Page 83 - shbh24_complete

P. 83

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – AST

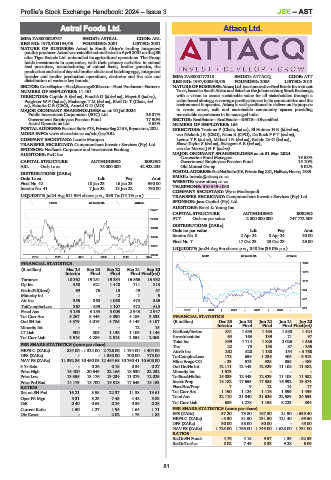

Astral Foods Ltd. Attacq Ltd.

AST ATT

ISIN: ZAE000029757 SHORT: ASTRAL CODE: ARL

REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001

NATURE OF BUSINESS: Astral is South Africa’s leading integrated

poultry producer. Astralwasestablished andlisted in April 2001 onthe JSE

after Tiger Brands Ltd. unbundled its agricultural operations. The Group

holds investments in companies, with their primary activities in animal

feed pre-mixes, manufacturing of animal feeds, broiler genetics, the

production and sale of day-old broiler chicks and hatching eggs, integrated

breeder and broiler production operations, abattoirs and the sale and ISIN: ZAE000177218 SHORT: ATTACQ CODE: ATT

distribution of various key brands. REG NO: 1997/000543/06 FOUNDED: 2005 LISTED: 2013

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers NATUREOFBUSINESS:AttacqLtd.isaninnovativeRealEstateInvestment

NUMBER OF EMPLOYEES: 11 461 Trust, based in South Africa and listed on the Johannesburg Stock Exchange,

DIRECTORS: Cupido A (ind ne), Fouché D (ld ind ne), Mayet S (ind ne), with a vision to create sustainable value for all stakeholders through a

PotgieterWF(ind ne), ShabanguTM(ind ne), Eloff Dr T (Chair, ind value-based strategy, ensuring a positive impact in its communities and the

ne), Schutte C E (CEO), Arnold G D (MD) environment it operates. Attacq is well-positioned to deliver on its purpose

MAJOR ORDINARY SHAREHOLDERS as at 10 Jul 2024 to create smart, safe and sustainable community spaces providing

Public Investment Corporation (SOC) Ltd. 26.37% remarkable experiences in its managed hubs.

Government Employees Pension Fund 17.90% SECTOR: RealEstate—RealEstate—REITS—Diversified

Astral Operations Ltd. 9.53% NUMBER OF EMPLOYEES: 166

POSTAL ADDRESS:PostnetSuite#78, PrivateBagX153, Bryanston,2021 DIRECTORS: Tredoux P (Chair, ind ne), El HaimerHR(ld ind ne),

MORE INFO: www.sharedata.co.za/sdo/jse/ARL van Niekerk J R (CEO), Nana R (CFO), De BuckFFT(ind ne),

COMPANY SECRETARY: Leonie Marupen LeeuwTP(ind ne), MkhariIN(ind ne), Rohde Dr G (ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Shaw-Taylor S (ind ne), SwiegersAE(ind ne),

SPONSOR: Nedbank Corporate and Investment Banking van der MerweJHP(ind ne)

AUDITORS: PwC Inc. MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

Coronation Fund Managers 19.58%

CAPITAL STRUCTURE AUTHORISED ISSUED Government Employees Pension Fund 15.10%

ARL Ords 1c ea 75 000 000 42 922 235 Old Mutual Group 6.02%

DISTRIBUTIONS [ZARc] POSTALADDRESS:PostNetSuite016,PrivateBagX81,HalfwayHouse,1685

Ords 1c ea Ldt Pay Amt EMAIL: brenda@attacq.co.za

Final No 42 10 Jan 23 16 Jan 23 590.00 WEBSITE: www.attacq.co.za

Interim No 41 7 Jun 22 13 Jun 22 790.00 TELEPHONE: 010-549-1050

COMPANY SECRETARY: Wyna Modisapodi

LIQUIDITY: Jul24 Avg 611 994 shares p.w., R93.7m(74.1% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

FOOD 40 Week MA ASTRAL

AUDITORS: Ernst & Young Inc.

