Page 202 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 202

JSE – SUN Profile’s Stock Exchange Handbook: 2025 – Issue 1

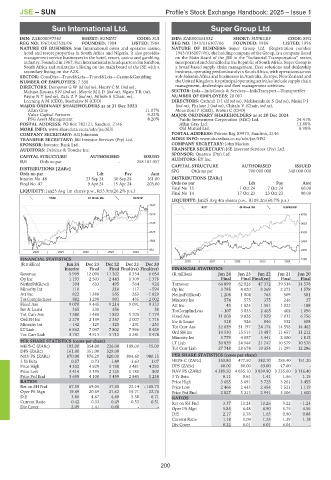

Sun International Ltd. Super Group Ltd.

SUN SUP

ISIN: ZAE000097580 SHORT: SUNINT CODE: SUI ISIN: ZAE000161832 SHORT: SUPRGRP CODE: SPG

REG NO: 1967/007528/06 FOUNDED: 1984 LISTED: 1984 REG NO: 1943/016107/06 FOUNDED: 1986 LISTED: 1996

NATURE OF BUSINESS: Sun International owns and operates casino, NATURE OF BUSINESS: Super Group Ltd. (Registration number

hotel and resort properties in South Africa and Nigeria. It also provides 1943/016107/06), the holding company of the Group, is a company listed

management service businesses in the hotel, resort, casino and gambling on the Main Board of the JSE in the “Industrial Transportation” sector,

industry. Founded in 1967, Sun International is headquartered in Sandton, incorporatedanddomiciled inthe Republic ofSouth Africa. Super Groupis

South Africa and maintains a listing on the main board of the JSE with a a broad-based supply chain management, fleet solutions and dealership

secondary listing on the A2X.. business, operating predominantly in South Africa, with operations across

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling sub-Saharan Africa and businesses in Australia, Europe, New Zealand and

NUMBER OF EMPLOYEES: 7 538 the United Kingdom. Its principal operating activities include supply chain

DIRECTORS: DempsterGW(ld ind ne), HenryCM(ind ne), management, dealerships and fleet management activities.

Mabaso-KoyanaSN(ind ne), MaroleMLD(ind ne), NgaraTR(ne), SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

PayneNT(ind ne), ZatuZP(ind ne), Sithole S (Chair, ne), NUMBER OF EMPLOYEES: 20 007

Leeming A M (CEO), Basthdaw N (CFO) DIRECTORS: CathrallDI(ld ind ne), Mehlomakulu S (ind ne), Mnisi P J

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 (ind ne), Phalane J (ind ne), Chitalu V (Chair, ind ne),

Allan Gray 11.07% Mountford P (CEO), Brown C (CFO)

Value Capital Partners 9.22% MAJOR ORDINARY SHAREHOLDERS as at 20 Dec 2024

PSG Asset Management 8.20% Public Investment Corporation (SOC) Ltd. 24.41%

POSTAL ADDRESS: PO Box 782121, Sandton, 2146 Allan Gray Ltd. 13.88%

MORE INFO: www.sharedata.co.za/sdo/jse/SUI Old Mutual Ltd. 8.98%

COMPANY SECRETARY: AG Johnston POSTAL ADDRESS: Private Bag X9973, Sandton, 2146

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/SPG

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY: John Mackay

AUDITORS: Deloitte & Touche Inc. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Questco (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: EY Inc.

SUI Ords no par - 258 181 057

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] SPG Ords no par 700 000 000 340 000 000

Ords no par Ldt Pay Amt

Interim No 48 23 Sep 24 30 Sep 24 161.00 DISTRIBUTIONS [ZARc]

Final No 47 9 Apr 24 15 Apr 24 203.00 Ords no par Ldt Pay Amt

Final No 15 1 Oct 24 7 Oct 24 60.00

LIQUIDITY: Jan25 Avg 1m shares p.w., R53.9m(26.2% p.a.)

