Page 192 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 192

JSE – SCH Profile’s Stock Exchange Handbook: 2025 – Issue 1

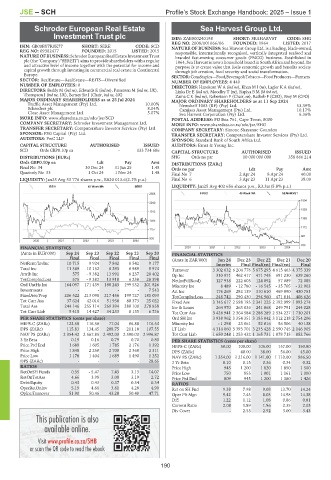

Schroder European Real Estate Sea Harvest Group Ltd.

Investment Trust plc ISIN: ZAE000240198 SHORT: SEAHARVST CODE: SHG

SEA

SCH REG NO: 2008/001066/06 FOUNDED: 1964 LISTED: 2017

ISIN: GB00BY7R8K77 SHORT: SERE CODE: SCD NATURE OF BUSINESS: Sea Harvest Group Ltd. is a leading, black-owned,

REG NO: 09382477 FOUNDED: 2015 LISTED: 2015 responsible, internationally recognised, vertically integrated seafood and

NATUREOF BUSINESS:SchroderEuropeanRealEstateInvestmentTrust branded fast-moving consumer goods (FMCG) business. Established in

plc (the ‘Company’/‘SEREIT’) aims to provide shareholders with a regular 1964, Sea Harvest is now a household brand in South Africa and beyond. Its

and attractive level of income together with the potential for income and purpose is to create value that fuels economic growth and benefits society

capital growth through investing in commercial real estate in Continental through job creation, food security and social transformation.

Europe. SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

SECTOR: RealEstate—RealEstate—REITS—Diversified NUMBER OF EMPLOYEES: 4 440

NUMBER OF EMPLOYEES: 0 DIRECTORS: Hanekom W A (ind ne), Khan MI(ne), Lagler K A (ind ne),

DIRECTORS: Beddy M (ind ne), Edwards E (ind ne), Patterson M (ind ne, UK), Links Dr E (ind ne), Moodley T (ne), Rapiya B M (ld ind ne),

Thompson J (ind ne, UK), Berney Sir J (Chair, ind ne, UK) Zama C K (ind ne), Robertson F (Chair, ne), Ratheb F (CEO), Brey M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 25 Jul 2024 MAJOR ORDINARY SHAREHOLDERS as at 11 Sep 2024

Truffle Asset Management (Pty) Ltd. 10.00% Newshelf 1063 (RF) (Pty) Ltd. 53.39%

Schroders plc 8.04% Camissa Asset Management (Pty) Ltd. 10.17%

Close Asset Management Ltd. 5.07% Sea Harvest Corporation (Pty) Ltd. 6.36%

MORE INFO: www.sharedata.co.za/sdo/jse/SCD POSTAL ADDRESS: PO Box 761, Cape Town, 8000

COMPANY SECRETARY: Schroder Investment Management Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SHG

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Simone Shayanne Gounden

SPONSOR: PSG Capital (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: PwC LLP

SPONSOR: Standard Bank of South Africa Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Ernst & Young Inc.

SCD Ords GBP0.10p ea - 133 734 686 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [EURc] SHG Ords no par 10 000 000 000 358 866 214

Ords GBP0.10p ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 34 30 Dec 24 31 Jan 25 1.48 Ords no par Ldt Pay Amt

Quarterly No 33 1 Oct 24 1 Nov 24 1.48 Final No 7 2 Apr 24 8 Apr 24 40.00

LIQUIDITY: Jan25 Avg 53 776 shares p.w., R820 013.6(2.1% p.a.) Final No 6 3 Apr 23 11 Apr 23 38.00

REIV 40 Week MA SERE LIQUIDITY: Jan25 Avg 402 656 shares p.w., R3.3m(5.8% p.a.)

