Page 204 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 204

JSE – TEL Profile’s Stock Exchange Handbook: 2025 – Issue 1

TeleMasters Holdings Ltd. Telkom SA SOC Ltd.

TEL TEL

ISIN: ZAE000093324 SHORT: TELEMASTR CODE: TLM ISIN: ZAE000044897 SHORT: TELKOM CODE: TKG

REG NO: 2006/015734/06 FOUNDED: 2006 LISTED: 2007 REG NO: 1991/005476/30 FOUNDED: 1991 LISTED: 2003

NATURE OF BUSINESS: TeleMastersHoldingsLtd.isadiversified NATURE OF BUSINESS: Telkom is a leading information and

technology investment firm. The various companies under TeleMasters’ communications technology (ICT) services provider in South Africa. We

umbrella complement each other, with a primary focus on advancing digital offer end-to-end ICT solutions, including high-speed fibre, mobile and

transformation, enabling next-generation connectivity, and expediting the data services, information technology (IT) services, property management

development of intelligent work environments. TeleMasters’ overarching and masts and towers solutions.

goal is to generate and enhance shareholder value through responsible SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

growth, strategic acquisitions and targeted investments. NUMBER OF EMPLOYEES: 9 877

SECTOR: AltX DIRECTORS: Booi M (ind ne), Ighodaro O (ind ne, Nig), Kennedy B (ind ne),

NUMBER OF EMPLOYEES: 0 Lebina K P (ind ne), Luthuli P C S (ind ne), Matenge-Sebesho E G (ind ne),

DIRECTORS: Bate DrDJ(ind ne), Krastanov M (ind ne), Moela Adv Msimang M (ind ne), Rayner K A (ind ne), Selele I (ind ne), Sibisi Dr S P (ind

M(ld ind ne), Steinberg F (ind ne), Tappan M (ind ne), Pretorius ne), Singh E (ind ne), Yoon S H (ne), Qhena M G (Chair, ind ne),

M B (Chair, ne), Voigt J (CEO), Topham B (CFO) Taukobong S (Group CE), Dlamini N (Group CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 MAJOR ORDINARY SHAREHOLDERS as at 23 Aug 2024

Maison d’Obsession Trust 62.11% The Government of the Republic of South Africa 40.52%

JM Voigt 14.98% Government Employees Pension Fund 15.89%

LP Pieton 8.70% Public Investment Company SOC Ltd. 9.95%

POSTALADDRESS:Postnetsuite#51,PrivateBagX81,HalfwayHouse,1685 POSTAL ADDRESS: Private Bag X881, Pretoria, 0001

MORE INFO: www.sharedata.co.za/sdo/jse/TLM MORE INFO: www.sharedata.co.za/sdo/jse/TKG

COMPANY SECRETARY: Sascha Ramirez-Victor COMPANY SECRETARY: Ephy Motlhamme

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. SPONSOR: Nedbank CIB

AUDITORS: Nexia SAB&T Inc. AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

TLM Ords 0.01c ea 500 000 000 57 482 830 TKG Ords of R10.00 ea 1 000 000 000 511 140 239

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt Ords of R10.00 ea Ldt Pay Amt

Final No 65 22 Oct 24 28 Oct 24 0.10 Final No 26 7 Jul 20 13 Jul 20 50.08

Quarterly No 64 23 Jul 24 29 Jul 24 0.10 Interim No 25 26 Nov 19 2 Dec 19 71.53

LIQUIDITY: Jan25 Avg 15 009 shares p.w., R14 087.7(1.4% p.a.) LIQUIDITY: Jan25 Avg 6m shares p.w., R163.2m(62.7% p.a.)

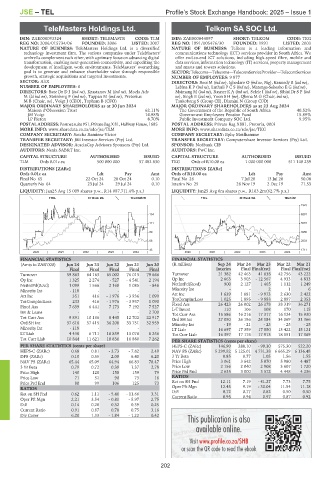

FTEL 40 Week MA TELEMASTR FTEL 40 Week MA TELKOM

7323

134 6201

111 5078

89 3956

66 2833

43 1711

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Final Final Final Final Final Interim Final Final(rst) Final Final(rst)

Turnover 59 863 64 163 65 002 76 013 79 666 Turnover 21 382 42 463 41 838 42 756 43 222

Op Inc 1 325 2 274 - 527 - 4 541 2 194 Op Inc 2 663 3 903 - 12 567 4 933 4 833

NetIntPd(Rcvd) 1 099 1 566 2 168 1 085 - 846 NetIntPd(Rcvd) 900 2 127 1 465 1 112 1 249

Minority Int - 118 - - - - Minority Int - - 2 1 6

Att Inc 351 416 - 1 976 - 3 936 1 090 Att Inc 1 639 1 881 - 9 973 2 630 2 422

1 895

1 025

TotCompIncLoss

2 353

2 897

- 9 883

TotCompIncLoss 233 416 - 1 976 - 3 937 1 090

Fixed Ass 7 639 6 441 7 173 7 192 7 527 Fixed Ass 26 423 26 002 26 178 38 319 36 271

170

108

110

L-T Invest

106

115

Inv & Loans - - - - 2 700 Tot Curr Ass 15 586 16 216 17 317 16 124 15 930

Tot Curr Ass 9 891 10 136 8 445 12 702 22 917 Ord SH Int 27 090 26 196 24 184 34 069 31 366

Ord SH Int 37 618 37 415 36 208 33 751 32 959 Minority Int - 19 - 21 - 23 - 25 - 25

Minority Int - 118 - - - - LT Liab 16 697 17 359 17 550 13 422 15 121

LT Liab 4 438 6 711 10 839 13 076 8 256 Tot Curr Liab 16 397 17 176 17 913 18 551 17 369

Tot Curr Liab 10 844 11 621 10 836 16 880 7 262

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 146.90 288.10 - 99.30 575.30 522.20

HEPS-C (ZARc) 0.68 0.81 - 3.73 - 7.82 2.49 NAV PS (ZARc) 5 299.92 5 125.01 4 731.38 6 665.29 6 136.48

DPS (ZARc) 0.10 0.55 2.00 6.40 6.20 3 Yr Beta 0.85 0.77 1.05 1.56 1.55

NAV PS (ZARc) 65.44 65.09 64.94 66.83 78.47 Price High 3 061 3 642 5 070 5 980 4 487

3 Yr Beta 0.79 0.72 0.39 1.37 2.78 Price Low 2 156 2 040 2 908 3 607 1 720

Price High 140 128 150 159 79 Price Prd End 2 635 3 000 3 572 4 448 4 236

Price Low 71 51 90 73 16 RATIOS

Price Prd End 80 99 106 125 73 Ret on SH Fnd 12.11 7.19 - 41.27 7.73 7.75

RATIOS Oper Pft Mgn 12.45 9.19 - 30.04 11.54 11.18

0.82

0.50

D:E

0.72

0.77

0.50

Ret on SH Fnd 0.62 1.11 - 5.46 - 11.66 3.31

Oper Pft Mgn 2.21 3.54 - 0.81 - 5.97 2.75 Current Ratio 0.95 0.94 0.97 0.87 0.92

D:E 0.14 0.20 0.32 0.39 0.25

Current Ratio 0.91 0.87 0.78 0.75 3.16

Div Cover 6.20 1.33 - 1.84 - 1.22 0.42

202