Page 212 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 212

JSE – VOD Profile’s Stock Exchange Handbook: 2025 – Issue 1

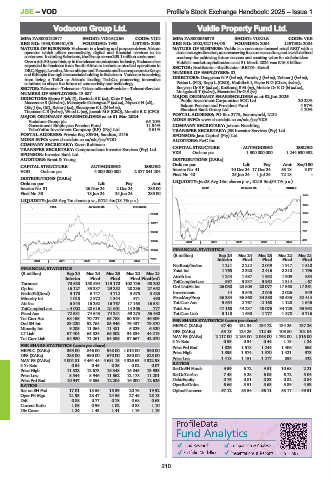

Vodacom Group Ltd. Vukile Property Fund Ltd.

VOD VUK

ISIN: ZAE000132577 SHORT: VODACOM CODE: VOD ISIN: ZAE000056370 SHORT: VUKILE CODE: VKE

REG NO: 1993/005461/06 FOUNDED: 1993 LISTED: 2009 REG NO: 2002/027194/06 FOUNDED: 2004 LISTED: 2004

NATURE OF BUSINESS: Vodacom is a leading and purpose-driven African NATURE OF BUSINESS: Vukile is a consumer-focused retail REIT with a

operator which offers connectivity, digital and financial services to its clearstrategicdirection,anunwaveringfocusonexecution,andawell-defined

customers.IncludingSafaricom,theGroupserves203.1millioncustomers. roadmap for achieving future success and creating value for stakeholders.

Overarich30-yearhistoryinthetelecommunicationsindustry,Vodacomhas Vukile’s market capitalisation as at 31 March 2024 was R16.8 billion.

expanded its business from South Africa to include controlled operations in SECTOR: RealEstate—RealEstate—REITS—Retail

DRC,Egypt,Lesotho,MozambiqueandTanzaniaandhaveexposuretoKenya NUMBER OF EMPLOYEES: 82

and Ethiopia through its associate holding in Safaricom. Vodacom is evolving

from being a TelCo to Africa’s leading TechCo, pioneering innovative DIRECTORS: Dongwana N P (ind ne), Formby J (ind ne), Zehner J (ind ne),

solutions to shape the future of connectivity and technology. Pottas L (FD), Rapp L (CEO), Mothibeli I, Payne N G (Chair, ind ne),

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices Booysen Dr S F (ind ne), Kodisang B M (ne), Mokate Dr R D (ld ind ne),

NUMBER OF EMPLOYEES: 13 687 Mokgabudi T (ind ne), Moseneke Dr G S (ne)

DIRECTORS: Bianco F (alt, It), Govinda S K (ne), Klotz P (ne), MAJOR ORDINARY SHAREHOLDERS as at 02 Jan 2025

Macozoma S (ld ind ne), Mahanyele-Dabengwa P (ind ne), Nqweni N (alt), Public Investment Corporation SOC Ltd. 20.22%

Otty J (ne, UK), Reiter J (ne), Shuenyane K L (ld ind ne), Eskom Pension and Provident Fund 4.97%

Standard Bank Group Ltd.

4.70%

Thomson C B (ind ne), WoodL(ne), Joosub M S (CEO), Morathi R K (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 POSTAL ADDRESS: PO Box 2779, Saxonworld, 2132

Vodafone Group plc 65.10% MORE INFO: www.sharedata.co.za/sdo/jse/VKE

Government Employees Pension Fund 11.94% COMPANY SECRETARY: Johann Neethling

YeboYethu Investment Company (RF) (Pty) Ltd. 5.51% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

POSTAL ADDRESS: Private Bag X9904, Sandton, 2146 SPONSOR: Java Capital (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/VOD AUDITORS: PwC Inc.

COMPANY SECRETARY: Karen Robinson

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Investec Bank Ltd. VKE Ords no par 1 500 000 000 1 244 630 392

AUDITORS: Ernst & Young DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords no par Ldt Pay Amt Scr/100

VOD Ords no par 4 000 000 000 2 077 841 204 Interim No 41 10 Dec 24 17 Dec 24 55.18 3.07

Final No 40 25 Jun 24 1 Jul 24 72.18 -

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt LIQUIDITY: Jan25 Avg 13m shares p.w., R215.9m(54.7% p.a.)

