Page 81 - shbh24_complete

P. 81

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – ARG

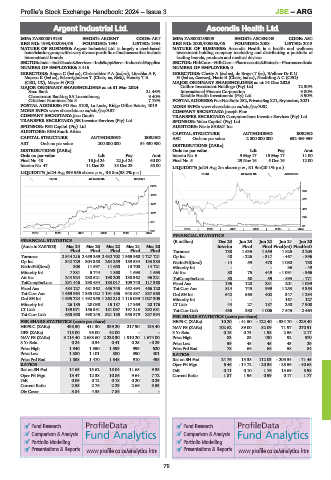

Argent Industrial Ltd. Ascendis Health Ltd.

ARG ASC

ISIN: ZAE000019188 SHORT: ARGENT CODE: ART ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC

REG NO: 1993/002054/06 FOUNDED: 1994 LISTED: 1994 REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013

NATURE OF BUSINESS: Argent Industrial Ltd. is largely a steel-based NATURE OF BUSINESS: Ascendis Health is a health and wellness

beneficiation group with a very diverse portfolio of businesses that include investment holding company marketing and distributing a portfolio of

international brands. leading brands, products and medical devices.

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals

NUMBER OF EMPLOYEES: 3 416 NUMBER OF EMPLOYEES: 0

DIRECTORS: Angus C (ind ne), ChristofidesPA(ind ne), Litschka A F, DIRECTORS: Chetty A (ind ne), de Bruyn T (ne), Wellner Dr K U

Mapasa K (ind ne), Scharrighuisen T (Chair, ne, Neth), Hendry T R H(ind ne, German), Harie B (Chair, ind ne), Neethling A C (CEO)

(CEO, UK), Meyer H (FD) MAJOR ORDINARY SHAREHOLDERS as at 14 Dec 2023

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Calibre Investment Holdings (Pty) Ltd. 12.30%

Saxo Bank 21.46% International Finance Corporation 9.80%

Clearstream Banking SA Luxembourg 9.40% Kefolile Health Investments (Pty) Ltd. 8.90%

Citiclient Nominees No 8 7.79% POSTAL ADDRESS:PostNetSuite252, PrivateBagX21,Bryanston,2021

POSTAL ADDRESS: PO Box 5108, La Lucia, Ridge Office Estate, 4019 MORE INFO: www.sharedata.co.za/sdo/jse/ASC

MORE INFO: www.sharedata.co.za/sdo/jse/ART COMPANY SECRETARY: Joseph Fine

COMPANY SECRETARY: Jaco Dauth TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Valeo Capital (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. AUDITORS: Nexia SAB&T Inc.

AUDITORS: RSM South Africa

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED ASC Ords no par value 2 000 000 000 632 469 959

ART Ords no par value 200 000 000 54 430 980

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords no par value Ldt Pay Amt

Ords no par value Ldt Pay Amt Interim No 6 9 May 17 15 May 17 11.00

Final No 48 16 Jul 24 22 Jul 24 60.00 Final No 5 29 Nov 16 5 Dec 16 12.00

Interim No 47 11 Dec 23 18 Dec 23 55.00

LIQUIDITY: Jul24 Avg 2m shares p.w., R1.9m(20.1% p.a.)

LIQUIDITY: Jul24 Avg 399 556 shares p.w., R6.8m(38.2% p.a.)

PHAR 40 Week MA ASCENDIS

SUPS 40 Week MA ARGENT

2270

805

1870

612

1471

418

1071

225

671

31

2019 | 2020 | 2021 | 2022 | 2023 | 2024

272

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 Interim Final Final Final(rst) Final(rst)

Final Final Final Final Final Turnover 738 1 535 1 559 1 825 2 203

Turnover 2 544 216 2 459 359 2 432 702 1 965 960 1 727 721 Op Inc 48 - 226 - 317 - 467 - 896

Op Inc 342 729 304 358 264 259 189 534 133 383 NetIntPd(Rcvd) - 14 59 478 1 080 788

NetIntPd(Rcvd) 303 11 597 11 650 13 700 14 721 Minority Int - - - 36 - 49

Minority Int 7 381 5 744 1 868 1 693 1 693 Att Inc 80 75 449 - 1 091 - 966

Att Inc 244 924 230 521 190 208 130 362 96 221 TotCompIncLoss 80 60 59 - 893 - 771

TotCompIncLoss 291 446 298 434 183 017 109 740 117 368 Fixed Ass 196 120 231 201 1 039

Fixed Ass 484 127 481 362 456 745 452 494 466 120 Tot Curr Ass 814 745 999 1 253 4 353

Tot Curr Ass 1 669 964 1 355 022 1 191 456 943 537 837 568 Ord SH Int 642 563 402 347 1 294

Ord SH Int 1 695 724 1 492 955 1 262 210 1 116 039 1 027 305 Minority Int - - - 167 127

Minority Int 26 185 20 038 15 187 17 369 20 176 LT Liab 44 27 187 250 7 908

LT Liab 139 071 156 351 181 097 197 213 292 681 Tot Curr Liab 436 380 1 006 7 545 2 464

Tot Curr Liab 653 690 490 245 521 185 355 379 237 394

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 10.20 - 41.50 - 122.40 - 334.70 - 229.40

HEPS-C (ZARc) 438.50 411.30 339.20 217.90 133.40 NAV PS (ZARc) 102.62 89.00 82.09 71.97 270.91

DPS (ZARc) 115.00 95.00 42.00 - - 3 Yr Beta 0.15 0.73 1.98 2.56 2.17

NAV PS (ZARc) 3 115.40 2 683.60 2 238.30 1 910.20 1 674.00 Price High 83 83 130 92 570

3 Yr Beta 0.24 0.34 0.41 0.25 - 0.29 Price Low 59 48 45 43 29

Price High 1 940 1 550 1 599 999 620 Price Prd End 78 66 68 58 84

Price Low 1 380 1 101 880 390 401 RATIOS

Price Prd End 1 858 1 470 1 348 910 495 Ret on SH Fnd 24.76 13.38 112.03 - 205.34 - 71.45

RATIOS Oper Pft Mgn 6.46 - 14.72 - 20.36 - 25.56 - 40.68

Ret on SH Fnd 14.65 15.62 15.04 11.65 9.35 D:E 0.11 0.10 1.76 13.69 5.98

Oper Pft Mgn 13.47 12.38 10.86 9.64 7.72 Current Ratio 1.87 1.96 0.99 0.17 1.77

D:E 0.09 0.12 0.18 0.20 0.29

Current Ratio 2.55 2.76 2.29 2.66 3.53

Div Cover 3.84 4.35 7.86 - -

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

79