Page 78 - shbh24_complete

P. 78

JSE – ANG Profile’s Stock Exchange Handbook: 2024 – Issue 3

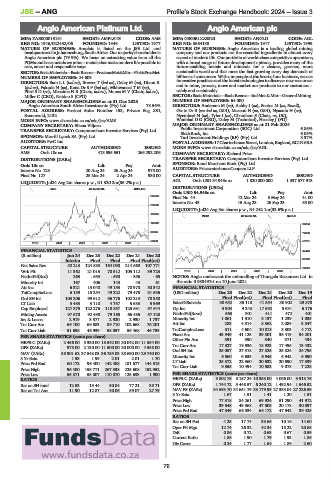

Anglo American Platinum Ltd. Anglo American plc

ANG ANG

ISIN: ZAE000013181 SHORT: AMPLATS CODE: AMS ISIN: GB00B1XZS820 SHORT: ANGLO CODE: AGL

REG NO: 1946/022452/06 FOUNDED: 1946 LISTED: 1977 REG NO: 3564138 FOUNDED: 1917 LISTED: 1999

NATURE OF BUSINESS: Amplats is listed on the JSE Ltd. and NATURE OF BUSINESS: Anglo American is a leading global mining

headquartered in Johannesburg, South Africa. Our majority shareholder is company and our products are the essential ingredients in almost every

Anglo American plc (79.9%). We focus on extracting value from all the aspect of modern life. Our portfolio of world-class competitive operations,

PGMs and base metals we mine – metals that make modern life possible in with a broad range of future development options, provides many of the

safe, smart and responsible ways. future-enabling metals and minerals for a cleaner, greener, more

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet sustainable world and that meet the fast growing every day demands of

NUMBER OF EMPLOYEES: 24 603 billions of consumers. With our people at the heart of our business, we use

DIRECTORS: BamLL(ind ne), Brewer T (ind ne), Daley M (ne), Dixon R innovative practices and the latest technologies to discover new resources

(ind ne), Fakude N (ne), Kana DrSP(ind ne), MkhwanaziTM(ne), and to mine, process, move and market our products to our customers –

PhiriSD(ne), Mbazima N B (Chair, ind ne), Moosa M V (Chair, ind ne), safely and sustainably.

Miller C (CEO), Naidoo S (CFO) SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 NUMBER OF EMPLOYEES: 64 000

Anglo American South Africa Investments (Pty) Ltd. 78.56% DIRECTORS: Anderson M (ne), Ashby I (ne), Bastos M (ne, Brazil),

POSTAL ADDRESS: Postnet Suite Number 153, Private Bag X31, Grote Dr B (snr ind ne, USA), Maxson H (ne, USA), Nyasulu H (ne),

Saxonwold, 2132 Nyembezi N (ne), Tyler I (ne), Chambers S (Chair, ne, UK),

MORE INFO: www.sharedata.co.za/sdo/jse/AMS Wanblad D G (CEO), Daley M (Technical), Heasley J (FD)

COMPANY SECRETARY: Elizna Viljoen MAJOR ORDINARY SHAREHOLDERS as at 21 Feb 2024

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Public Investment Corporation (SOC) Ltd. 6.86%

BlackRock, Inc.

6.05%

SPONSOR: Merrill Lynch SA (Pty) Ltd. Tarl Investment Holdings (RF) (Pty) Ltd. 3.37%

AUDITORS: PwC Inc. POSTAL ADDRESS:17Charterhouse Street,London,England,EC1N6RA

CAPITAL STRUCTURE AUTHORISED ISSUED MORE INFO: www.sharedata.co.za/sdo/jse/AGL

AMS Ords 10c ea 413 595 651 265 292 206 COMPANY SECRETARY: Richard Price

DISTRIBUTIONS [ZARc] TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ords 10c ea Ldt Pay Amt SPONSOR: Rand Merchant Bank (Pty) Ltd.

Interim No 128 20 Aug 24 26 Aug 24 975.00 AUDITORS: PricewaterhouseCoopers LLP

Final No 127 25 Mar 24 2 Apr 24 930.00 CAPITAL STRUCTURE AUTHORISED ISSUED

AGL Ords USD 54.945c ea 1 820 000 000 1 337 577 913

LIQUIDITY: Jul24 Avg 2m shares p.w., R1 320.2m(36.2% p.a.)