Interim No 31 26 Nov 24 2 Dec 24 285.00 REIV 40 Week MA VUKILE

Final No 30 18 Jun 24 24 Jun 24 285.00

1955

LIQUIDITY: Jan25 Avg 7m shares p.w., R721.4m(18.1% p.a.)

1655

FTEL 40 Week MA VODACOM

1356

21848

1057

18917

757

15986

458

13055 2020 | 2021 | 2022 | 2023 | 2024 |

10124 FINANCIAL STATISTICS

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

7193 Interim Final Final Final Final

2020 | 2021 | 2022 | 2023 | 2024 |

NetRent/InvInc 1 211 2 212 2 049 1 917 1 510

FINANCIAL STATISTICS Total Inc 1 765 2 328 2 416 2 310 1 796

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Interim Final Final Final Final(rst) Attrib Inc 1 244 1 587 1 932 1 909 584

Turnover 73 538 150 594 119 170 102 736 98 302 TotCompIncLoss 997 3 337 3 952 1 314 - 67

Op Inc 16 127 35 337 29 252 28 236 27 652 Ord UntHs Int 26 038 23 803 20 077 17 568 17 361

NetIntPd(Rcvd) 3 178 6 747 4 712 3 675 3 423 Investments 14 3 545 2 046 2 026 949

Minority Int 1 018 2 972 1 344 571 490 FixedAss/Prop 36 334 36 568 34 380 30 535 32 414

Att Inc 6 843 16 292 16 767 17 163 16 581 Tot Curr Ass 5 654 2 767 2 168 1 128 1 646

TotCompIncLoss - 4 002 20 616 21 601 14 366 777 Total Ass 47 160 44 237 40 076 34 725 35 992

Fixed Ass 72 531 74 643 74 241 59 273 56 480 Tot Curr Liab 3 118 1 630 1 777 1 878 3 716

Tot Curr Ass 68 155 70 727 65 788 50 519 46 309 PER SHARE STATISTICS (cents per share)

Ord SH Int 83 220 92 764 85 946 79 437 79 370 HEPS-C (ZARc) 87.40 131.34 134.72 134.25 137.26

Minority Int 9 205 11 064 11 481 6 029 6 320 DPS (ZARc) 55.18 124.25 112.43 105.80 101.04

LT Liab 67 404 65 524 66 502 34 834 44 219 NAV PS (ZARc) 2 117.00 2 155.00 2 048.00 1 792.00 1 816.00

Tot Curr Liab 64 980 71 261 64 386 57 667 42 070

3 Yr Beta 0.59 0.34 0.44 1.19 1.24

PER SHARE STATISTICS (cents per share) Price Prd End 1 826 1 518 1 244 1 406 865

HEPS-C (ZARc) 353.00 846.00 948.00 1 013.00 980.00 Price High 1 895 1 574 1 570 1 421 973

DPS (ZARc) 285.00 590.00 670.00 850.00 825.00 Price Low 1 418 1 151 1 217 858 422

NAV PS (ZARc) 4 004.81 4 464.44 4 681.15 4 326.63 4 322.98 RATIOS

3 Yr Beta 0.54 0.45 0.25 0.02 0.07

Price High 11 522 12 673 16 348 16 045 13 935 RetOnSH Funds 9.59 6.72 9.51 10.68 2.21

Price Low 8 544 8 946 11 562 12 178 11 201 RetOnTotAss 7.48 5.28 6.05 6.72 5.04

Price Prd End 10 947 9 855 12 204 16 000 12 626 Debt:Equity 0.76 0.81 0.83 0.82 0.84

RATIOS OperRetOnInv 6.66 5.51 5.63 5.89 4.53

Ret on SH Fnd 17.01 18.55 18.59 20.75 19.92 OpInc:Turnover 57.12 55.54 56.11 55.17 49.51

Oper Pft Mgn 21.93 23.47 24.55 27.48 28.13

D:E 0.88 0.77 0.78 0.68 0.63

Current Ratio 1.05 0.99 1.02 0.88 1.10

Div Cover 1.24 1.43 1.41 1.19 1.19

210