Page 200 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 200

JSE – STA Profile’s Stock Exchange Handbook: 2025 – Issue 1

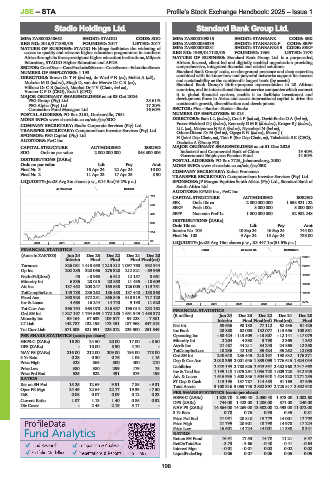

Stadio Holdings Ltd. Standard Bank Group Ltd.

STA STA

ISIN: ZAE000248662 SHORT: STADIO CODE: SDO ISIN: ZAE000109815 SHORT: STANBANK CODE: SBK

REG NO: 2016/371398/06 FOUNDED: 2017 LISTED: 2017 ISIN: ZAE000056339 SHORT: STANBANK-P CODE: SBPP

NATURE OF BUSINESS: STADIO Holdings facilitates the widening of ISIN: ZAE000038881 SHORT: STANBANK6.5 CODE: SBKP

access to quality and relevant higher education programmes in southern REG NO: 1969/017128/06 FOUNDED: 1969 LISTED: 1970

Africa through its three prestigious higher education institutions, Milpark NATURE OF BUSINESS: Standard Bank Group Ltd. is a purpose-led,

Education, STADIO Higher Education and AFDA. African focused, client led and digitally enabled organisation providing

SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs comprehensive, integrated financial and related solutions.

NUMBER OF EMPLOYEES: 1 193 Standard Bank Group’ scale, on-the-ground presence and deep expertise,

DIRECTORS: Brown DrTH(ind ne), de WaalPN(ne), Mellet A (alt), combined with its know-how and powerful networks support its success

and sustainability as the continent’s largest bank (by assets).

MokokaMG(ind ne), Singh D, van der Merwe DrCR(ne),

Vilikazi DrCB(ind ne), Maphai Dr T V (Chair, ind ne), Standard Bank Group’s fit-for-purpose representation in 20 African

countries, and its international financial service companies which connect

VorsterCPD (CEO), Kula I (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 03 Oct 2024 it to global financial centres, enable it to facilitate investment and

development flows in Africa and access international capital to drive the

PSG Group (Pty) Ltd. 25.61% continent’s growth, diversification and development.

PSG Alpha (Pty) Ltd. 17.20%

Coronation Fund Managers Ltd. 16.60% SECTOR: Fins—Banks—Banks—Banks

POSTAL ADDRESS: PO Box 2161, Durbanville, 7551 NUMBER OF EMPLOYEES: 50 815

MORE INFO: www.sharedata.co.za/sdo/jse/SDO DIRECTORS: BamLL(ind ne), Cook P (ind ne), David-Borha O A (ind ne),

COMPANY SECRETARY: Stadio Corporate Services (Pty) Ltd. Fraser-Moleketi G J (ind ne), Kennealy G M B (ld ind ne), Kruger B J (ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Li L (ne), Matyumza N N A (ind ne), Nyembezi N (ind ne),

SPONSOR: PSG Capital (Pty) Ltd. Oduor-Otieno Dr M (ind ne), Ogega R N (ind ne), Maree J (

H (Joint Dep Chair, ne), Tian F (Snr Dep Chair, ne), Tshabalala S K (CEO),

AUDITORS: PwC Inc. Daehnke A (Group FD)

CAPITAL STRUCTURE AUTHORISED ISSUED MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

SDO Ords no par value 2 000 000 000 848 300 306 Industrial and Commercial Bank of China 19.40%

Government Employees Pension Fund 14.50%

DISTRIBUTIONS [ZARc] POSTAL ADDRESS: PO Box 7725, Johannesburg, 2000

Ords no par value Ldt Pay Amt MORE INFO: www.sharedata.co.za/sdo/jse/SBK

Final No 3 16 Apr 24 22 Apr 24 10.00 COMPANY SECRETARY: Kobus Froneman

Final No 2 11 Apr 23 17 Apr 23 8.90

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

LIQUIDITY: Jan25 Avg 3m shares p.w., R14.9m(16.2% p.a.) SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Standard Bank of

South Africa Ltd.

40 Week MA STADIO

AUDITORS: KPMG Inc., PwC Inc.

