Page 88 - shbh24_complete

P. 88

JSE – BID Profile’s Stock Exchange Handbook: 2024 – Issue 3

The Bidvest Group Ltd. Blue Label Telecoms Ltd.

BID BLU

ISIN: ZAE000117321 SHORT: BIDVEST CODE: BVT ISIN: ZAE000109088 SHORT: BLUETEL CODE: BLU

REG NO: 1946/021180/06 FOUNDED: 1988 LISTED: 1990 REG NO: 2006/022679/06 FOUNDED: 2001 LISTED: 2007

NATURE OF BUSINESS: Bidvest is a leading B2B services, trading and NATURE OF BUSINESS: Blue Label Telecoms’ core business is the virtual

distribution Group operating in the areas of consumer, pharmaceutical distribution of secure electronic tokens of value and transactional services

and industrial products, outsourced hard and soft services, financial across its global footprint of touch points. The Group’s stated strategy is to

services, freight management, office and print solutions, travel services extend its global footprint of touch points, both organically and

and automotive retailing. acquisitively, to meet the significant demand for the delivery of multiple

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr prepaid products and services through a single distributor, across various

NUMBER OF EMPLOYEES: 121 344 delivery mechanisms and via numerous merchants or vendors.

DIRECTORS: KhanyileFN(ind ne), KhumaloMG(ind ne), SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

Mabaso-KoyanaSN(ind ne), McMahon G C, Mokate DrRD(ld ind ne), NUMBER OF EMPLOYEES: 2 505

ThomsonNW(ind ne), Mohale B (Chair, ind ne), Madisa N T (CEO), DIRECTORS: Masondo H (ind ne), MnxasanaNP(ind ne), Mthimunye J

Steyn M (CFO) (ind ne), MthimunyeLE(ind ne), VilakaziJS(ind ne), Nestadt L

MAJOR ORDINARY SHAREHOLDERS as at 06 Jun 2024 M (Chair, ind ne), Levy B M (Joint CEO), Levy M S (Joint CEO),

Government Employees Pension Fund 20.62% Suntup D (FD)

Lazard Asset Managers LLC 5.21% MAJOR ORDINARY SHAREHOLDERS as at 31 May 2023

GIC Private Ltd. 5.00% Shotput Investments (Pty) Ltd. 10.95%

POSTAL ADDRESS: PO Box 87274, Houghton, Johannesburg, 2041 Levy B M 9.56%

MORE INFO: www.sharedata.co.za/sdo/jse/BVT Levy M S 8.75%

COMPANY SECRETARY: Nonqaba Katamzi POSTAL ADDRESS: PO Box 652261, Benmore, 2010

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/BLU

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY: Janine van Eden

AUDITORS: PwC Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

BVT Ords 5c ea 540 000 000 340 274 346 AUDITORS: SNG Grant Thornton Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] BLU Ords 0.0001c ea 2 000 000 000 913 655 873

Ords 5c ea Ldt Pay Amt

Interim No 52 25 Mar 24 2 Apr 24 467.00 DISTRIBUTIONS [ZARc]

Final No 51 26 Sep 23 2 Oct 23 439.00 Ords 0.0001c ea Ldt Pay Amt

Final No 8 12 Sep 17 18 Sep 17 40.00

LIQUIDITY: Jul24 Avg 5m shares p.w., R1 335.5m(79.1% p.a.)

Final No 7 13 Sep 16 19 Sep 16 36.00

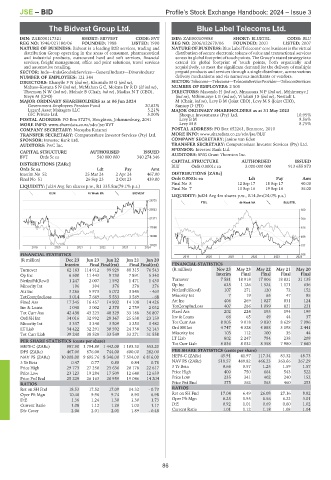

GENI 40 Week MA BIDVEST

LIQUIDITY: Jul24 Avg 4m shares p.w., R14.0m(24.0% p.a.)

28735

FTEL 40 Week MA BLUETEL

25053 920

21371 769

17690 618

14008 468

10326 317

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 166

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final(rst) Final Final(rst) FINANCIAL STATISTICS

Turnover 62 163 114 912 99 929 88 315 76 543 (R million) Nov 23 May 23 May 22 May 21 May 20

Op Inc 6 500 11 443 9 730 7 891 5 340 Interim Final Final Final Final

NetIntPd(Rcvd) 1 247 2 007 1 592 1 471 1 430 Turnover 7 581 18 918 17 806 18 821 21 135

Minority Int 196 394 376 278 276 Op Inc 625 1 126 1 524 1 171 636

Att Inc 3 266 5 973 5 072 3 845 - 463 NetIntPd(Rcvd) 107 271 120 72 152

TotCompIncLoss 3 014 7 669 5 533 3 569 - 68 Minority Int 7 19 65 47 95

Fixed Ass 17 345 16 457 14 902 14 108 14 426 Att Inc 406 269 1 027 831 124

Inv & Loans 1 048 3 002 2 378 2 759 2 032 TotCompIncLoss 407 286 1 099 821 221

Tot Curr Ass 42 438 43 223 40 329 33 188 36 807 Fixed Ass 202 224 195 194 199

Ord SH Int 34 016 32 992 28 367 25 538 23 159 Inv & Loans 66 65 49 44 37

Minority Int 3 337 3 340 3 509 3 253 3 482 Tot Curr Ass 8 905 9 018 9 830 8 629 7 996

LT Liab 34 422 32 291 30 592 24 338 32 143 Ord SH Int 4 747 4 328 4 088 3 198 2 441

Tot Curr Liab 39 240 38 528 33 549 33 271 31 558 Minority Int 103 112 100 35 44

LT Liab 802 2 247 784 238 209

PER SHARE STATISTICS (cents per share) Tot Curr Liab 8 836 8 032 8 358 7 980 7 660

HEPS-C (ZARc) 987.90 1 794.80 1 442.00 1 183.30 553.20

DPS (ZARc) 467.00 876.00 744.00 600.00 282.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 10 008.00 9 695.76 8 346.00 7 514.00 6 816.00 HEPS-C (ZARc) 45.91 41.97 117.34 83.32 48.73

3 Yr Beta 0.47 0.77 0.80 0.84 0.78 NAV PS (ZARc) 519.57 489.82 466.23 363.66 267.29

Price High 29 773 27 250 23 636 20 178 22 617 3 Yr Beta 0.66 0.57 1.25 1.59 1.57

Price Low 23 123 19 284 17 509 12 648 12 639 Price High 400 750 664 543 522

Price Prd End 25 229 26 163 20 959 19 046 14 204 Price Low 235 341 402 240 152

RATIOS Price Prd End 375 362 563 460 253

Ret on SH Fnd 18.53 17.52 17.09 14.32 - 0.70 RATIOS

Oper Pft Mgn 10.46 9.96 9.74 8.93 6.98 Ret on SH Fnd 17.04 6.49 26.08 27.16 8.82

D:E 1.36 1.24 1.30 1.30 1.73 Oper Pft Mgn 8.25 5.95 8.56 6.22 3.01

Current Ratio 1.08 1.12 1.20 1.00 1.17 D:E 0.92 1.01 0.69 0.60 1.02

Div Cover 2.06 2.01 2.01 1.89 - 0.48 Current Ratio 1.01 1.12 1.18 1.08 1.04

86