Page 82 - shbh24_complete

P. 82

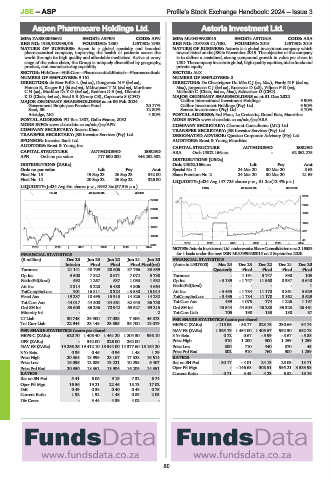

JSE – ASP Profile’s Stock Exchange Handbook: 2024 – Issue 3

Aspen Pharmacare Holdings Ltd. Astoria Investment Ltd.

ASP AST

ISIN: ZAE000066692 SHORT: ASPEN CODE: APN ISIN: MU0499N00015 SHORT: ASTORIA CODE: ARA

REG NO: 1985/002935/06 FOUNDED: 1850 LISTED: 1998 REG NO: 1297585 C1/GBL FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Aspen is a global specialty and branded NATURE OF BUSINESS: Astoria is a global investment company which

pharmaceutical company, improving the health of patients across the inward listed on the JSE in November 2015. The objective of the company

world through its high quality and affordable medicines. Active at every is to deliver a sustained, strong compound growth in value per share in

stage of the value chain, the Group is uniquely diversified by geography, USD. The company investsin global, high quality equities, niche fundsand

product, and manufacturing capability. private equity.

SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals SECTOR: AltX

NUMBER OF EMPLOYEES: 9 161 NUMBER OF EMPLOYEES: 0

DIRECTORS: de Beer PrfDr L (ind ne), DongwanaNP(ind ne), DIRECTORS: De Chasteigner Du MéeCJ(ne, Mau), HardyNF(ind ne,

Haman R, KrugerBJ(ld ind ne), MkhwanaziTM(ind ne), Mortimer Mau), JorgensenCJ(ind ne), Rosevear D (alt), ViljoenPG(ne),

CN(ne), Muthien DrYG(ind ne), RedfernDS(ne), Dlamini McIlraith C (Chair, ind ne, Mau), Schweizer D (CFO)

K D (Chair, ind ne), Saad S B (Group CE), Capazorio S (CFO) MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2022

MAJOR ORDINARY SHAREHOLDERS as at 06 Feb 2024 Calibre International Investment Holdings 9.90%

Government Employees Pension Fund 20.17% Calibre Investment Holdings (Pty) Ltd. 9.90%

Saad, SB 12.80% Seneca Investments (Pty) Ltd. 8.70%

Attridge, MG 4.30% POSTAL ADDRESS: 3rd Floor, La Croisette, Grand Baie, Mauritius

POSTAL ADDRESS: PO Box 1587, Gallo Manor, 2052 MORE INFO: www.sharedata.co.za/sdo/jse/ARA

MORE INFO: www.sharedata.co.za/sdo/jse/APN COMPANY SECRETARY: Clermont Consultants (MU) Ltd.

COMPANY SECRETARY: Raeesa Khan TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: Investec Bank Ltd. AUDITORS: Ernst & Young Mauritius

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED ARA Ords USD2.166c ea - 62 062 275

APN Ords no par value 717 600 000 446 252 332

DISTRIBUTIONS [USDc]

DISTRIBUTIONS [ZARc] Ords USD2.166c ea Ldt Pay Amt

Ords no par value Ldt Pay Amt Special No 1 24 Mar 20 30 Mar 20 8.63

Final No 13 19 Sep 23 26 Sep 23 342.00 Share Premium No 2 24 Mar 20 30 Mar 20 21.69

Final No 12 20 Sep 22 26 Sep 22 326.00

LIQUIDITY: Jul24 Avg 147 725 shares p.w., R1.2m(12.4% p.a.)

LIQUIDITY: Jul24 Avg 5m shares p.w., R992.3m(57.3% p.a.)

FINA 40 Week MA ASTORIA

PHAR 40 Week MA ASPEN

3106

27049

2494

23026

1882

19003

1269

14981

657

10958

45

2019 | 2020 | 2021 | 2022 | 2023 | 2024

6935

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: AstoriaInvestmentLtd.underwentaShareConsolidationona2.16583

FINANCIAL STATISTICS for 1 basis under the new ISIN MU0499N00015 on 2 September 2020.

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 FINANCIAL STATISTICS

Interim Final Final Final Final(rst) (Amts in USD’000) Mar 24 Dec 23 Dec 22 Dec 21 Dec 20

Turnover 21 141 40 709 38 606 37 766 33 659 Quarterly Final Final Final Final

Op Inc 3 500 7 822 8 671 7 072 5 730 Turnover - 1 191 3 747 898 103

NetIntPd(Rcvd) 592 1 267 537 1 083 1 532 Op Inc - 3 189 - 1 747 11 560 8 937 3 640

Att Inc 2 314 5 228 6 488 4 806 4 664 NetIntPd(Rcvd) - - - - 1

TotCompIncLoss 901 16 811 8 324 - 3 580 15 014 Att Inc - 3 435 - 1 784 11 170 8 861 3 629

Fixed Ass 19 237 18 495 15 913 14 826 14 232 TotCompIncLoss - 3 435 - 1 784 11 170 8 862 3 629

Tot Curr Ass 44 017 44 500 34 561 32 643 36 738 Tot Curr Ass 499 1 075 774 1 226 1 197

Ord SH Int 85 600 86 236 70 942 65 627 69 215 Ord SH Int 45 544 44 504 46 288 35 323 26 461

Minority Int - - - - 2 Tot Curr Liab 705 198 183 188 87

LT Liab 30 748 24 900 17 038 7 306 45 873 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 22 944 23 148 23 395 36 700 18 079 HEPS-C (ZARc) - 115.05 - 58.77 323.76 230.66 94.74

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 1 365.79 1 454.00 1 405.57 992.30 682.78

HEPS-C (ZARc) 620.70 1 405.40 1 461.20 1 204.30 998.10 3 Yr Beta 0.72 0.67 - 5.99 - 8.67 - 5.88

DPS (ZARc) - 342.00 326.00 262.00 - Price High 910 1 200 900 1 259 1 259

NAV PS (ZARc) 19 266.26 19 412.10 15 944.00 14 377.60 15 164.20 Price Low 800 710 440 370 45

3 Yr Beta 0.35 0.46 0.96 1.48 1.29 Price Prd End 802 910 760 500 1 259

Price High 20 564 18 999 28 167 17 328 16 514 RATIOS

Price Low 16 096 12 889 13 221 10 298 6 407 Ret on SH Fnd - 30.17 - 4.01 24.13 25.09 13.71

Price Prd End 20 350 18 362 13 904 16 209 14 351 Oper Pft Mgn - - 146.68 308.51 995.21 3 533.98

RATIOS Current Ratio 0.71 5.43 4.23 6.52 13.76

Ret on SH Fnd 5.41 6.06 9.15 7.32 6.74

Oper Pft Mgn 16.56 19.21 22.46 18.73 17.02

D:E 0.49 0.38 0.40 0.49 0.75

Current Ratio 1.92 1.92 1.48 0.89 2.03

Div Cover - 3.44 4.39 4.02 -

80