Page 89 - shbh24_complete

P. 89

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – BOW

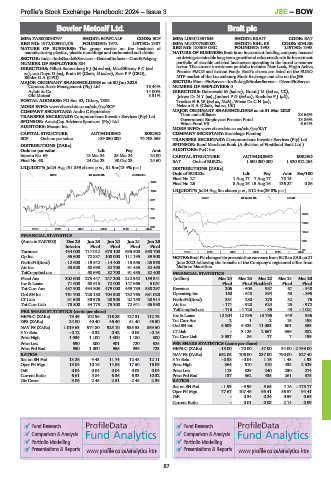

Bowler Metcalf Ltd. Brait plc

BOW BRA

ISIN: ZAE000030797 SHORT: BOWCALF CODE: BCF ISIN: LU0011857645 SHORT: BRAIT CODE: BAT

REG NO: 1972/005921/06 FOUNDED: 1972 LISTED: 1987 ISIN: MU0707E00002 SHORT: BIHL EB CODE: BIHLEB

NATURE OF BUSINESS: The group carries on the business of REG NO: 183309 GBC FOUNDED: 1998 LISTED: 1998

manufacturing plastics, plastic mouldings and carbonated soft drinks. NATURE OF BUSINESS: Brait is an investment holding company focused

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng ondrivingsustainablelong-termgrowthandvaluecreationinitsinvestment

NUMBER OF EMPLOYEES: 804 portfolio of sizeable unlisted businesses operating in the broad consumer

DIRECTORS: Gillett SonnenbergSJ(ld ind ne), MacGillivrayFC(ind sector. The current investment portfolio includes New Look, Virgin Active,

ne), van Duyn D (ne), Brain M (Chair, ld ind ne), Sass P F (CEO), Premier FMCG and Iceland Foods. Brait’s shares are listed on the EURO

Böhler G A (CFO) MTF market of the Luxembourg Stock Exchange and also on the JSE.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

Camissa Asset Management (Pty) Ltd. 16.44% NUMBER OF EMPLOYEES: 0

Aylett & Co 14.00% DIRECTORS: Dabrowski M (ind ne), GrantJM(ind ne, UK),

Old Mutual 8.31% Jekwa Dr N Y (ne), Joubert P G (ind ne), Roelofse P J (alt),

POSTAL ADDRESS: PO Box 92, Ottery, 7808 Troskie H R W (ind ne, Neth), Wiese Dr C H (ne),

MORE INFO: www.sharedata.co.za/sdo/jse/BCF Nelson R A (Chair, ind ne, UK)

COMPANY SECRETARY: Andre C September MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2023

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Titan and affiliates 28.66%

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd. Government Employees Pension Fund 13.86%

Ethos Fund VII

6.64%

AUDITORS: Mazars Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/BAT

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Stonehage Fleming

BCF Ords no par value 189 850 000 74 703 569 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Ords no par value Ldt Pay Amt AUDITORS: PwC Inc.

Interim No 69 18 Mar 24 25 Mar 24 24.00 CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 68 24 Oct 23 30 Oct 23 24.60 BAT Ords of EUR22c 1 500 000 000 1 320 312 254

LIQUIDITY: Jul24 Avg 191 859 shares p.w., R1.9m(13.4% p.a.) DISTRIBUTIONS [ZARc]

Ords of EUR22c Ldt Pay Amt Scr/100

GENI 40 Week MA BOWCALF

Final No 27 1 Aug 17 7 Aug 17 78.15 -

1200

Final No 26 8 Aug 16 15 Aug 16 136.27 0.86

1034 LIQUIDITY: Jul24 Avg 8m shares p.w., R12.4m(29.8% p.a.)

GENF 40 Week MA BRAIT

867

701

3024

535

2290

368

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1556

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 822

Interim Final Final Final Final

88

Turnover 434 000 717 012 673 100 635 500 558 700 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Op Inc 56 600 72 837 100 000 111 195 89 900 NOTES: Brait Plc changed its presentation currency from EUR to ZAR on 21

NetIntPd(Rcvd) - 12 600 - 19 542 - 14 400 - 15 556 - 25 398 June 2022 following the transfer of the Company’s registered office from

Att Inc 50 500 68 698 82 700 91 485 82 498 Malta to Mauritius.

TotCompIncLoss - 68 698 82 700 91 485 82 400 FINANCIAL STATISTICS

Fixed Ass 302 600 273 447 247 200 212 952 159 341 (million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Inv & Loans 71 600 68 615 72 000 147 666 5 051 Final Final Final(rst) Final Final

Tot Curr Ass 487 900 494 803 479 000 459 789 588 297 Revenue 206 - 603 937 67 - 948

Ord SH Int 761 700 728 180 704 300 732 765 681 020 Operating Inc 160 - 648 894 58 - 895

LT Liab 31 500 30 576 28 300 22 158 28 914 NetIntPd(Rcvd) 331 280 270 32 76

Tot Curr Liab 73 800 84 773 75 300 72 641 56 990 Att Inc - 171 - 928 624 25 - 972

PER SHARE STATISTICS (cents per share) TotCompIncLoss - 716 - 1 728 - 35 48 - 1 021

HEPS-C (ZARc) 73.49 102.96 116.25 127.31 112.75 Inv & Loans 12 204 12 535 13 795 949 936

DPS (ZARc) 24.00 40.40 46.40 51.40 46.50 Tot Curr Ass 2 1 2 15 198

NAV PS (ZARc) 1 019.63 974.80 925.10 935.53 869.50 Ord SH Int 8 609 9 325 11 053 601 553

3 Yr Beta - 0.12 0.32 0.42 0.05 - 0.16 LT Liab - 3 125 2 667 356 382

Price High 1 035 1 100 1 300 1 180 800 Tot Curr Liab 3 597 86 77 7 199

Price Low 690 800 901 720 624 PER SHARE STATISTICS (cents per share)

Price Prd End 950 1 000 965 936 723 HEPS-C (ZARc) - 13.00 - 70.00 47.00 34.00 - 2 799.00

RATIOS NAV PS (ZARc) 652.05 706.00 837.00 790.00 827.40

Ret on SH Fnd 13.26 9.43 11.74 12.48 12.11 3 Yr Beta - 0.38 - 0.04 1.16 1.48 1.93

Oper Pft Mgn 13.04 10.16 14.86 17.50 16.09 Price High 364 510 510 438 2 529

D:E 0.04 0.04 0.04 0.03 0.04 Price Low 113 329 240 230 274

Current Ratio 6.61 5.84 6.36 6.33 10.32 Price Prd End 137 362 435 261 375

Div Cover 3.06 2.45 2.51 2.48 2.39 RATIOS

Ret on SH Fnd - 1.99 - 9.95 5.65 4.16 - 175.77

Oper Pft Mgn 77.67 107.46 95.41 86.57 94.41

D:E - 0.34 0.24 0.59 0.69

Current Ratio - 0.01 0.03 2.14 0.99

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

87