo S (ne), Thomas S (ind ne), Vundla K (ind ne),

Earl B (ind ne, UK), Gwagwa Dr N (ind ne), Kgaboesele I (ind ne), Macey J (Chair, ld ind ne), Katz R S (CEO), van Wyk W O (FD)

MoholiNT(ld ind ne), Skweyiya T (ind ne), ThomsonCB(ind ne), MAJOR ORDINARY SHAREHOLDERS as at 26 Apr 2024

Brody H R (Chair, ind ne), Bagattini R (CEO), Manjra Z (Group FD), Force Holdings (Pty) Ltd. 62.70%

Ngumeni S (COO) Little Kittens (Pty) Ltd. 27.02%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 POSTAL ADDRESS: PO Box 11137, Johannesburg, 2000

Allan Gray 17.40% MORE INFO: www.sharedata.co.za/sdo/jse/WKF

Government Employees Pension Fund 15.10% COMPANY SECRETARY: Sirkien van Schalkwyk

Ninety One SA (Pty) Ltd. 7.10% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 680, Cape Town, 8000 DESIGNATED ADVISOR: Merchantec Capital

MORE INFO: www.sharedata.co.za/sdo/jse/WHL AUDITORS: Crowe JHB

COMPANY SECRETARY: Chantel Reddiar

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Investec Bank Ltd. WKF Ords no par 1 000 000 000 243 731 343

AUDITORS: KPMG Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords no par Ldt Pay Amt

WHL Ords no par value 2 410 600 000 988 695 949 Final No 2 6 May 19 13 May 19 1.50

Final No 1 9 May 08 19 May 08 4.50

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt LIQUIDITY: Jan25 Avg 239 998 shares p.w., R392 253.0(5.1% p.a.)

Final No 44 23 Sep 24 30 Sep 24 117.50 SUPS 40 Week MA WORKFORCE

Interim No 43 13 Mar 24 19 Mar 24 148.00

521

LIQUIDITY: Jan25 Avg 17m shares p.w., R1 083.4m(91.4% p.a.)

434

GERE 40 Week MA WOOLIES

7962 347

6889 260

5816 172

4743 85

2020 | 2021 | 2022 | 2023 | 2024 |

3670 FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

2597 Interim Final Final Final(rst) Final(rst)

2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 2 355 875 4 504 615 4 327 959 3 503 798 2 778 034

FINANCIAL STATISTICS

Op Inc 38 914 - 40 097 119 354 96 869 29 281

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 NetIntPd(Rcvd) 18 170 40 023 31 689 21 683 17 758

Final Final Final(rst) Final(rst) Final

Revenue 77 335 72 688 65 739 80 942 74 058 Minority Int - 4 373 4 221 127 - 2 156 4 126

Op Inc 5 359 6 644 5 838 6 732 4 726 Att Inc 30 496 - 30 977 105 532 89 058 31 244

NetIntPd(Rcvd) 1 558 1 303 1 109 2 419 2 626 TotCompIncLoss 25 737 - 26 356 105 300 85 839 33 230

Minority Int 7 5 2 2 2 Fixed Ass 30 197 29 093 27 521 27 505 20 651

851 308

Att Inc 2 593 5 074 3 715 4 161 557 Tot Curr Ass 1 029 649 1 038 165 1 172 300 962 546 713 318

908 842

Ord SH Int

904 675

874 565

799 754

TotCompIncLoss 2 205 6 724 4 448 2 748 2 018

Fixed Ass 8 910 7 669 9 190 9 315 15 134 Minority Int 5 809 10 182 5 961 5 834 3 678

Inv & Loans 85 51 92 100 84 LT Liab 78 649 86 542 102 298 70 410 70 730

Tot Curr Ass 11 184 12 593 16 126 15 483 16 034 Tot Curr Liab 606 000 615 624 648 848 572 315 512 107

Ord SH Int 10 864 11 991 11 775 9 305 6 489 PER SHARE STATISTICS (cents per share)

Minority Int 62 30 25 23 21 HEPS-C (ZARc) 12.60 - 13.30 46.80 38.70 12.00

LT Liab 15 593 14 913 29 880 31 305 42 746 NAV PS (ZARc) 374.49 384.93 403.94 354.85 326.00

Tot Curr Liab 12 183 12 293 14 399 14 955 15 810 3 Yr Beta - 0.46 - 0.32 - 0.28 - 0.15 0.19

Price High 160 169 170 150 173

PER SHARE STATISTICS (cents per share)

91

HEPS-C (ZARc) 364.20 423.40 368.70 374.40 119.80 Price Low 101 120 130 130 76

169

Price Prd End

140

135

98

DPS (ZARc) 265.50 313.00 229.50 66.00 89.00

NAV PS (ZARc) 1 211.00 1 338.30 1 245.10 973.00 679.00 RATIOS

3 Yr Beta 0.43 0.38 0.84 0.94 0.92 Ret on SH Fnd 5.74 - 3.02 11.55 10.79 4.93

Price High 8 113 8 047 6 449 5 700 6 151 Oper Pft Mgn 1.65 - 0.89 2.76 2.76 1.05

Price Low 5 330 5 060 4 903 2 940 2 401 D:E 0.09 0.10 0.11 0.11 0.12

1.66

1.81

1.68

1.70

Current Ratio

1.69

Price Prd End 6 178 7 037 5 425 5 391 3 310

RATIOS

Ret on SH Fnd 23.80 42.25 31.50 44.63 8.59

Oper Pft Mgn 6.93 9.14 8.88 8.32 6.38

D:E 1.56 1.32 2.56 3.43 6.73

Current Ratio 0.92 1.02 1.12 1.04 1.01

Div Cover 1.09 1.76 1.69 6.59 0.65

213