Page 92 - shbh24_complete

P. 92

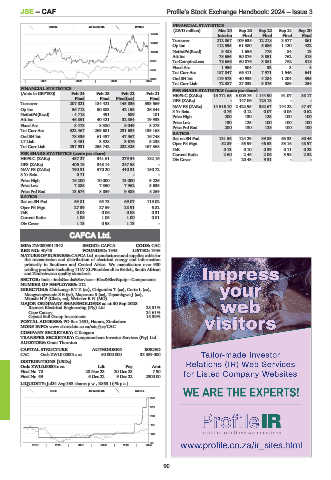

JSE – CAF Profile’s Stock Exchange Handbook: 2024 – Issue 3

FINANCIAL STATISTICS

SCOM 40 Week MA BYTES

(ZWD million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

16000 Interim Final Final Final Final

Turnover 212 867 109 635 12 218 3 377 861

13442

Op Inc 112 595 61 380 5 686 1 120 422

NetIntPd(Rcvd) 3 488 1 656 776 84 13

10883

Att Inc 78 656 50 876 3 851 762 318

8325 TotCompIncLoss 78 656 50 876 3 851 762 318

Fixed Ass 1 956 504 33 3 4

5767

Tot Curr Ass 187 847 66 411 7 971 1 546 641

Ord SH Int 119 573 40 935 4 284 1 204 395

3208

| 2021 | 2022 | 2023 | 2024

Tot Curr Liab 72 387 27 033 3 875 389 254

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in GBP’000) Feb 24 Feb 23 Feb 22 Feb 21 HEPS-C (ZARc) 13 771.68 3 005.76 1 144.90 91.07 38.17

Final Final Final(rst) Final DPS (ZARc) - 147.06 123.18 - -

Turnover 207 021 184 421 145 836 393 569 NAV PS (ZARc) 14 516.10 2 422.95 382.67 144.22 47.47

Op Inc 56 712 50 883 42 155 26 844 3 Yr Beta 0.76 0.12 0.07 0.06 0.62

NetIntPd(Rcvd) - 4 718 491 589 181 Price High 200 130 125 100 100

Att Inc 46 851 40 421 32 854 19 933 Price Low 130 125 100 100 100

Fixed Ass 8 478 8 380 8 049 8 275 Price Prd End 200 130 125 100 100

Tot Curr Ass 322 467 269 681 231 634 135 168 RATIOS

Ord SH Int 78 336 61 497 47 567 16 748 Ret on SH Fnd 131.56 124.29 89.89 63.33 80.46

LT Liab 3 451 3 528 3 676 5 238 Oper Pft Mgn 52.89 55.99 46.53 33.16 48.97

Tot Curr Liab 297 931 255 742 232 325 167 568

D:E 0.13 0.10 0.39 0.11 0.23

PER SHARE STATISTICS (cents per share) Current Ratio 2.60 2.46 2.06 3.98 2.52

HEPS-C (ZARc) 457.27 341.61 279.34 182.16 Div Cover - 20.48 9.31 - -

DPS (ZARc) 406.19 348.14 247.58 -

NAV PS (ZARc) 790.31 570.20 410.31 150.72

3 Yr Beta 0.71 - - -

Price High 16 200 10 000 13 000 9 226

Price Low 7 885 7 350 7 962 5 635

Price Prd End 13 674 8 859 9 388 8 269

RATIOS

Ret on SH Fnd 59.81 65.73 69.07 119.02

Oper Pft Mgn 27.39 27.59 28.91 6.82

D:E 0.04 0.06 0.08 0.31

Current Ratio 1.08 1.05 1.00 0.81

Div Cover 1.13 0.98 1.13 -

CAFCA Ltd.

CAF

ISIN: ZW0009011942 SHORT: CAFCA CODE: CAC

REG NO: 40/45 FOUNDED: 1945 LISTED: 1946

NATURE OF BUSINESS: CAFCA Ltd. manufactures and supplies cable for

the transmission and distribution of electrical energy and information

primarily in Southern and Central Africa. We manufacture over 900

cabling products including 11kV XLPE cables all to British, South African

and Zimbabwean quality standards.

SECTOR: Inds—IndsGoods&Services—Elec&ElecEquip—Components

NUMBER OF EMPLOYEES: 212

DIRECTORS: ChidzongaETZ(ne), Chigumbu T (ne), Corte L (ne),

MangwengwendeSE(ne), Maparura S (ne), Tapambgwa J (ne),

Mkushi H P (Chair, ne), Webster R N (MD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023

Reunert Electrical Engineering (Pty) Ltd. 28.31%

Cape Canary 24.61%

Crystal Ball Group Investment 15.39%

POSTAL ADDRESS: PO Box 1651, Harare, Zimbabwe

MORE INFO: www.sharedata.co.za/sdo/jse/CAC

COMPANY SECRETARY: C Kangara

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Grant Thornton

CAPITAL STRUCTURE AUTHORISED ISSUED

CAC Ords ZWL0.00001c ea 50 000 000 33 389 000

DISTRIBUTIONS [USDc]

Ords ZWL0.00001c ea Ldt Pay Amt

Final No 70 28 Nov 23 20 Dec 23 7.90

Final No 69 6 Dec 22 9 Dec 22 2300.00

LIQUIDITY: Jul24 Avg 333 shares p.w., R863.1(-% p.a.)

ELEE 40 Week MA CAFCA

378

316

253

191

128

66

2019 | 2020 | 2021 | 2022 | 2023 | 2024

90