2568 FOOD 40 Week MA SEAHARVST

1804

2240

1593

1913

1382

1585

1172

1257

961

930

2020 | 2021 | 2022 | 2023 | 2024 |

750

FINANCIAL STATISTICS 2020 | 2021 | 2022 | 2023 | 2024 |

(Amts in EUR’000) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20 FINANCIAL STATISTICS

Final Final Final Final Final (Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

NetRent/InvInc 10 715 9 924 7 842 8 542 9 177 Interim Final Final(rst) Final(rst) Final

Total Inc 11 369 10 152 8 293 8 989 9 974 Turnover 3 302 632 6 204 776 5 875 295 4 615 463 4 375 339

Attrib Inc 575 - 9 382 13 991 6 237 28 402 Op Inc 310 971 462 417 471 743 691 230 629 260

TotCompIncLoss 575 - 9 382 13 918 6 238 28 398 NetIntPd(Rcvd) 127 938 222 605 124 092 57 089 72 085

Ord UntHs Int 164 097 171 439 188 243 199 532 201 826 Minority Int 8 489 - 12 780 - 16 545 - 35 705 - 32 903

Investments - - - - 7 543 Att Inc 176 269 282 139 310 610 469 890 430 751

FixedAss/Prop 206 522 213 098 217 456 199 727 181 093 TotCompIncLoss 248 742 290 430 294 960 471 814 408 626

Tot Curr Ass 37 624 42 016 51 938 80 373 25 022 Fixed Ass 3 145 617 2 598 195 2 341 225 2 192 999 1 993 274

Total Ass 244 146 255 114 269 394 280 100 278 858 Inv & Loans 264 970 263 036 241 068 249 791 244 028

Tot Curr Liab 5 415 14 427 34 233 8 135 6 736 Tot Curr Ass 3 428 941 2 364 584 2 286 289 2 534 227 1 730 201

PER SHARE STATISTICS (cents per share) Ord SH Int 3 938 962 3 354 351 3 185 042 3 112 218 2 754 206

HEPS-C (ZARc) 122.58 116.58 77.04 86.88 116.54 Minority Int - 1 298 23 061 52 016 56 506 40 138

DPS (ZARc) 115.83 134.45 208.75 211.18 107.55 LT Liab 4 314 060 3 393 701 3 235 428 2 590 745 2 146 905

NAV PS (ZARc) 2 354.42 2 567.85 2 492.00 2 590.00 2 996.87 Tot Curr Liab 1 650 248 1 253 432 1 165 731 1 078 715 852 766

3 Yr Beta 0.19 0.16 0.79 0.70 0.80 PER SHARE STATISTICS (cents per share)

Price Prd End 1 689 1 605 1 785 2 176 1 392 HEPS-C (ZARc) 50.00 100.00 105.00 157.00 150.80

Price High 1 848 2 250 2 700 2 368 2 311 DPS (ZARc) - 40.00 38.00 56.00 45.00

Price Low 1 178 1 404 1 689 1 490 1 252 NAV PS (ZARc) 1 354.00 1 216.00 1 141.00 1 110.00 986.50

DPS (ZARc) - - - - 28.65 3 Yr Beta 0.10 0.15 0.36 0.34 0.32

RATIOS Price High 945 1 200 1 820 1 850 1 500

RetOnSH Funds 0.35 - 5.47 7.43 3.13 14.07 Price Low 750 855 1 001 1 161 1 000

RetOnTotAss 4.66 3.98 3.08 3.19 2.72 Price Prd End 809 945 1 200 1 380 1 426

Debt:Equity 0.43 0.43 0.37 0.34 0.34 RATIOS

OperRetOnInv 5.19 4.66 3.61 4.28 4.90 Ret on SH Fnd 9.38 7.98 9.08 13.70 14.24

OpInc:Turnover 51.90 50.46 43.20 50.48 47.71 Oper Pft Mgn 9.42 7.45 8.03 14.98 14.38

D:E 1.22 1.12 1.08 0.86 0.81

Current Ratio 2.08 1.89 1.96 2.35 2.03

Div Cover - 2.55 2.92 3.00 3.43

190