24977

CAPITAL STRUCTURE AUTHORISED ISSUED

22153 ATT Ords no par value 2 000 000 000 747 772 509

DISTRIBUTIONS [ZARc]

19329

Ords no par value Ldt Pay Amt

16505 Interim No 8 2 Apr 24 8 Apr 24 30.00

Final No 7 17 Oct 23 23 Oct 23 29.00

13681

LIQUIDITY: Jun24 Avg 5m shares p.w., R48.3m(36.0% p.a.)

10856 REIV 40 Week MA ATTACQ

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 1646

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

Interim Final Final Final Final(rst) 1378

Turnover 10 362 19 251 19 334 15 866 13 932 1111

Op Inc 550 621 1 440 711 813

NetIntPd(Rcvd) 69 76 15 49 57 844

Minority Int - - 2 1 5

577

Att Inc 355 360 1 068 473 556

TotCompIncLoss 367 - 539 1 107 472 513 310

2019 | 2020 | 2021 | 2022 | 2023 |

Fixed Ass 3 155 3 153 3 003 2 943 2 947

Tot Curr Ass 5 267 5 446 4 890 4 189 3 535 FINANCIAL STATISTICS

Ord SH Int 4 379 4 019 4 786 4 149 4 107 (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Minority Int - - - 12 15 Interim Final Final Final Final(rst)

LT Liab 900 805 1 136 1 105 1 146 NetRent/InvInc 831 1 535 1 483 1 588 1 424

Tot Curr Liab 3 516 4 286 2 516 2 558 2 063 Investment inc 64 163 139 71 97

Total Inc 899 1 714 1 825 2 026 1 586

PER SHARE STATISTICS (cents per share) Tax 22 73 153 87 - 255

HEPS-C (ZARc) 884.00 - 1 324.00 2 726.00 1 194.00 1 404.00 Attrib Inc 262 520 1 180 154 - 3 768

DPS (ZARc) - - 1 380.00 700.00 775.00 TotCompIncLoss 173 659 1 236 406 - 3 513

NAV PS (ZARc) 11 392.86 10 450.05 12 464.68 10 760.41 10 608.00 Hline Erngs-CO - 23 575 928 855 - 489

3 Yr Beta - 0.26 0.15 0.34 0.27 Ord UntHs Int 12 111 12 443 12 329 11 108 11 582

Price High 16 400 20 549 22 166 18 530 22 252 Minority Int 1 673 - - - -

Price Low 13 355 13 176 13 234 11 079 12 029 TotStockHldInt 15 039 12 443 12 329 11 108 11 582

Price Prd End 14 179 13 700 19 318 17 643 13 153 Invest Prop 18 182 17 653 17 585 16 992 19 374

RATIOS FixedAss/Prop 7 9 12 14 17

Ret on SH Fnd 16.21 8.95 22.37 11.38 13.61 Tot Curr Ass 1 190 1 124 1 116 1 599 1 459

Oper Pft Mgn 5.31 3.23 7.45 4.48 5.83 Total Ass 22 110 21 840 21 626 22 589 24 553

D:E 0.40 0.63 0.24 0.36 0.28 Tot Curr Liab 689 1 278 1 158 2 223 834

Current Ratio 1.50 1.27 1.94 1.64 1.71 PER SHARE STATISTICS (cents per share)

Div Cover - - 2.02 1.75 1.85 EPS (ZARc) 37.20 73.80 167.30 21.90 - 535.40

HEPS-C (ZARc) - 3.30 81.50 131.50 121.40 - 69.50

DPS (ZARc) 30.00 58.00 50.00 - 45.00

NAV PS (ZARc) 1 725.00 1 765.00 1 749.00 1 628.00 1 731.00

RATIOS

RetOnSH Funds 4.76 4.18 9.57 1.39 - 32.53

RetOnTotAss 8.02 7.49 8.33 9.28 6.09

81