Page 207 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 207

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – TRA

Transaction Capital Ltd. Transpaco Ltd.

TRA TRA

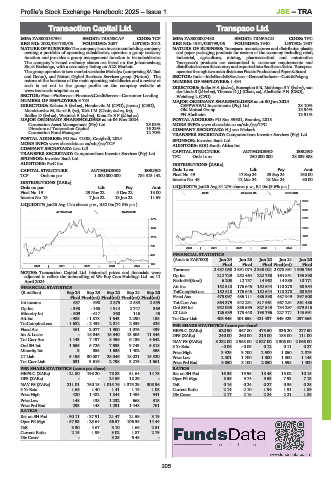

ISIN: ZAE000167391 SHORT: TRANSCAP CODE: TCP ISIN: ZAE000007480 SHORT: TRNPACO CODE: TPC

REG NO: 2002/031730/06 FOUNDED: 2007 LISTED: 2012 REG NO: 1951/000799/06 FOUNDED: 1940 LISTED: 1987

NATURE OF BUSINESS: The company is an investment holding company NATURE OF BUSINESS: Transpaco manufactures and distributes plastic

owning a portfolio of operating subsidiaries, operates a group treasury and paper packaging products for sectors of the economy including retail,

function and provides a group management function to its subsidiaries. industrial, agriculture, mining, pharmaceutical and automotive.

The company’s issued ordinary shares are listed on the Johannesburg Transpaco’s products are customised to customer requirements and

Stock Exchange, with a secondary listing on A2X Markets. distributed across the country and exported into Southern Africa. Transpaco

The group operates in two market verticals: Mobalyz (comprising SA Taxi operatesthroughtwomaindivisions:PlasticProductsandPaper&Board.

and Gomo), and Nutun Digital Business Services group (Nutun) . The SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng

nature of the business of the main operating subsidiaries and a review of NUMBER OF EMPLOYEES: 1 434

each is set out in the group profile on the company website at DIRECTORS: Botha H A (ind ne), Bouzaglou S R, Mahlangu S Y (ind ne), van

www.transactioncapital.co.za. der Linde S (ld ind ne), Thomas D J J (Chair, ne), Abelheim P N (CEO),

SECTOR: Fins—FinServcs—Finance&CreditServcs—Consumer Lending Weinberg L (CFO)

NUMBER OF EMPLOYEES: 9 784 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

DIRECTORS: Kekana A (ind ne), Herskovits M (CFO), Jawno J (CEO), CEPPWAWU Investments (Pty) Ltd. 23.10%

Mendelowitz M, Rossi R (ne), Kirk I M (Chair, ind ne, Ire), Old Mutual Group 13.94%

Radley D (ind ne), Wapnick S (ind ne), Kana DrSP(ld ind ne) PN Abelheim 13.91%

MAJOR ORDINARY SHAREHOLDERS as at 04 Nov 2024 POSTAL ADDRESS: PO Box 39601, Bramley, 2018

Coronation Asset Management (Pty) Ltd. 25.03% MORE INFO: www.sharedata.co.za/sdo/jse/TPC

Directors of Transaction Capital 16.23% COMPANY SECRETARY: H J van Niekerk

Coronation Fund Managers 12.70% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 41888, Craighall, 2024 SPONSOR: Investec Bank Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TCP AUDITORS: BDO South Africa Inc.

COMPANY SECRETARY: Lisa Lill

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Investec Bank Ltd. TPC Ords 1c ea 250 000 000 28 839 388

AUDITORS: PwC Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords 1c ea Ldt Pay Amt

TCP Ords no par 1 000 000 000 784 313 142 Final No 49 17 Sep 24 23 Sep 24 160.00

Interim No 48 12 Mar 24 18 Mar 24 80.00

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt LIQUIDITY: Jan25 Avg 31 276 shares p.w., R1.0m(5.6% p.a.)

