Page 87 - shbh24_complete

P. 87

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – BHP

BHP Group Ltd. Bid Corporation Ltd.

BHP BID

ISIN: AU000000BHP4 SHORT: BHP CODE: BHG ISIN: ZAE000216537 SHORT: BIDCORP CODE: BID

REG NO: ABN49004028077 FOUNDED: 1885 LISTED: 2022 REG NO: 1995/008615/06 FOUNDED: 1995 LISTED: 2016

NATURE OF BUSINESS: BHP currently operates across three principal NATURE OF BUSINESS: Bidcorp is an international broad-line

asset divisions: foodservice group, listed on the Johannesburg Stock Exchange, and

-The Minerals Australia asset group, which includes operated assets in present in developed and developing economies on five continents.

Western Australia, Queensland, New South Wales and South Australia and SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

produces iron ore, metallurgical coal, copper, nickel and energy coal. NUMBER OF EMPLOYEES: 22 552

-The Minerals Americas asset group, which includes projects, operated assets DIRECTORS: Abdool-Samad T (ind ne), BaloyiPC(ind ne),

andnon-operatedjointventuresinCanada,Chile,Peru,theUS,Colombiaand Joffe B (ind ne), MolokoKR(ind ne), PayneNG(ld ind ne),

Brazil, and currently produces copper, iron ore and energy coal. Rosenberg C (ind ne, Aus), Wiseman H (ind ne, Aus), Koseff S (Chair,

-The Petroleum unit, which includes conventional assets located in the US ind ne), Berson B L (CEO, Aus), Cleasby D E (CFO)

GulfofMexico,Australia,TrinidadandTobago,AlgeriaandMexico.Italsohas MAJOR ORDINARY SHAREHOLDERS as at 20 Mar 2024

appraisalandexplorationoptionsinTrinidadandTobago,centralandwestern Government Employees Pension Fund 19.30%

Gulf of Mexico, Eastern Canada and Barbados. BHP produces crude oil and JP Morgan Chase & Co. 7.99%

condensate, gas and natural gas liquids. POSTAL ADDRESS:PostnetSuite136, PrivateBagX9976, Sandton,2146

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining MORE INFO: www.sharedata.co.za/sdo/jse/BID

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Bidcorp Corporate Services (Pty) Ltd.

DIRECTORS: Broomhead M (ind ne), Clever X (ind ne), Goldberg G TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

(snr ind ne), Hinchliffe M, Lindsay D (ne), McEwan R (ne), O’Reilly C SPONSOR: Standard Bank of SA Ltd.

(ind ne), Tanna C (ind ne), Weisler D (ind ne), MacKenzie K (Chair, ind

ne), Henry M (CEO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 12 Jul 2023 CAPITAL STRUCTURE AUTHORISED ISSUED

HSBC Custody Nominees (Australia) Ltd. 26.54% BID Ords no par val 540 000 000 335 404 212

JP Morgan Nominees Australia (Pty) Ltd. 16.28%

Citicorp Nominees (Pty) Ltd. 7.11% DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/BHG Ords no par val Ldt Pay Amt

COMPANY SECRETARY: Stefanie Wilkinson Interim No 14 18 Mar 24 25 Mar 24 525.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 13 26 Sep 23 2 Oct 23 500.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul24 Avg 4m shares p.w., R1 876.4m(67.9% p.a.)

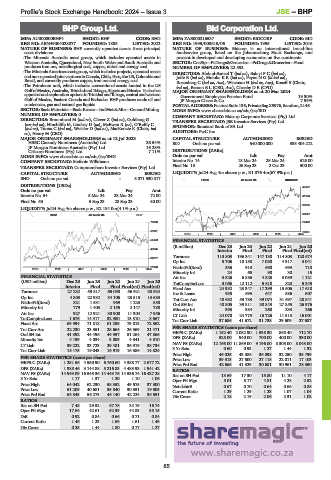

BHG Ords no par val - 5 071 530 817 FOOR 40 Week MA BIDCORP

DISTRIBUTIONS [USDc] 47072

Ords no par val Ldt Pay Amt

Interim No 54 5 Mar 24 28 Mar 24 72.00 41664

Final No 53 5 Sep 23 28 Sep 23 80.00

36256

LIQUIDITY: Jul24 Avg 4m shares p.w., R2 184.0m(4.1% p.a.)

