Page 85 - shbh24_complete

P. 85

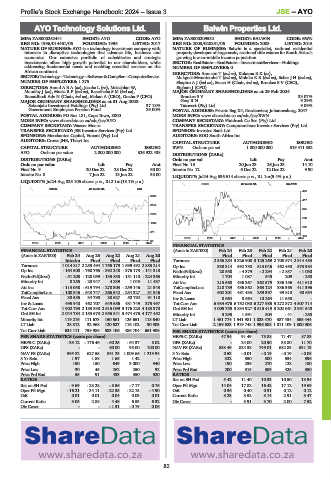

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – AYO

AYO Technology Solutions Ltd. Balwin Properties Ltd.

AYO BAL

ISIN: ZAE000252441 SHORT: AYO CODE: AYO ISIN: ZAE000209532 SHORT: BALWIN CODE: BWN

REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017 REG NO: 2003/028851/06 FOUNDED: 2003 LISTED: 2015

NATURE OF BUSINESS: AYO is a technology investment company with NATURE OF BUSINESS: Balwin is a specialist, national residential

interests in disruptive technologies that advance life, business and property developer of large-scale, sectional title estates for South Africa’s

economics. Our extensive portfolio of subsidiaries and strategic growing low-to-middle income population.

investments offers high growth potential to our shareholders, while SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

addressing fundamental needs and enabling essential services on the NUMBER OF EMPLOYEES: 0

African continent. DIRECTORS: Amosun T (ind ne), KukamaRK(ne),

SECTOR:Technology—Technology—Software&CompSer—ComputerService Mokgosi-Mwantembe T (ind ne), MolokoKR(ind ne), ScherJH(ind ne),

NUMBER OF EMPLOYEES: 1 275 ShapiroAJ(ind ne), Saven H (Chair, ind ne), Brookes S V (CEO),

DIRECTORS: AmodABA(ne), Jacobs L (ne), Mclachlan W, Bigham J (CFO)

Moodley J (ne), MosiaRP(ind ne), RasethabaSM(ind ne), MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Ramatlhodi Adv N (Chair, ind ne), Makan A (CEO), Guzha P (CFO) Brookes S V 33.07%

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2023 Gray R N 9.29%

Sekunjalo Investment Holdings (Pty) Ltd. 37.18% Tatovect (Pty) Ltd. 9.09%

Government Employees Pension Fund 29.00% POSTAL ADDRESS: Private Bag X4, Gardenview, Johannesburg, 2047

POSTAL ADDRESS: PO Box 181, Cape Town, 8000 MORE INFO: www.sharedata.co.za/sdo/jse/BWN

MORE INFO: www.sharedata.co.za/sdo/jse/AYO COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd.

COMPANY SECRETARY: Wazeer Moosa TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSORS: Merchantec Capital, Vunani (Pty) Ltd. AUDITORS: BDO South Africa Inc.

AUDITORS: Crowe JHB, Thawt Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED BWN Ords no par val 1 000 000 000 519 411 852

AYO Ords no par value 2 000 000 000 326 922 438

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords no par val Ldt Pay Amt

Ords no par value Ldt Pay Amt Final No 13 20 Jun 23 26 Jun 23 14.10

Final No 9 20 Dec 22 28 Dec 22 60.00 Interim No 12 6 Dec 22 12 Dec 22 9.90

Interim No 8 7 Jun 22 13 Jun 22 35.00

LIQUIDITY: Jul24 Avg 536 514 shares p.w., R1.1m(5.4% p.a.)

LIQUIDITY: Jul24 Avg 825 105 shares p.w., R12.1m(13.1% p.a.)

REDS 40 Week MA BALWIN

SCOM 40 Week MA AYO

479

3935

417

3154

355

2373

293

1592

232

811

170

2019 | 2020 | 2021 | 2022 | 2023 | 2024

30

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

(Amts in ZAR’000) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20 Final Final Final Final Final

Interim Final Final Final Final Turnover 2 356 284 3 326 908 3 125 269 2 700 574 2 914 453

Turnover 1 014 817 2 253 494 1 755 179 1 699 492 2 885 214 Op Inc 330 814 592 750 513 046 462 450 573 984

Op Inc - 164 500 - 768 765 - 392 248 - 376 173 - 141 310 NetIntPd(Rcvd) 20 558 - 4 379 - 2 294 - 2 857 - 1 030

NetIntPd(Rcvd) - 51 208 - 128 059 - 133 838 - 151 110 - 224 365 Minority Int 1 704 1 087 545 209 - 250

Minority Int 8 255 - 20 947 4 239 1 043 11 437 Att Inc 215 668 436 267 362 579 336 156 411 610

Att Inc - 113 058 - 619 794 - 270 303 - 259 146 21 343 TotCompIncLoss 218 789 436 862 363 124 336 365 411 396

TotCompIncLoss - 100 346 - 643 747 - 266 542 - 254 327 31 946 Fixed Ass 602 201 481 433 259 397 99 810 90 654

Fixed Ass 30 585 34 798 38 627 50 792 91 110 Inv & Loans 8 664 8 664 10 264 11 658 -

Inv & Loans 495 940 462 707 649 656 431 749 375 497 Tot Curr Ass 6 984 676 6 752 030 6 277 985 5 272 372 4 507 714

Tot Curr Ass 1 902 793 2 185 338 2 615 099 3 176 223 4 183 370 Ord SH Int 4 005 755 3 834 927 3 515 419 3 202 661 2 951 640

Ord SH Int 2 044 784 2 153 673 2 956 841 3 474 476 4 177 452 Minority Int 3 295 1 591 504 - 41 - 250

Minority Int 119 216 111 673 150 561 125 651 118 640 LT Liab 1 461 774 1 541 981 1 083 470 387 434 355 444

LT Liab 28 312 32 968 120 627 116 102 30 903 Tot Curr Liab 2 159 523 1 919 748 1 996 588 1 811 109 1 300 906

Tot Curr Liab 624 111 759 986 583 106 486 704 661 908 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 47.94 91.49 75.88 71.47 87.83

HEPS-C (ZARc) - 33.12 - 176.46 - 60.25 - 64.37 8.02 DPS (ZARc) - 24.00 20.90 35.80 11.70

DPS (ZARc) - - 60.00 95.00 100.00 NAV PS (ZARc) 858.49 824.38 749.01 682.83 631.13

NAV PS (ZARc) 595.82 627.55 861.25 1 009.66 1 213.94 3 Yr Beta 0.53 - 0.01 - 0.19 - 0.19 - 0.08

3 Yr Beta 1.97 1.88 1.65 1.42 - Price High 322 350 500 534 396

Price High 150 150 649 3 000 940 Price Low 190 236 270 128 180

Price Low 30 45 262 250 92 Price Prd End 200 315 309 425 350

Price Prd End 55 91 433 350 520 RATIOS

RATIOS Ret on SH Fnd 5.42 11.40 10.33 10.50 13.94

Ret on SH Fnd - 9.69 - 28.28 - 8.56 - 7.17 0.76 Oper Pft Mgn 14.04 17.82 16.42 17.12 19.69

Oper Pft Mgn - 16.21 - 34.11 - 22.35 - 22.13 - 4.90 D:E 0.36 0.40 0.31 0.12 0.12

D:E 0.01 0.01 0.04 0.03 0.01 Current Ratio 3.23 3.52 3.14 2.91 3.47

Current Ratio 3.05 2.88 4.48 6.53 6.32 Div Cover - 3.91 3.70 2.00 7.52

Div Cover - - - 1.31 - 0.79 0.06

83