Page 195 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 195

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – SIB

Sibanye Stillwater Ltd. Sirius Real Estate Ltd.

SIB SIR

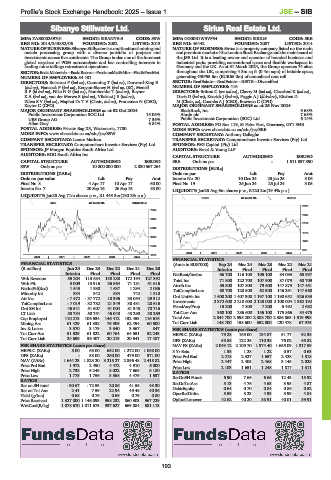

ISIN: ZAE000259701 SHORT: SIBANYE-S CODE: SSW ISIN: GG00B1W3VF54 SHORT: SIRIUS CODE: SRE

REG NO: 2014/243852/06 FOUNDED: 2002 LISTED: 2013 REG NO: 46442 FOUNDED: 2007 LISTED: 2014

NATURE OF BUSINESS: Sibanye-Stillwater is a multinational mining and NATURE OF BUSINESS: Sirius is a property company listed on the main

metals processing group with a diverse portfolio of projects and and premium market of the London Stock Exchange and the main board of

investments across five continents. The Group is also one of the foremost the JSE Ltd. It is a leading owner and operator of branded business and

global recyclers of PGM autocatalysts and has controlling interests in industrial parks providing conventional space and flexible workspace in

leading mine tailings retreatment operations. Germany and the UK. As at 31 March 2024, the Group operates 74 sites

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet throughout the UK, comprising 4.3m sq ft (0.4m sqm) of lettable space,

NUMBER OF EMPLOYEES: 84 481 generating GBP55.6m (EUR65.0m) of annualised rent roll.

DIRECTORS: Boisseau P (ind ne), Cumming T (ind ne), Dorward-King E SECTOR: RealEstate—RealEstate—REITS—Diversified

(ind ne), Hancock P (ind ne), Kenyon-Slaney H (ind ne, UK), Menell NUMBER OF EMPLOYEES: 416

RP(ld ind ne), NikaNG(ind ne), Nombembe T (ind ne), Rayner DIRECTORS: Britton C (snr ind ne), Cherry M (ind ne), Cleveland K (ind ne),

KA(ind ne), van der Merwe S (ind ne), VilakaziJS(ind ne), Davis D (ind ne), Kenrick J (ind ne), Peggie A J (ld ind ne), Kitchen D

ZilwaSV(ind ne), Maphai Dr T V (Chair, ind ne), Froneman N (CEO), M(Chair, ne), Coombs A J (CEO), Bowman C (CFO)

Keyter C (CFO) MAJOR ORDINARY SHAREHOLDERS as at 25 Nov 2024

MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2024 BlackRock, Inc. 9.68%

Public Investment Corporation SOC Ltd. 15.05% Abrdn plc 7.65%

UBS Group AG 7.36% Public Investment Corporation (SOC) Ltd. 6.14%

Allan Gray 6.84% POSTAL ADDRESS: PO Box 119, St Peter Port, Guernsey, GY1 3HB

POSTAL ADDRESS: Private Bag X5, Westonaria, 1780 MORE INFO: www.sharedata.co.za/sdo/jse/SRE

MORE INFO: www.sharedata.co.za/sdo/jse/SSW COMPANY SECRETARY: Anthony Gallaghe

COMPANY SECRETARY: Lerato Matlosa TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: PSG Capital (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa Ltd. AUDITORS: Ernst & Young LLP

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED SRE Ords no par - 1 511 857 390

SSW Ords no par 10 000 000 000 2 830 567 264

DISTRIBUTIONS [EURc]

DISTRIBUTIONS [ZARc] Ords no par Ldt Pay Amt

Ords no par value Ldt Pay Amt Interim No 20 10 Dec 24 23 Jan 25 3.06

Final No 8 4 Apr 17 10 Apr 17 60.00 Final No 19 25 Jun 24 25 Jul 24 3.05

Interim No 7 20 Sep 16 26 Sep 16 85.00

LIQUIDITY: Jan25 Avg 6m shares p.w., R120.2m(19.4% p.a.)

