Page 210 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 210

JSE – TRU Profile’s Stock Exchange Handbook: 2025 – Issue 1

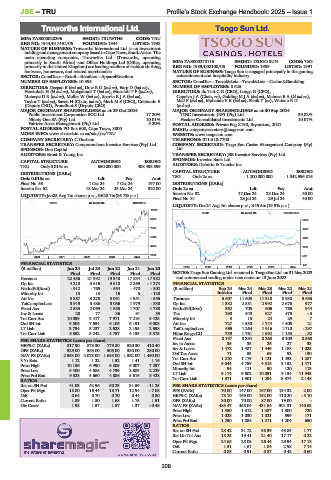

Truworths International Ltd. Tsogo Sun Ltd.

TRU TSO

ISIN: ZAE000028296 SHORT: TRUWTHS CODE: TRU

REG NO: 1944/017491/06 FOUNDED: 1944 LISTED: 1998

NATURE OF BUSINESS: Truworths International Ltd. is an investment

holding and management company based in Cape Town, South Africa. The

main operating companies, Truworths Ltd. (Truworths, operating

primarily in South Africa) and Office Holdings Ltd.(Office, operating ISIN: ZAE000273116 SHORT: TSOGO SUN CODE: TSG

primarily in the United Kingdom) are leading retailers of fashion clothing, REG NO: 1989/002108/06 FOUNDED: 1989 LISTED: 1991

footwear, homeware, and related merchandise. NATURE OF BUSINESS: Tsogo Sun is engaged principally in the gaming,

SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers entertainment and hospitality industry.

NUMBER OF EMPLOYEES: 10 395 SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling

DIRECTORS: Deegan B (ind ne), DowRG(ind ne), Earp D (ind ne), NUMBER OF EMPLOYEES: 8 625

Hawinkels H (ld ind ne), Mokgabudi T (ind ne), MosololiTF(ind ne), DIRECTORS: du Toit C G (CEO), Lunga G (CFO),

MotsepeDR(ind ne), Muller W (ind ne), SparksRJA(ind ne), Copelyn J A (Chair, ne), GoldingMJA(ind ne), MabuzaBA(ld ind ne),

Taylor T (ind ne), Saven H (Chair, ind ne), Mark M S (CEO), Cristaudo E Mall F (ind ne), MphandeVE(ind ne), Shaik Y (ne), Watson R D

(Deputy CEO), Proudfoot S (Deputy CEO) (ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 29 Oct 2024 MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024

Public Investment Corporation SOC Ltd. 17.20% TIHC Investments (RF) (Pty) Ltd. 39.82%

Ninety One SA (Pty) Ltd. 10.01% Hosken Consolidated Investments Ltd. 10.07%

Fairtree Asset Management (Pty) Ltd. 5.20% POSTAL ADDRESS: Private Bag X190, Bryanston, 2021

POSTAL ADDRESS: PO Box 600, Cape Town, 8000 EMAIL: companysecretary@tsogosun.com

MORE INFO: www.sharedata.co.za/sdo/jse/TRU WEBSITE: www.tsogosun.com

COMPANY SECRETARY: C Durham TELEPHONE: 011-510-7700

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Tsogo Sun Casino Management Company (Pty)

SPONSOR: One Capital Ltd.

AUDITORS: Ernst & Young Inc. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Investec Bank Ltd.

TRU Ords 0.015c ea 650 000 000 408 498 899 AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc]

Ords 0.015c ea Ldt Pay Amt TSG Ords 2c ea 1 200 000 000 1 042 596 816

Final No 53 1 Oct 24 7 Oct 24 197.00 DISTRIBUTIONS [ZARc]

Interim No 52 18 Mar 24 25 Mar 24 332.00 Ords 2c ea Ldt Pay Amt

Interim No 32 17 Dec 24 23 Dec 24 30.00

LIQUIDITY: Jan25 Avg 7m shares p.w., R620.7m(86.7% p.a.)

Final No 31 23 Jul 24 29 Jul 24 40.00

GERE 40 Week MA TRUWTHS

LIQUIDITY: Dec24 Avg 4m shares p.w., R45.5m(19.9% p.a.)

