Page 214 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 214

JSE – WES Profile’s Stock Exchange Handbook: 2025 – Issue 1

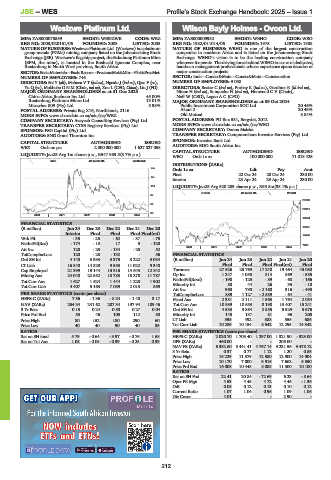

Wesizwe Platinum Ltd. Wilson Bayly Holmes - Ovcon Ltd.

WES WIL

ISIN: ZAE000075859 SHORT: WESIZWE CODE: WEZ ISIN: ZAE000009932 SHORT: WBHO CODE: WBO

REG NO: 2003/020161/06 FOUNDED: 2003 LISTED: 2005 REG NO: 1982/011014/06 FOUNDED: 1975 LISTED: 1988

NATURE OF BUSINESS: Wesizwe Platinum Ltd. (Wesizwe) is a platinum NATURE OF BUSINESS: WBHO is one of the largest construction

group metals (PGMs) mining company listed on the Johannesburg Stock companies in southern Africa and is listed on the Johannesburg Stock

Exchange (JSE). Wesizwe’s flagship project, the Bakubung Platinum Mine Exchange. WBHO’s vision is to be the leading construction company

(BPM, the mine), is located in the Bushveld Igneous Complex, near wherever it operate. The driving force behind WBHO is a core of dedicated,

Rustenburg in North West province, South Africa. hands-on management professionals whose experience spans decades of

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet major construction projects.

NUMBER OF EMPLOYEES: 746 SECTOR: Inds—Constr&Mats—Constr&Mats—Construction

DIRECTORS: Bai Y (alt), Mabuza V T (ind ne), Ngculu J (ind ne), Qiao F (ne), NUMBER OF EMPLOYEES: 9 038

Yu Q (ne), Mokhobo D N M (Chair, ind ne), Zou L (CEO, China), Liu J (FD) DIRECTORS: Bester C (ind ne), Forbay K (ind ne), Gardiner R (ld ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 Ntene H (ind ne), Sonqushu N (ind ne), Henwood C V (Chair),

China-Africa Jinchuan Inv Ltd. 45.00% Neff W (CEO), Logan A C (CFO)

Rustenburg Platinum Mines Ltd. 13.01% MAJOR ORDINARY SHAREHOLDERS as at 09 Oct 2024

Micawber 809 (Pty) Ltd. 5.98% Public Investment Corporation SOC Ltd. 20.46%

POSTAL ADDRESS: Private Bag X16, Northlands, 2116 Akani 2 20.43%

MORE INFO: www.sharedata.co.za/sdo/jse/WEZ Old Mutual 8.84%

COMPANY SECRETARY: Azeyech Consulting Services (Pty) Ltd. POSTAL ADDRESS: PO Box 531, Bergvlei, 2012

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/WBO

SPONSOR: PSG Capital (Pty) Ltd. COMPANY SECRETARY: Donna Msiska

AUDITORS: SNG Grant Thornton Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: BDO South Africa Inc.

WEZ Ords no par 2 000 000 000 1 627 827 058

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Jan25 Avg 1m shares p.w., R547 983.5(3.7% p.a.)

WBO Ords 1c ea 100 000 000 71 018 425

MINI 40 Week MA WESIZWE

DISTRIBUTIONS [ZARc]

168 Ords 1c ea Ldt Pay Amt

Final 22 Oct 24 28 Oct 24 230.00

141 Interim 23 Apr 24 29 Apr 24 230.00

114 LIQUIDITY: Jan25 Avg 520 289 shares p.w., R95.8m(38.1% p.a.)

CONM 40 Week MA WBHO

87

23199

60

20016

33

2020 | 2021 | 2022 | 2023 | 2024 |

16834

FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 13651

Interim Final Final Final Final(rst)

10469

WrkPft -35 - 25 -62 - 37 -75

NetIntPd(Rcd) - 174 - 13 17 5 - 128 7286

2020 | 2021 | 2022 | 2023 | 2024 |

Att Inc 120 - 25 - 134 - 25 52

TotCompIncLoss 120 - 28 - 132 - 56 FINANCIAL STATISTICS

Ord SH Int 4 140 3 933 3 375 3 222 3 084 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

LT Liab 16 840 14 829 9 553 11 022 9 348 Final Final Final Final(rst) Final

Cap Employed 21 399 19 144 13 316 14 643 12 842 Turnover 27 526 23 769 17 240 19 464 43 080

Mining Ass 24 048 22 552 18 783 15 278 11 787 Op Inc 1 247 1 058 814 869 - 585

Tot Curr Ass 1 627 1 624 1 444 1 228 1 902 NetIntPd(Rcvd) - 198 - 125 - 89 - 68 - 166

Tot Curr Liab 4 407 5 163 7 089 2 013 869 Minority Int 80 44 26 35 - 10

Att Inc 968 790 - 2 160 316 - 498

PER SHARE STATISTICS (cents per share) TotCompIncLoss 889 1 127 - 2 589 - 64 - 41

HEPS-C (ZARc) 7.36 - 1.36 - 8.24 - 1.48 3.17 Fixed Ass 2 331 2 111 1 563 1 764 2 054

NAV (ZARc) 254.34 241.62 207.34 197.94 189.46 Tot Curr Ass 10 989 10 553 8 198 13 407 15 241

3 Yr Beta 0.15 0.24 0.50 0.27 0.04 Ord SH Int 4 533 3 864 2 855 5 529 5 676

Price Prd End 53 46 105 112 50 Minority Int 145 137 81 96 205

Price High 80 152 180 290 60 LT Liab 395 492 388 555 686

Price Low 40 40 90 40 35 Tot Curr Liab 10 289 10 154 8 542 12 295 14 342

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH fund 5.79 - 0.64 - 3.97 - 0.76 1.68 HEPS-C (ZARc) 2 020.70 1 703.40 1 297.00 1 321.90 - 923.00

Ret on Tot Ass 1.08 - 0.05 - 0.39 - 0.25 0.39 DPS (ZARc) 460.00 - - 205.00 -

NAV PS (ZARc) 6 382.60 5 441.41 4 767.14 9 231.56 9 478.12

3 Yr Beta 0.37 0.77 1.12 1.20 0.86

Price High 16 229 11 379 12 580 12 900 14 904

Price Low 10 170 7 000 6 916 7 662 6 350

Price Prd End 16 008 10 448 8 088 11 300 10 100

RATIOS

Ret on SH Fnd 22.41 20.84 - 72.69 6.23 - 8.64

Oper Pft Mgn 4.53 4.45 4.72 4.46 - 1.36

D:E 0.08 0.12 0.13 0.10 0.12

Current Ratio 1.07 1.04 0.96 1.09 1.06

Div Cover 4.01 - - 2.90 -

212