Final No 19 29 Nov 22 5 Dec 22 13.00 GENI 40 Week MA TRNPACO

Interim No 18 7 Jun 22 13 Jun 22 11.59

3924

LIQUIDITY: Jan25 Avg 11m shares p.w., R52.0m(74.8% p.a.)

3301

40 Week MA TRANSCAP

1774 2678

1449 2055

1124 1431

798 808

2020 | 2021 | 2022 | 2023 | 2024 |

473 FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

148 Final Final Final Final(rst) Final

2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 2 487 058 2 591 074 2 338 021 2 078 891 1 905 764

NOTES: Transaction Capital Ltd. historical prices and financials were

adjusted to reflect the unbundling of We Buy Cars Holdings Ltd. on 11 Op Inc 212 729 252 464 222 758 164 851 135 890

April 2024. NetIntPd(Rcvd) 6 203 12 757 14 962 14 385 10 771

FINANCIAL STATISTICS Att Inc 152 518 176 645 152 644 110 278 68 954

(R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20 TotCompIncLoss 152 518 176 645 152 644 110 278 68 954

Final Final(rst) Final(rst) Final(rst) Final(rst) Fixed Ass 475 097 486 111 486 898 487 949 397 508

Int income 687 698 2 875 2 583 2 555 Tot Curr Ass 864 379 842 231 817 961 667 281 561 486

Op Inc - 398 - 165 1 914 2 747 369 Ord SH Int 932 035 885 595 827 543 734 297 679 515

Minority Int - 509 - 617 360 116 45 LT Liab 126 639 175 448 193 796 227 771 143 691

Att Inc - 985 - 1 878 1 643 2 290 158 Tot Curr Liab 403 948 401 658 421 437 349 423 297 365

TotCompIncLoss - 1 632 - 2 433 2 014 2 339 326 PER SHARE STATISTICS (cents per share)

Fixed Ass 461 2 077 1 900 1 075 439 HEPS-C (ZARc) 520.90 567.80 475.50 336.20 277.50

Inv & Loans - 15 046 15 340 13 305 11 545 DPS (ZARc) 240.00 260.00 215.00 153.00 111.00

Tot Curr Ass 1 143 7 197 8 456 6 136 4 642 NAV PS (ZARc) 3 232.00 2 958.00 2 627.00 2 306.00 2 066.00

Ord SH Int 1 655 5 726 7 693 9 743 5 818 3 Yr Beta - 0.06 - 0.09 0.12 0.11 0.27

Minority Int 3 855 1 636 1 402 555 Price High 3 925 3 700 2 600 1 850 2 079

LT Liab 5 196 30 087 28 046 18 021 15 520 Price Low 2 501 1 700 1 300 1 300 1 145

Tot Curr Liab 531 3 616 2 798 3 275 1 661 Price Prd End 3 050 3 100 2 050 1 598 1 400

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 21.80 198.20 78.83 51.64 14.75 Ret on SH Fnd 16.36 19.95 18.45 15.02 10.15

DPS (ZARc) - - 24.59 18.26 - Oper Pft Mgn 8.55 9.74 9.53 7.93 7.13

NAV PS (ZARc) 211.01 750.15 1 015.76 1 375.29 308.96 D:E 0.16 0.24 0.27 0.36 0.25

3 Yr Beta 1.66 1.40 1.41 1.19 1.08 Current Ratio 2.14 2.10 1.94 1.91 1.89

Price High 420 1 482 1 844 1 454 941 Div Cover 2.17 2.18 2.24 2.21 1.89

Price Low 148 138 1 232 668 315

Price Prd End 293 148 1 291 1 448 761

RATIOS

Ret on SH Fnd - 90.11 - 37.91 21.47 21.59 3.19

Oper Pft Mgn - 57.93 - 23.64 66.57 106.35 14.44

D:E 3.30 4.67 3.10 1.66 2.51

Current Ratio 2.15 1.99 3.02 1.87 2.79

Div Cover - - 3.25 6.48 -

205