710

CAPITAL STRUCTURE AUTHORISED ISSUED

SBK Ords 10c ea 2 000 000 000 1 658 921 122

586

SBKP Prefs 100c 8 000 000 8 000 000

462 SBPP Non-cum Pref 1c 1 000 000 000 52 982 248

DISTRIBUTIONS [ZARc]

338

Ords 10c ea Ldt Pay Amt

214 Interim No 109 10 Sep 24 16 Sep 24 744.00

Final No 108 9 Apr 24 15 Apr 24 733.00

90

2020 | 2021 | 2022 | 2023 | 2024 | LIQUIDITY: Jan25 Avg 16m shares p.w., R3 447.1m(51.5% p.a.)

FINANCIAL STATISTICS BANK 40 Week MA STANBANK

(Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 26071

Interim Final Final Final Final(rst)

Turnover 826 031 1 413 650 1 213 812 1 097 768 932 944 22612

Op Inc 202 285 320 066 276 328 212 821 - 69 969

19152

NetIntPd(Rcvd) 45 - 3 963 6 612 12 157 8 661

Minority Int 6 336 28 015 20 850 11 435 - 18 609

15693

Att Inc 137 452 208 247 165 638 126 005 - 119 751

TotCompIncLoss 143 788 236 262 186 488 137 440 - 138 360 12233

Fixed Ass 890 923 872 281 866 846 810 319 717 120

8774

Inv & Loans 4 663 16 244 14 740 9 190 11 620 2020 | 2021 | 2022 | 2023 | 2024 |

Tot Curr Ass 396 754 363 070 316 657 196 014 232 162 FINANCIAL STATISTICS

Ord SH Int 1 827 197 1 794 569 1 772 185 1 651 949 1 493 372 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Minority Int 59 164 67 633 109 517 99 228 - 7 381 Interim Final Final(rst) Final(rst) Final

LT Liab 142 787 132 195 173 451 187 968 347 315 Net Int 50 656 98 188 77 112 62 436 61 425

Tot Curr Liab 371 303 321 591 226 012 229 500 251 549 Inc Bank 28 880 62 003 132 077 113 556 108 581

PER SHARE STATISTICS (cents per share) Operating Inc - 58 424 - 113 509 - 13 807 - 12 141 - 17 079

HEPS-C (ZARc) 16.20 24.50 20.00 17.00 - 8.50 Minority Int 2 204 4 330 3 798 2 369 1 352

DPS (ZARc) - 10.00 8.90 4.70 - Attrib Inc 21 487 44 211 34 243 24 865 12 358

42 138

12 083

35 262

35 424

18 296

NAV PS (ZARc) 216.00 212.00 209.00 195.00 178.00 TotCompIncLoss 240 648 236 445 218 197 198 832 176 371

Ord SH Int

3 Yr Beta 0.28 0.30 0.76 1.08 1.15

Price High 528 565 500 400 210 Dep & Cur Acc 2 018 369 2 001 646 1 889 099 1 776 615 1 624 044

Liabilities

2 820 193 2 788 825 2 623 531 2 482 968 2 317 668

Price Low 380 380 299 179 75 Inv & Trad Sec 1 139 118 1 075 291 1 056 720 1 009 720 912 925

Price Prd End 525 522 491 375 195 Adv & Loans 1 616 936 1 608 846 1 504 940 1 424 328 1 271 255

RATIOS

ST Dep & Cash 113 196 137 787 114 483 91 169 87 505

Ret on SH Fnd 15.25 12.69 9.91 7.85 - 9.31 Total Assets 3 100 316 3 065 745 2 882 397 2 725 817 2 532 940

Oper Pft Mgn 24.49 22.64 22.77 19.39 - 7.50 PER SHARE STATISTICS (cents per share)

D:E 0.08 0.07 0.09 0.12 0.23 HEPS-C (ZARc) 1 328.70 2 590.40 2 050.40 1 573.00 1 002.60

Current Ratio 1.07 1.13 1.40 0.85 0.92 DPS (ZARc) 744.00 1 423.00 1 206.00 871.00 240.00

Div Cover - 2.45 2.19 3.17 -

NAV PS (ZARc) 14 564.00 14 269.00 13 302.00 12 493.00 11 072.00

3 Yr Beta 0.78 0.76 0.93 0.85 0.81

Price Prd End 21 081 20 810 16 779 14 001 12 708

Price High 21 799 20 901 18 798 14 978 17 224

Price Low 16 601 14 724 14 001 11 338 8 341

RATIOS

Ret on SH Fund 16.91 17.53 14.70 11.21 6.37

RetOnTotalAss - 3.73 - 3.66 - 0.40 - 0.41 - 0.64

Interest Mgn - 0.01 - 0.01 0.02 0.02 0.02

LiquidFnds:Dep 0.06 0.07 0.06 0.05 0.05

198