Page 196 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 196

JSE – SOU Profile’s Stock Exchange Handbook: 2025 – Issue 1

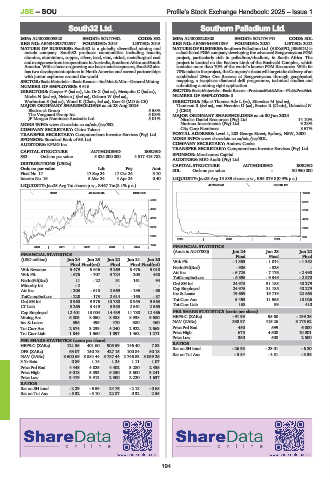

South32 Ltd. Southern Palladium Ltd.

SOU SOU

ISIN: AU000000S320 SHORT: SOUTH32 CODE: S32 ISIN: AU0000220808 SHORT: SOUTH PD CODE: SDL

REG NO: ABN84093732597 FOUNDED: 2015 LISTED: 2015 REG NO: ABN59646391899 FOUNDED: 2020 LISTED: 2022

NATURE OF BUSINESS: South32 is a globally diversified mining and NATURE OF BUSINESS: Southern Palladium Ltd. (ASX:SPD, JSE:SDL) is

metals company. South32 produces commodities including bauxite, a dual-listed PGM company developing the advanced Bengwenyama PGM

alumina, aluminium, copper, silver, lead, zinc, nickel, metallurgical coal project, particularly rich in palladium/rhodium, in South Africa. The

andmanganesefromitsoperationsinAustralia,SouthernAfricaandSouth project is located on the Eastern Limb of the Bushveld Complex, which

America. With a focus on growing our base metals exposure, South32 also contains more than 70% of the world’s known PGM Resources. With its

has two development options in North America and several partnerships 70% stake in the project, the Company’s focus will target the delivery of an

with junior explorers around the world. established 2Moz Ore Reserve at Bengwenyama through geophysical

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining mapping, a twophase diamond drill programme, technical studies and

NUMBER OF EMPLOYEES: 9 616 submitting a mining right application.

DIRECTORS: Cooper F (ind ne), Liu Dr X (ind ne), Mesquita C (ind ne), SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

Mtoba N (ind ne), Nelson J (ind ne), Osborn W (ind ne), NUMBER OF EMPLOYEES: 0

Warburton S (ind ne), Wood K (Chair, ind ne), Kerr G (MD & CE) DIRECTORS: Nkosi-Thomas Adv L (ne), Stirzaker M (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 23 Aug 2024 Thomson R (ind ne), van Heerden D (ne), Baxter R (Chair), Odendaal N

Blackrock Group 5.58% J (CEO)

The Vanguard Group Inc. 5.08% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

JP Morgan Nominees Australia Ltd. 5.01% Nicolas Daniel Resources (Pty) Ltd. 14.10%

MORE INFO: www.sharedata.co.za/sdo/jse/S32 Nurinox Investments (Pty) Ltd. 9.28%

COMPANY SECRETARY: Claire Tolcon City Corp Nominees 8.57%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: Level 1, 283 George Street, Sydney, NSW, 2000

SPONSOR: Standard Bank of SA Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SDL

AUDITORS: KPMG Inc. COMPANY SECRETARY: Andrew Cooke

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

S32 Ords no par value 5 324 000 000 4 517 415 782 SPONSOR: Merchantec Capital

AUDITORS: BDO Audit (Pty) Ltd.

DISTRIBUTIONS [USDc]

ISSUED

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED - 90 950 000

Ords no par value

SDL

Final No 17 17 Sep 24 17 Oct 24 3.10

Interim No 16 5 Mar 24 4 Apr 24 0.40 LIQUIDITY: Jan25 Avg 15 839 shares p.w., R95 879.8(0.9% p.a.)

LIQUIDITY: Jan25 Avg 7m shares p.w., R467.7m(8.1% p.a.) 40 Week MA SOUTH PD

INDM 40 Week MA SOUTH32 10000

5860

8070

4997 6140

4135

4210

3272 2280

2409 350

2022 | 2023 | 2024 |

1547

2020 | 2021 | 2022 | 2023 | 2024 | FINANCIAL STATISTICS

(Amts in AUD’000) Jun 24 Jun 23 Jun 22

FINANCIAL STATISTICS Final Final Final

(USD million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Wrk Pft - 1 353 - 1 014 - 1 352

Final Final(rst) Final Final Final(rst)

Wrk Revenue 5 479 5 646 9 269 5 476 5 010 NetIntPd(Rcd) - 906 - 325 -

Wrk Pft - 676 - 707 3 724 203 438 Att Inc - 6 725 - 7 176 - 2 498

- 9 345

- 6 395

- 2 570

TotCompIncLoss

NetIntPd(Rcd) 11 - 22 31 161 94

Minority Int - 2 - - - - Ord SH Int 24 975 31 185 40 279

Cap Employed

40 279

31 185

24 975

Att Inc - 203 - 618 2 669 - 195 - 65

TotCompIncLoss - 228 - 173 2 614 - 165 - 87 Inv & Loans 19 659 19 719 22 663

Ord SH Int 8 960 9 376 10 780 8 955 9 563 Tot Curr Ass 5 453 11 565 18 026

Tot Curr Liab

99

138

410

LT Liab 3 265 3 419 3 353 2 561 2 565

Cap Employed 12 401 13 004 14 439 11 780 12 466 PER SHARE STATISTICS (cents per share)

Mining Ass 6 503 8 050 8 988 8 938 9 680 HEPS-C (ZARc) - 91.95 95.60 - 199.26

Inv & Loans 396 499 470 380 460 NAV (ZARc) 338.97 415.26 3 175.52

Tot Curr Ass 2 574 3 239 4 240 2 922 2 663 Price Prd End 450 599 6 000

Tot Curr Liab 1 844 1 560 1 897 1 462 1 271 Price High 675 4 500 10 001

Price Low 350 500 2 500

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 121.55 401.60 905.59 146.40 7.83

DPS (ZARc) 63.07 150.78 427.15 100.84 50.18 Ret on SH fund - 26.93 - 23.01 - 6.20

- 4.51

- 3.36

Ret on Tot Ass

- 3.84

NAV (ZARc) 3 600.69 3 884.44 3 787.44 2 746.83 3 059.26

3 Yr Beta 0.89 1.14 1.24 1.11 1.07

Price Prd End 4 448 4 825 4 402 3 280 2 435

Price High 5 018 5 893 6 250 3 500 3 241

Price Low 3 479 3 913 2 900 2 220 1 637

RATIOS

Ret on SH fund - 2.29 - 6.59 24.76 - 2.18 - 0.68

Ret on Tot Ass - 5.32 - 3.10 22.87 0.32 2.55

194