Page 208 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 208

JSE – TRE Profile’s Stock Exchange Handbook: 2025 – Issue 1

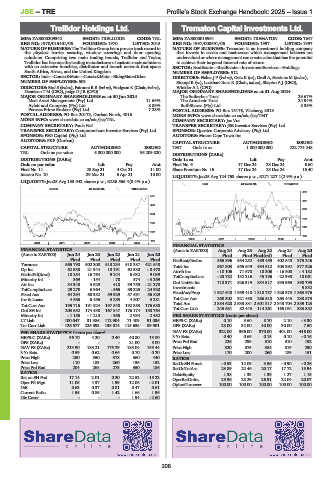

Trellidor Holdings Ltd. Trematon Capital Investments Ltd.

TRE TRE

ISIN: ZAE000209342 SHORT: TRELLIDOR CODE: TRL ISIN: ZAE000013991 SHORT: TREMATON CODE: TMT

REG NO: 1970/015401/06 FOUNDED: 1970 LISTED: 2015 REG NO: 1997/008691/06 FOUNDED: 1997 LISTED: 1997

NATURE OF BUSINESS: The Trellidor Group has a proven track record in NATURE OF BUSINESS: Trematon is an investment holding company

the physical barrier security, window coverings and door opening that invests in assets and businesses which management believes are

solutions. Comprising two main trading brands, Trellidor and Taylor, undervalued or where management can create value that has the potential

Trellidor has become the leading manufacturer of custom-made solutions to achieve their targeted internal rate of return.

with an extensive franchise, distributor and branch network that spans SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

South Africa, Africa, and the United Kingdom. NUMBER OF EMPLOYEES: 512

SECTOR: Inds—Constr&Mats—Constr&Mats—BldngMats:Other DIRECTORS: Fisher J P (ind ne), Getz K (ne), Groll A, Sessions M (ind ne),

NUMBER OF EMPLOYEES: 503 Stumpf R (ne), Lockhart-Ross R (Chair, ind ne), Shapiro A J (CEO),

DIRECTORS: Bird S (ind ne), Patmore R B (ind ne), Hodgson K (Chair, ind ne), Winkler A L (CFO)

Dennison T M (CEO), Judge D J R (CFO) MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 The Suikerbos Trust 29.67%

Mazi Asset Management (Pty) Ltd. 11.69% The Armchair Trust 24.94%

Aylett and Company (Pty) Ltd. 8.89% Buff-Shares (Pty) Ltd. 8.35%

Peresec Prime Brokers (Pty) Ltd. 7.28% POSTAL ADDRESS: PO Box 15176, Vlaeberg, 8018

POSTAL ADDRESS: PO Box 20173, Durban North, 4016 MORE INFO: www.sharedata.co.za/sdo/jse/TMT

MORE INFO: www.sharedata.co.za/sdo/jse/TRL COMPANY SECRETARY: Jac Vos

COMPANY SECRETARY: Paula Nel TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. AUDITORS: Moore Cape Town Inc.

AUDITORS: PKF (Durban)

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED TMT Ords 1c ea 1 000 000 000 222 774 248

TRL Ords no par value 5 000 000 000 95 209 820

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 1c ea Ldt Pay Amt

Ords no par value Ldt Pay Amt Final No 6 17 Dec 24 23 Dec 24 6.60

Final No 11 28 Sep 21 4 Oct 21 11.00 Share Premium No 16 17 Dec 24 23 Dec 24 16.40

Interim No 10 29 Mar 21 6 Apr 21 10.00

LIQUIDITY: Jan25 Avg 124 753 shares p.w., R271 227.1(2.9% p.a.)

LIQUIDITY: Jan25 Avg 153 942 shares p.w., R236 566.4(8.4% p.a.)

EQII 40 Week MA TREMATON

CONM 40 Week MA TRELLIDOR

486

561

422

473

358

384

293

296

229

207

165

2020 | 2021 | 2022 | 2023 |

119

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in ZAR’000) Aug 24 Aug 23 Aug 22 Aug 21 Aug 20

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Final Final Final(rst) Final Final

Final Final Final Final Final NetRent/InvInc 565 896 554 252 489 459 402 540 375 246

Turnover 565 790 502 300 513 234 518 387 421 548 Total Inc 567 303 555 649 494 512 403 392 377 326

Op Inc 62 538 21 944 10 191 62 530 - 8 470 Attrib Inc - 10 106 71 578 18 306 - 16 500 - 4 182

NetIntPd(Rcvd) 18 254 16 764 9 244 6 632 9 039 TotCompIncLoss - 23 782 132 216 45 196 - 22 998 18 061

Minority Int 369 - 154 - 78 574 - 3 269 Ord UntHs Int 718 371 826 319 834 517 835 965 898 795

Att Inc 34 340 3 629 418 39 755 - 21 270

TotCompIncLoss 29 270 6 364 - 565 39 325 - 24 920 Investments - - - - 5 832

Fixed Ass 64 294 68 982 59 929 57 591 56 829 FixedAss/Prop 1 927 640 1 959 410 1 818 757 1 826 373 1 863 976

Inv & Loans 4 686 6 456 3 253 4 807 3 281 Tot Curr Ass 268 302 321 488 266 518 263 443 230 573

Tot Curr Ass 195 716 191 924 197 548 192 353 176 638 Total Ass 2 384 620 2 533 831 2 501 317 2 343 704 2 389 123

Ord SH Int 203 652 174 438 167 847 176 174 158 764 Tot Curr Liab 245 681 82 443 114 261 165 031 333 882

Minority Int - 1 156 - 1 213 - 985 2 934 2 432 PER SHARE STATISTICS (cents per share)

LT Liab 100 047 31 386 112 904 71 409 91 036 HEPS-C (ZARc) 0.10 3.60 8.70 2.10 - 3.30

Tot Curr Liab 126 577 225 893 138 814 115 635 89 901 DPS (ZARc) 23.00 32.00 40.00 30.00 7.50

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 322.00 366.00 370.00 401.00 416.00

HEPS-C (ZARc) 36.10 4.20 0.40 40.80 13.80 3 Yr Beta 0.40 0.69 0.15 0.10 - 0.16

DPS (ZARc) - - - 21.00 8.00 Price Prd End 226 299 310 310 192

NAV PS (ZARc) 213.90 183.21 176.29 185.04 158.44 Price High 320 375 384 319 290

3 Yr Beta 0.59 0.62 0.66 0.70 0.20 Price Low 170 200 260 189 151

Price High 250 350 378 360 440 RATIOS

Price Low 110 183 260 136 152 RetOnSH Funds - 0.53 12.09 3.56 - 0.90 - 0.26

Price Prd End 204 268 275 350 186 RetOnTotAss 23.89 22.46 20.17 17.72 15.94

RATIOS Debt:Equity 1.38 1.33 1.39 1.27 1.15

Ret on SH Fnd 17.14 2.01 0.20 22.52 - 15.22

Oper Pft Mgn 11.05 4.37 1.99 12.06 - 2.01 OperRetOnInv 29.36 28.29 26.91 22.04 20.07

D:E 0.63 0.37 0.81 0.47 0.61 OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

Current Ratio 1.55 0.85 1.42 1.66 1.96

Div Cover - - - 1.94 - 2.60

206