LIQUIDITY: Jan25 Avg 71m shares p.w., R1 443.3m(130.2% p.a.)

REDS 40 Week MA SIRIUS

MINI 40 Week MA SIBANYE-S

3033

7360

2597

6203

2160

5046

1724

3889

1287

2732

851

2020 | 2021 | 2022 | 2023 | 2024 |

1575

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in EUR’000) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Interim Final Final Final Final

Interim Final Final Final Final NetRent/InvInc 66 700 116 100 105 100 84 093 65 997

Wrk Revenue 55 204 113 684 138 288 172 194 127 392 Total Inc 71 800 122 700 107 900 87 079 68 709

Wrk Pft 3 009 13 916 36 664 71 181 51 616 Attrib Inc 55 500 107 800 79 600 147 873 147 451

NetIntPd(Rcd) 1 543 1 930 1 637 1 294 2 086 TotCompIncLoss 68 700 120 800 62 500 146 291 147 560

Minority Int 334 342 584 742 1 310 Ord UntHs Int 1 608 200 1 407 300 1 197 100 1 190 652 926 533

Att Inc - 7 472 - 37 772 18 396 33 054 29 312

TotCompIncLoss - 7 019 - 32 782 21 349 38 431 28 616 Investments 2 372 600 2 210 600 2 123 000 2 100 004 1 362 192

Ord SH Int 46 541 51 607 91 004 81 345 70 716 FixedAss/Prop 15 200 7 800 7 200 5 492 2 682

LT Liab 58 784 50 751 46 048 43 290 38 269 Tot Curr Ass 368 100 286 600 156 100 175 866 84 475

Cap Employed 110 213 106 534 146 412 132 453 116 616 Total Ass 2 844 700 2 595 200 2 388 700 2 386 863 1 519 998

Mining Ass 61 429 61 338 76 909 62 494 60 600 Tot Curr Liab 148 700 153 600 352 800 120 478 67 975

Inv & Loans 3 370 3 179 3 340 3 367 847 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 51 529 61 822 60 764 64 551 52 243 HEPS-C (ZARc) 79.28 165.00 134.87 91.77 92.38

Tot Curr Liab 24 699 36 407 20 219 20 541 17 487 DPS (ZARc) 58.85 122.25 110.38 76.02 65.82

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 2 049.12 2 109.70 1 974.40 1 655.09 1 317.59

HEPS-C (ZARc) 5.00 63.00 652.00 1 272.00 1 068.00 3 Yr Beta 1.35 1.28 1.22 0.57 0.63

DPS (ZARc) - 53.00 260.00 479.00 371.00 Price Prd End 2 218 2 327 1 657 2 428 1 818

NAV (ZARc) 1 644.23 1 823.20 3 215.27 2 896.48 2 418.82 Price High 2 447 2 405 2 468 3 145 2 028

Price Prd End 1 972 2 490 4 472 4 910 6 000 Price Low 2 103 1 651 1 248 1 817 1 311

Price High 2 738 5 245 8 022 7 665 6 180 RATIOS

Price Low 1 775 1 756 3 568 4 479 1 537 RetOnSH Funds 6.90 7.66 6.65 12.43 15.92

RATIOS RetOnTotAss 5.13 4.76 4.63 3.95 4.87

Ret on SH fund - 30.67 - 72.53 20.86 41.55 43.30 Debt:Equity 0.64 0.70 0.84 0.86 0.52

Ret on Tot Ass 2.41 7.59 22.94 49.48 40.36

Yield (g/ton) 0.68 0.76 0.69 0.79 0.80 OperRetOnInv 5.59 5.23 4.93 3.99 4.84

Price Received 1 327 000 1 146 093 958 232 860 303 967 229 OpInc:Turnover 42.62 40.20 38.91 40.01 39.91

WrkCost(R/kg) 1 078 670 1 011 673 937 627 669 084 581 113

193