Final No 14 17 Oct 23 23 Oct 23 80.00

TRAV 40 Week MA SUNINT

LIQUIDITY: Jan25 Avg 4m shares p.w., R108.2m(60.7% p.a.)

.

4687

INDT 40 Week MA SUPRGRP

3916 6708

3145 5623

2375 4539

1604 3454

833 2370

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 1285

2020 | 2021 | 2022 | 2023 | 2024 |

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final(rst) Final(rst) FINANCIAL STATISTICS

Revenue 5 999 12 096 11 302 8 334 6 054 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Op Inc 1 193 2 503 2 443 1 309 - 1 378 Final Final Final(rst) Final Final

NetIntPd(Rcvd) 304 633 495 564 924 Turnover 64 899 62 026 47 372 39 518 34 578

Minority Int 110 - 210 117 - 594 Op Inc 3 795 4 020 3 269 2 273 1 578

Att Inc 822 1 388 555 263 - 1 829 NetIntPd(Rcvd) 1 206 1 004 763 509 581

TotCompIncLoss 882 1 298 801 435 - 2 002 Minority Int 574 575 375 246 27

Fixed Ass 9 070 9 445 9 214 9 091 9 333 Att Inc 43 1 625 1 361 1 022 - 188

Inv & Loans 365 338 356 - 58 TotCompIncLoss - 107 3 833 2 465 402 1 096

Tot Curr Ass 1 580 1 488 1 822 1 705 1 774 Fixed Ass 11 003 9 826 7 929 7 012 6 756

Ord SH Int 2 270 2 139 2 357 2 007 1 715 Inv & Loans 518 926 846 532 608

Minority Int - 142 - 129 - 325 - 291 - 253

LT Liab 6 862 7 047 7 802 7 996 8 429 Tot Curr Ass 32 839 31 197 24 174 14 558 14 462

11 657

13 487

15 513

14 530

Ord SH Int

11 212

Tot Curr Liab 3 737 4 513 3 712 3 241 3 478

Minority Int 3 779 4 057 3 441 2 100 1 815

PER SHARE STATISTICS (cents per share) LT Liab 30 839 24 944 21 747 10 579 10 576

HEPS-C (ZARc) 192.00 354.00 226.00 109.00 - 15.00 Tot Curr Liab 27 748 28 674 19 354 11 299 12 286

DPS (ZARc) 161.00 351.00 329.00 - -

NAV PS (ZARc) 870.00 876.29 820.00 804.60 980.15 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.57 0.73 1.49 1.63 1.07 HEPS-C (ZARc) 353.80 477.50 380.70 285.40 151.20

Price High 4 332 4 529 3 758 3 481 4 292 DPS (ZARc) 60.00 80.00 63.00 47.00 -

Price Low 3 414 3 195 2 125 1 180 800 NAV PS (ZARc) 4 289.50 4 635.10 3 839.90 3 235.00 3 116.40

Price Prd End 3 698 4 100 3 459 2 845 1 238 3 Yr Beta 0.11 0.61 1.41 1.56 1.15

RATIOS Price High 3 655 3 691 3 725 3 261 3 455

Ret on SH Fnd 87.59 69.05 37.65 22.14 - 165.73 Price Low 2 466 2 443 2 454 1 521 1 119

Oper Pft Mgn 19.89 20.69 21.62 15.71 - 22.76 Price Prd End 2 827 3 213 2 941 3 106 1 600

D:E 3.86 4.67 4.60 5.38 6.71 RATIOS

Current Ratio 0.42 0.33 0.49 0.53 0.51 Ret on SH Fnd 3.37 11.24 10.26 9.22 - 1.24

Div Cover 2.09 1.41 0.68 - - Oper Pft Mgn 5.85 6.48 6.90 5.75 4.56

D:E 2.17 1.78 1.65 0.90 0.88

Current Ratio 1.18 1.09 1.25 1.29 1.18

Div Cover 0.22 6.01 6.01 6.04 -

200