11221

TRAV 40 Week MA TSOGO SUN

9479

2270

7737

1850

5994 1431

4252

1011

2510 592

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 172

(R million) Jun 24 Jul 23 Jun 22 Jun 21 Jun 20 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Final Final Final Final Final NOTES: Tsogo Sun Gaming Ltd. renamed to Tsogo Sun Ltd. on 31 May 2023

Revenue 22 436 21 992 19 340 17 534 17 982 and commenced trading under new name on 13 June 2023.

Op Inc 4 218 3 616 3 618 2 269 - 1 274 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 912 - 765 - 554 - 470 - 802 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Minority Int 13 13 16 5 - 120 Interim Final Final Final Final

Att Inc 3 887 3 275 3 051 1 951 - 556 Turnover 5 607 11 503 11 318 8 938 5 686

TotCompIncLoss 3 919 3 486 3 056 1 979 - 330 Op Inc 1 382 2 881 2 992 2 676 977

Fixed Ass 2 533 2 069 1 685 1 707 1 788 NetIntPd(Rcvd) 362 705 606 766 944

Inv & Loans 28 77 36 91 53 Tax 290 640 627 478 - 3

Tot Curr Ass 10 099 9 417 7 971 7 216 8 425 Minority Int 3 15 24 29 7

Ord SH Int 9 506 7 654 6 106 6 191 6 008 Att Inc 727 1 530 1 744 1 405 21

LT Liab 3 794 3 237 2 628 2 195 2 698 TotCompIncLoss 695 1 264 1 916 1 710 - 297

Tot Curr Liab 5 352 5 242 4 757 4 135 5 575 Hline Erngs-CO 759 1 761 1 592 1 153 - 32

PER SHARE STATISTICS (cents per share) Fixed Ass 8 197 8 294 8 263 8 109 8 560

HEPS-C (ZARc) 817.90 873.30 779.80 520.30 410.40 Inv in Assoc 35 35 26 27 33

DPS (ZARc) 529.00 565.00 505.00 350.00 280.00 Inv & Loans 1 472 1 487 1 449 1 188 1 025

NAV PS (ZARc) 2 553.00 2 073.00 1 658.00 1 562.00 1 450.00 Def Tax Asset 71 53 69 92 130

3 Yr Beta 1.12 1.22 1.52 1.41 1.16 Tot Curr Ass 1 210 1 179 1 121 1 433 1 287

Price High 10 136 6 990 6 809 6 007 7 297 Ord SH Int 5 044 4 759 4 515 3 152 1 471

Price Low 5 400 4 586 4 739 2 889 2 229 Minority Int 94 111 90 120 113

Price Prd End 9 328 5 660 4 886 5 616 3 428 LT Liab 9 174 9 602 10 091 9 134 11 943

RATIOS Tot Curr Liab 1 371 1 301 1 294 3 374 2 148

Ret on SH Fnd 41.03 42.96 50.23 31.59 - 11.25 PER SHARE STATISTICS (cents per share)

Oper Pft Mgn 18.80 16.44 18.71 12.94 - 7.08 EPS (ZARc) 70.00 147.00 167.00 134.32 2.00

D:E 0.64 0.70 0.70 0.44 0.80 HEPS-C (ZARc) 73.10 169.00 152.00 110.20 - 3.10

Current Ratio 1.89 1.80 1.68 1.75 1.51 DPS (ZARc) 30.00 70.00 87.00 19.00 -

Div Cover 1.98 1.57 1.57 1.37 - 0.48 NAV PS (ZARc) 485.47 458.04 431.64 301.31 140.63

Price High 1 350 1 312 1 387 1 300 720

Price Low 1 028 1 030 1 021 599 171

Price Prd End 1 250 1 088 1 211 1 204 650

RATIOS

Ret on SH Fnd 28.42 31.72 38.39 43.83 1.77

Ret On Tot Ass 18.25 19.41 21.40 17.17 0.22

Oper Pft Mgn 24.65 25.05 26.44 29.94 17.18

D:E 1.51 1.67 1.84 2.98 7.14

Current Ratio 0.88 0.91 0.87 0.42 0.60

208