Page 86 - shbh24_complete

P. 86

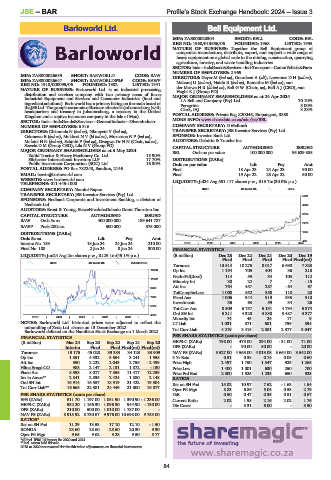

JSE – BAR Profile’s Stock Exchange Handbook: 2024 – Issue 3

Barloworld Ltd. Bell Equipment Ltd.

BAR BEL

ISIN: ZAE000028304 SHORT: BELL CODE: BEL

REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995

NATURE OF BUSINESS: Together the Bell Equipment group of

companies manufacture, distribute, export, and support a wide range of

heavy equipment on a global scale to the mining, construction, quarrying,

agriculture, forestry, and waste handling industries.

SECTOR: Inds—IndsGoods&Services—IndsTransport—CommVehicle&Parts

NUMBER OF EMPLOYEES: 2 969

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW DIRECTORS: Geyer M (ind ne), Goordeen A (alt), LawranceDH(ind ne),

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP Maharaj U (ind ne), Naidu R (ind ne), Ramathe M (ind ne), van

REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941 der MerweHR(ld ind ne), Bell G W (Chair, ne), Bell A J (CEO), van

NATURE OF BUSINESS: Barloworld Ltd. is an industrial processing, Haght K J (Group FD)

distribution and services company with two primary areas of focus: MAJOR ORDINARY SHAREHOLDERS as at 24 Apr 2024

Industrial Equipment and Services and Consumer Industries (food and I A Bell and Company (Pty) Ltd. 70.10%

ingredient solutions). Barloworld has a primary listing on the main board of Peregrine 5.00%

theJSELtd.Thegroup’scorporateofficesaresituatedinJohannesburg(with Clark, IAJ 3.28%

headquarters and treasury in Johannesburg, a treasury in the United POSTAL ADDRESS: Private Bag X20046, Empangeni, 3880

Kingdom and a captive insurance company in the Isle of Man).

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr MORE INFO: www.sharedata.co.za/sdo/jse/BEL

NUMBER OF EMPLOYEES: 6 316 COMPANY SECRETARY: D McIlrath

DIRECTORS: Chiaranda N (ind ne), NkonyeniV(ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Odunewu B (ind ne), MokhesiNV(ld ind ne), Mnxasana N P (ind ne), SPONSOR: Investec Bank Ltd.

Molotsi H N (ind ne), Schmid P (ind ne), Gwagwa Dr N N (Chair, ind ne), AUDITORS: Deloitte & Touche Inc.

Sewela D M (Group CEO), Lila N V (Group FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 3 May 2024 BEL Ords no par value 100 000 000 95 629 385

Zahid Tractor & Heavy Machinery Co. Ltd. 18.90%

Silchester International Investors LLP 17.70% DISTRIBUTIONS [ZARc]

Public Investment Corporation (SOC) Ltd. 16.30% Ords no par value Ldt Pay Amt

POSTAL ADDRESS: PO Box 782248, Sandton, 2146 Final 18 Apr 23 24 Apr 23 90.00

EMAIL: bawir@barloworld.com Final 19 Apr 22 25 Apr 22 50.00

WEBSITE: www.barloworld.com LIQUIDITY: Jul24 Avg 551 117 shares p.w., R13.7m(30.0% p.a.)

TELEPHONE: 011-445-1000

COMPANY SECRETARY: Nomini Rapoo INDT 40 Week MA BELL

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. 5001

SPONSORS: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd. 4092

AUDITORS: Ernst & Young, SizweNtsalubaGobodo Grant Thornton Inc.

