Page 209 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 209

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – TRE

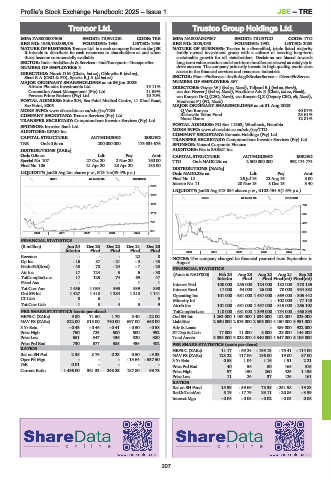

Trencor Ltd. Trustco Group Holdings Ltd.

TRE TRU

ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE ISIN: NA000A0RF067 SHORT: TRUSTCO CODE: TTO

REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955 REG NO: 2003/058 FOUNDED: 1992 LISTED: 2009

NATURE OF BUSINESS: Trencor Ltd. is a cash company listed on the JSE. NATURE OF BUSINESS: Trustco is a diversified, triple listed majority

It intends to distribute its cash resources to shareholders as and when family owned investment group with a culture of creating long-term

these become commercially available. sustainable growth for all stakeholders. Decisions are biased towards

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer long-term value creation and short-term hurdles are viewed as catalysts to

NUMBER OF EMPLOYEES: 3 drive success. The company primarily invests in high quality, world class

DIRECTORS: Nurek D M (Chair, ind ne), Oblowitz E (ind ne), assets in the financial services and resources industries.

Sieni R A (CEO & FD), SparksRJA(ld ind ne) SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

MAJOR ORDINARY SHAREHOLDERS as at 06 Jan 2025 NUMBER OF EMPLOYEES: 567

African Phoenix Investments Ltd. 19.11% DIRECTORS: Geyser W J (ind ne, Namb), Taljaard R J (ind ne, Namb),

Coronation Asset Management (Pty) Ltd. 11.59% van den Heever J (ind ne, Namb), Heathcote Adv R (Chair, ind ne, Namb),

Peresec Prime Brokers (Pty) Ltd. 10.70% van Rooyen Dr Q (CEO, Namb), van Rooyen Q Z (Deputy CEO, alt, Namb),

POSTAL ADDRESS: Suite 304, Sea Point Medical Centre, 11 Kloof Road, Abrahams F J (FD, Namb)

Sea Point, 8005 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2023

MORE INFO: www.sharedata.co.za/sdo/jse/TRE Q.Van Rooyen 40.07%

COMPANY SECRETARY: Trencor Services (Pty) Ltd. Riskowits Value Fund 23.61%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Notre Dame 12.81%

SPONSOR: Investec Bank Ltd. POSTAL ADDRESS: PO Box 11363, Windhoek, Namibia

AUDITORS: KPMG Inc. MORE INFO: www.sharedata.co.za/sdo/jse/TTO

COMPANY SECRETARY: Komada Holdings (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRE Ords 0.5c ea 200 000 000 173 534 676 SPONSOR: Vunani Corporate Finance

DISTRIBUTIONS [ZARc] AUDITORS: Nexia SAB&T Inc.

Ords 0.5c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Special No 107 27 Oct 20 2 Nov 20 160.00 TTO Ords NAD0.23c ea 2 500 000 000 992 174 774

Final No 106 21 Apr 20 28 Apr 20 185.00

DISTRIBUTIONS [NADc]

LIQUIDITY: Jan25 Avg 2m shares p.w., R13.1m(49.4% p.a.) Ords NAD0.23c ea Ldt Pay Amt

INDT 40 Week MA TRENCOR Final No 12 26 Jul 16 22 Aug 16 5.00

Interim No 11 20 Nov 15 8 Dec 15 3.40

2378

LIQUIDITY: Jan25 Avg 313 864 shares p.w., R102 454.3(1.6% p.a.)

1976

GENF 40 Week MA TRUSTCO

1575 798

1174 642

772 487

371 331

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 176

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final 2020 | 2021 | 2022 | 2023 | 2024 | 20

Revenue - - - 22 8 NOTES: The company changed its financial year-end from September to

Op Inc - 16 87 - 21 - 3 - 43 August.

NetIntPd(Rcvd) - 43 -78 - 24 -7 -23 FINANCIAL STATISTICS

Att Inc 17 124 3 6 - 38 (Amts in NAD’000) Feb 24 Aug 23 Aug 22 Aug 21 Sep 20

TotCompIncLoss 17 125 74 69 47 Interim Final Final Final(rst) Final(rst)

Fixed Ass - - - 1 1 Interest Paid 100 000 255 000 124 000 182 000 378 185

Tot Curr Ass 1 436 1 084 993 939 898 Interest Rcvd 17 000 64 000 26 000 70 000 984 882

Ord SH Int 1 427 1 410 1 284 1 210 1 141 Operating Inc 101 000 - 681 000 1 437 000 - 869 000 - 305 442

LT Liab 8 6 - - 3 Minority Int - - - - 102 000 - 77 140

Tot Curr Liab 1 3 4 5 9 Attrib Inc 101 000 - 681 000 1 437 000 - 815 000 - 266 102

PER SHARE STATISTICS (cents per share) TotCompIncLoss 110 000 - 681 000 1 399 000 - 754 000 - 466 893

HEPS-C (ZARc) 9.80 71.50 1.70 3.40 - 22.00 Ord SH Int 1 263 000 1 153 000 1 834 000 182 000 829 000

NAV PS (ZARc) 822.00 813.00 740.00 697.00 658.00 Liabilities 2 630 000 2 675 000 2 506 000 4 150 000 3 951 000

3 Yr Beta - 0.43 - 0.46 - 0.41 - 0.50 - 0.58 Adv & Loans - - - 489 000 922 000

Price High 750 725 600 500 992 ST Dep & Cash 17 000 11 000 8 000 23 000 144 000

Price Low 651 547 436 320 380 Total Assets 3 893 000 3 828 000 4 340 000 4 547 000 5 105 000

Price Prd End 730 677 585 459 402 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 11.17 - 69.24 - 195.13 - 75.41 - 114.00

Ret on SH Fnd 2.38 8.79 0.23 0.50 - 3.33 NAV PS (ZARc) 128.22 117.06 186.00 19.00 87.00

Oper Pft Mgn - - - - 13.64 - 537.50 3 Yr Beta 0.58 1.04 1.16 1.91 2.21

D:E 0.01 - - - - Price Prd End 40 56 50 165 315

Current Ratio 1 436.00 361.33 248.25 187.80 99.78 Price High 97 150 260 425 1 135

Price Low 11 24 37 125 161

RATIOS

Ret on SH Fund 15.99 - 59.06 78.35 - 251.98 - 19.83

RetOnTotalAss 5.19 - 17.79 33.11 - 20.85 - 3.99

Interest Mgn - 0.04 - 0.05 - 0.02 - 0.03 0.08

207