Page 199 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 199

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – SPE

Spear REIT Ltd. Spur Corporation Ltd.

SPE SPU

ISIN: ZAE000228995 SHORT: SPEARREIT CODE: SEA ISIN: ZAE000022653 SHORT: SPURCORP CODE: SUR

REG NO: 2015/407237/06 FOUNDED: 2011 LISTED: 2016 REG NO: 1998/000828/06 FOUNDED: 1967 LISTED: 1999

NATURE OF BUSINESS: Spear REIT Ltd. listed as a Real Estate NATURE OF BUSINESS: Spur Corporation Ltd. (company registration

Investment Trust (“REIT”) on the main board of the Johannesburg Stock number: 1998/000828/06), which is domiciled and incorporated in the

Exchange (“JSE”) and is the only regionally-focused REIT listed on the JSE Republic of South Africa and listed on the JSE Ltd., the recognised securities

that invests in high-quality income-generating assets in the Western Cape. exchange in South Africa, is an investment holding company. Through

Spear obtains its diversification through asset type rather than various subsidiaries, the group carries on the business of franchisor in

geographical investment. predominantly the family sit-down and quick service restaurant markets.

SECTOR: RealEstate—RealEstate—REITS—Diversified Through other subsidiaries, the group provides marketing and promotional

NUMBER OF EMPLOYEES: 30 services to franchisees. A subsidiary of the company, Spur Group Properties

DIRECTORS: AllieJE(ld ind ne), GoldbergBL(ind ne), McCarthy C S (Pty) Ltd., owns certain properties which are owner-occupied from a group

(ne), Phillips Dr R (ind ne), Raziya B (ind ne), Varachhia A (Chair, ne), perspective. A subsidiary, Share Buy-back (Pty) Ltd., holds treasury shares

Flax M N (Dep Chair, ne), Rossi Q M (CEO), Barnard C (CFO) as authorised by shareholders by way of special resolution on an annual

MAJOR ORDINARY SHAREHOLDERS as at 11 Oct 2024 basis. The company also has indirect interests in five local entities that

36One Asset Management (Pty) Ltd. 8.08% operate four The Hussar Grills, one RocoMamas and one Modrockers (pilot

Spear Holdco (Pty) Ltd. 7.90% proof of concept) outlet in South Africa.

Old Mutual Group 7.48% SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Resturants&Bars

POSTAL ADDRESS: PO Box 50, Observatory, 7935 NUMBER OF EMPLOYEES: 434

MORE INFO: www.sharedata.co.za/sdo/jse/SEA DIRECTORS: Boggenpoel J (ind ne), Fernandez C (ind ne),

COMPANY SECRETARY: René Cheryl Stober Molebatsi L (ind ne), ParkerAC(ind ne), ZinnSA(ld ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Bosman M J (Chair, ind ne), Nichas V (CEO), Robertson K (COO),

SPONSOR: PSG Capital (Pty) Ltd. Teixeira C (CFO)

AUDITORS: BDO MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2024

Coronation Fund Managers 16.30%

CAPITAL STRUCTURE AUTHORISED ISSUED Camissa Asset Management (Pty) Ltd. 10.17%

SEA Ords no par 1 000 000 000 339 986 976 Allan Gray 10.10%

POSTAL ADDRESS: PO Box 166, Century City, 7446

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt MORE INFO: www.sharedata.co.za/sdo/jse/SUR

Interim No 16 12 Nov 24 18 Nov 24 39.53 COMPANY SECRETARY: Donfrey Meyer

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final No 15 11 Jun 24 18 Jun 24 40.53

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

LIQUIDITY: Jan25 Avg 1m shares p.w., R9.3m(15.6% p.a.) AUDITORS: PwC Inc.