DISTRIBUTIONS [USDc]

MINI 40 Week MA AMPLATS

Ords USD 54.945c ea Ldt Pay Amt

249706 Final No 44 12 Mar 24 3 May 24 41.00

Interim No 43 15 Aug 23 26 Sep 23 55.00

209781

LIQUIDITY: Jul24 Avg 8m shares p.w., R4 242.1m(32.6% p.a.)

169855

INDM 40 Week MA ANGLO

129930 84334

90004 72033

50079 59731

2019 | 2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS 47429

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final(rst) 35128

Net Sales Rev 52 213 124 583 164 090 214 568 107 771

22826

Wrk Pft 11 362 21 013 70 512 105 112 39 723 2019 | 2020 | 2021 | 2022 | 2023 |

NetIntPd(Rcd) 263 - 553 - 590 - 356 - 65 NOTES: Anglo underwent the unbundling of Thungela Resources Ltd. in

Minority Int 167 406 143 43 61 the ratio 0.988497:1 on 10 June 2021.

Att Inc 6 321 13 040 49 153 78 978 30 342 FINANCIAL STATISTICS

TotCompIncLoss 6 189 15 254 49 222 79 475 31 636 (USD million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Ord SH Int 103 206 99 612 96 776 102 213 78 350 Final Final(rst) Final Final(rst) Final

LT Liab 3 483 3 110 4 757 5 683 5 969 SalesOfSubsids 30 652 35 118 41 554 30 902 29 870

Cap Employed 127 375 122 276 118 857 123 681 97 644 Op Inc 3 904 9 243 17 592 5 631 6 176

Mining Assets 97 670 92 498 79 165 66 486 57 128 NetIntPd(Rcvd) 563 301 411 472 401

Inv & Loans 2 919 3 377 2 920 2 930 1 737 Minority Int 1 061 1 510 3 137 1 239 1 035

Tot Curr Ass 69 100 69 583 89 710 102 668 76 201 Att Inc 283 4 514 8 562 2 089 3 547

Tot Curr Liab 51 638 46 939 58 057 56 468 46 733 TotCompIncLoss 311 4 604 10 813 3 303 4 712

Fixed Ass 43 949 41 125 39 501 36 419 34 201

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 2 456.00 5 330.00 18 542.00 30 042.00 11 554.00 Other Fin Ass 391 390 340 371 434

DPS (ZARc) 975.00 2 130.00 11 500.00 30 000.00 4 558.00 Tot Curr Ass 17 327 19 936 18 923 17 495 13 432

NAV (ZARc) 38 901.62 37 548.03 36 755.03 38 690.00 29 740.00 Ord SH Int 25 057 27 318 27 825 25 824 24 795

3 Yr Beta 1.93 1.99 2.01 2.01 1.70 Minority Int 6 560 6 635 6 945 6 942 6 590

Price Prd End 60 172 96 400 142 488 181 677 144 315 LT Liab 25 572 22 960 20 632 20 690 17 539

Price High 96 400 158 771 267 538 225 608 152 952 Tot Curr Liab 9 355 10 494 10 583 9 078 7 228

Price Low 55 871 58 007 110 870 125 633 1 900 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 3 802.76 8 157.24 10 353.00 4 066.00 3 913.76

Ret on SH fund 12.53 13.44 50.84 77.21 38.71 DPS (ZARc) 1 744.72 3 448.57 6 240.12 1 492.94 1 546.52

Ret on Tot Ass 11.90 12.87 40.06 59.07 27.79 NAV PS (ZARc) 34 693.70 34 651.79 33 179.99 27 353.04 27 226.59

3 Yr Beta 1.67 1.51 1.41 1.20 1.51

Price High 77 318 84 261 69 924 51 290 41 912

Price Low 39 548 49 368 47 505 20 178 30 097

Price Prd End 47 349 66 334 65 172 47 942 39 425

RATIOS

Ret on SH Fnd 4.25 17.74 33.65 10.16 14.60

Oper Pft Mgn 12.74 26.32 42.34 18.22 20.68

D:E 0.86 0.72 0.63 0.67 0.59

Current Ratio 1.85 1.90 1.79 1.93 1.86

Div Cover 0.24 1.77 1.64 1.86 2.60

76