3184

CAPITAL STRUCTURE AUTHORISED ISSUED

BAW Ords 5c ea 400 000 000 189 641 787 2275

BAWP Prefs 200c ea 500 000 375 000

1367

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt 458

Interim No 189 18 Jun 24 24 Jun 24 210.00 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Final No 188 2 Jan 24 8 Jan 24 300.00 FINANCIAL STATISTICS

LIQUIDITY: Jun24 Avg 2m shares p.w., R129.1m(45.1% p.a.) (R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Final Final Final Final Final(rst)

GENI 40 Week MA BARWORLD

Turnover 13 514 10 276 8 017 6 690 7 823

12668 Op Inc 1 194 705 404 36 218

NetIntPd(Rcvd) 114 59 34 103 112

11082

Minority Int 30 22 7 7 - 15

9495 Att Inc 764 457 287 - 64 67

TotCompIncLoss 1 008 552 358 110 28

7909 Fixed Ass 1 006 944 919 935 910

Investments 36 63 59 34 26

6322

Tot Curr Ass 8 509 6 757 5 131 4 794 5 374

4736 Ord SH Int 5 211 4 320 3 838 3 487 3 377

2019 | 2020 | 2021 | 2022 | 2023 |

Minority Int 74 45 24 17 9

NOTES: Barloworld Ltd. historical prices were adjusted to reflect the LT Liab 1 031 871 681 759 594

unbundling of Zeda Ltd. shares on 13 December 2022.

Barloworld delisted on the Namibian Stock Exchange on 1 March 2022. Tot Curr Liab 4 219 3 415 2 381 2 377 3 047

PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20 HEPS-C (ZARc) 798.00 473.00 294.00 - 31.00 71.00

Interim Final Final Final(rst) Final(rst) DPS (ZARc) - 90.00 50.00 - 20.00

Turnover 19 176 45 028 39 383 34 123 33 909 NAV PS (ZARc) 5 527.00 4 565.00 4 013.08 3 664.00 3 542.00

Op Inc 1 851 4 332 3 654 3 241 1 958 3 Yr Beta 0.51 0.38 0.14 0.08 0.60

Att Inc 950 2 222 2 043 2 756 - 2 499 Price High 2 497 1 750 1 547 925 1 265

Hline Erngs-CO 988 2 147 2 131 1 872 - 130 Price Low 1 400 1 001 630 250 700

Fixed Ass 8 598 8 017 7 555 11 417 12 239 Price Prd End 2 300 1 525 1 235 650 925

Inv in Assoc** 2 841 2 835 2 424 1 880 2 148 RATIOS

Ord SH Int 16 914 16 557 18 919 21 422 19 504 Ret on SH Fnd 15.02 10.97 7.62 - 1.63 1.54

Tot Curr Liab** 16 666 22 381 24 449 21 000 16 877

Oper Pft Mgn 8.83 6.86 5.04 0.53 2.79

PER SHARE STATISTICS (cents per share) D:E 0.50 0.47 0.35 0.51 0.67

EPS (ZARc) 511.70 1 197.00 1 051.90 1 390.90 - 1 236.00 Current Ratio 2.02 1.98 2.16 2.02 1.76

HEPS-C (ZARc) 532.20 1 156.30 1 096.30 944.90 - 130.00 Div Cover - 5.31 6.00 - 3.50

DPS (ZARc) 210.00 500.00 1 010.00 1 787.00 -

NAV PS (ZARc) 8 918.92 8 730.67 9 976.00 10 698.00 9 753.00

RATIOS*

Ret on SH Fnd 11.29 13.53 17.10 12.10 - 1.50

RONOA 23.60 28.60 28.60 20.30 9.30

Oper Pft Mgn 9.65 9.62 9.28 9.50 5.77

*all incl. IFRS 16 impact for 2020 and 2021

**incl. assets held for sale

2018 to 2020 not restated for the fair value adjustments on financial instruments.

84