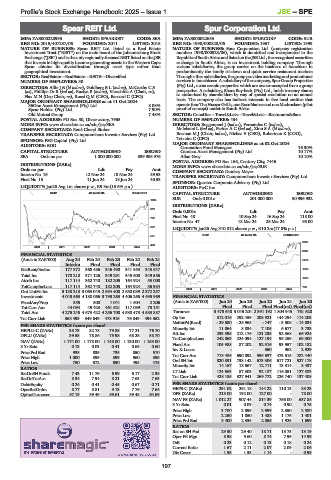

REIV 40 Week MA SPEARREIT CAPITAL STRUCTURE AUTHORISED ISSUED

SUR Ords 0.001c 201 000 000 90 996 932

1034

DISTRIBUTIONS [ZARc]

913

Ords 0.001c Ldt Pay Amt

Final No 48 10 Sep 24 16 Sep 24 118.00

792

Interim No 47 18 Mar 24 25 Mar 24 95.00

672 LIQUIDITY: Jan25 Avg 310 812 shares p.w., R10.2m(17.8% p.a.)

551 TRAV 40 Week MA SPURCORP

3597

430

2020 | 2021 | 2022 | 2023 | 2024 |

3037

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 2476

Interim Final Final Final Final

NetRent/InvInc 177 372 368 486 346 490 341 953 343 647 1916

Total Inc 178 218 371 126 349 291 345 600 349 556

1356

Attrib Inc 117 114 362 740 182 205 164 924 53 008

TotCompIncLoss 117 114 362 740 182 205 164 924 56 984 796

2020 | 2021 | 2022 | 2023 | 2024 |

Ord UntHs Int 3 138 213 3 063 045 2 594 408 2 650 089 2 372 257

Investments 4 043 563 4 180 066 3 793 263 4 406 265 4 495 969 FINANCIAL STATISTICS

FixedAss/Prop 355 500 1 041 1 604 2 206 (Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Tot Curr Ass 44 094 49 423 461 621 117 089 75 151 Final Final Final Final(rst) Final(rst)

Total Ass 4 275 245 4 673 422 4 256 708 4 530 473 4 583 887 Turnover 3 473 648 3 045 201 2 391 192 1 804 945 761 620

Tot Curr Liab 368 493 349 649 473 915 76 849 494 362 Op Inc 312 016 292 459 208 921 144 294 114 203

NetIntPd(Rcvd) - 29 580 - 25 965 - 747 - 3 508 - 14 034

PER SHARE STATISTICS (cents per share) Minority Int 11 064 8 834 7 105 6 677 3 733

HEPLU-C (ZARc) 38.73 82.78 79.85 77.21 76.70

DPLU (ZARc) 39.53 78.86 75.98 68.25 58.70 Att Inc 233 598 212 176 121 235 92 568 66 924

99 259

TotCompIncLoss

69 300

242 869

224 094

127 194

NAV (ZARc) 1 174.00 1 178.00 1 148.00 1 130.00 1 153.00

3 Yr Beta 0.13 0.03 0.41 0.65 0.60 Fixed Ass 105 988 87 202 92 516 93 957 102 182

2 929

962

350

Price Prd End 935 835 735 850 510 Inv & Loans 713 486 - 690 892 - 558 637 473 515 282 440

Tot Curr Ass

Price High 1 000 899 899 960 895

Price Low 750 672 690 495 475 Ord SH Int 820 891 738 142 673 306 617 721 527 178

14 167

Minority Int

13 567

12 711

8 437

13 314

RATIOS

RetOnSH Funds 7.43 11.79 6.99 6.17 2.38 LT Liab 124 663 87 303 92 187 116 051 127 883

RetOnTotAss 8.34 7.94 8.21 7.63 7.63 Tot Curr Liab 428 185 327 941 269 772 226 740 137 408

Debt:Equity 0.24 0.41 0.45 0.67 0.71 PER SHARE STATISTICS (cents per share)

OperRetOnInv 8.77 8.81 9.13 7.76 7.64 HEPS-C (ZARc) 291.02 261.18 144.22 110.13 83.23

OpInc:Turnover 57.19 59.49 59.61 59.48 64.69 DPS (ZARc) 213.00 192.00 127.00 - 78.00

NAV PS (ZARc) 1 012.27 907.44 814.39 756.00 637.88

3 Yr Beta 0.01 0.09 0.74 0.90 0.75

Price High 3 700 2 599 2 699 2 350 2 880

Price Low 2 250 1 850 1 488 1 176 1 401

Price Prd End 3 400 2 335 2 055 1 925 1 699

RATIOS

Ret on SH Fnd 29.30 29.40 18.71 15.73 13.19

Oper Pft Mgn 8.98 9.60 8.74 7.99 14.99

D:E 0.23 0.12 0.13 0.18 0.24

Current Ratio 1.67 2.11 2.07 2.09 2.06

Div Cover 1.35 1.35 1.14 - 0.99

197