30847

INDM 40 Week MA BHP

76069 25439

65121 20031

2019 | 2020 | 2021 | 2022 | 2023 | 2024

54173 FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

43225

Interim Final Final Final Final(rst)

Turnover 113 803 196 341 147 138 114 803 120 574

32277

Op Inc 5 706 10 158 7 080 4 917 3 041

21329 NetIntPd(Rcvd) 536 910 690 693 710

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Minority Int 24 65 90 30 15

FINANCIAL STATISTICS Att Inc 3 826 6 886 4 825 3 089 1 121

(USD million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 TotCompIncLoss 3 056 12 112 5 818 820 5 345

Interim Final Final Final(rst) Final(rst) Fixed Ass 24 932 23 347 17 299 15 506 17 618

Turnover 27 232 53 817 65 098 56 921 38 924 Inv & Loans 935 693 647 586 607

Op Inc 4 803 22 932 34 106 25 515 13 683 Tot Curr Ass 48 682 53 783 39 074 31 697 28 841

NetIntPd(Rcvd) 821 1 531 969 1 223 858 Ord SH Int 40 805 39 811 30 843 27 855 26 976

Minority Int 779 1 403 2 155 2 147 780 Minority Int 393 384 260 233 266

Att Inc 927 12 921 30 900 11 304 7 956 LT Liab 24 070 24 773 16 726 11 513 16 001

TotCompIncLoss 1 676 14 317 32 980 13 510 8 667

Tot Curr Liab 37 686 41 672 31 738 29 609 27 687

Fixed Ass 69 994 71 818 61 295 73 813 72 362

Tot Curr Ass 22 230 23 351 28 664 26 369 21 471 PER SHARE STATISTICS (cents per share)

Ord SH Int 41 392 44 496 44 957 51 264 47 865 HEPS-C (ZARc) 1 152.40 2 082.90 1 538.30 868.40 712.70

Minority Int 4 199 4 034 3 809 4 341 4 310 DPS (ZARc) 525.00 940.00 700.00 400.00 330.00

LT Liab 39 222 33 723 29 481 36 919 38 734 NAV PS (ZARc) 12 166.00 11 869.00 9 196.00 8 305.00 8 043.00

3 Yr Beta 0.60 0.93 1.27 1.44 1.32

Tot Curr Liab 15 175 19 043 16 919 16 386 14 824

Price High 46 025 43 386 36 098 32 250 35 799

PER SHARE STATISTICS (cents per share) Price Low 39 313 27 500 27 118 22 011 17 103

HEPS-C (ZARc) 1 251.56 4 550.90 6 760.60 4 388.77 2 677.72 Price Prd End 42 665 41 329 30 681 30 961 28 350

DPS (ZARc) 1 388.46 3 144.88 5 216.83 4 483.93 1 941.42 RATIOS

NAV PS (ZARc) 14 949.09 16 545.36 14 443.76 14 536.74 16 427.28 Ret on SH Fnd 18.69 17.30 15.80 11.10 4.17

3 Yr Beta 1.17 1.37 1.20 1.10 1.06 Oper Pft Mgn 5.01 5.17 4.81 4.28 2.52

Price High 64 042 62 230 58 352 49 575 37 300 Net debt:E 0.67 0.70 0.64 0.66 0.88

Price Low 51 209 40 681 35 840 30 351 19 505 Current Ratio 1.29 1.29 1.23 1.07 1.04

Price Prd End 63 343 56 273 45 140 42 224 35 551 Div Cover 2.18 2.19 2.06 2.31 1.02

RATIOS

Ret on SH Fnd 7.48 29.52 67.78 24.19 16.74

Oper Pft Mgn 17.64 42.61 52.39 44.83 35.15

D:E 0.92 0.84 0.66 0.71 0.84

Current Ratio 1.46 1.23 1.69 1.61 1.45

Div Cover 0.25 1.44 1.80 0.77 1.27

85