Page 80 - shbh24_complete

P. 80

JSE – ARC Profile’s Stock Exchange Handbook: 2024 – Issue 3

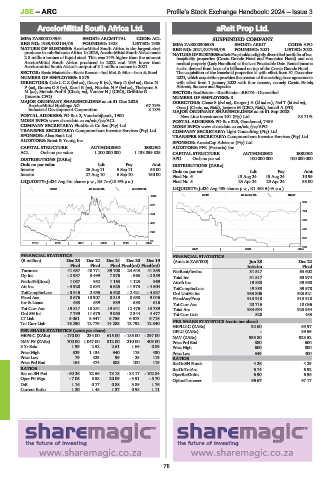

ArcelorMittal South Africa Ltd. aReit Prop Ltd.

ARC ARE

ISIN: ZAE000134961 SHORT: ARCMITTAL CODE: ACL SUSPENDED COMPANY

REG NO: 1989/002164/06 FOUNDED: 1928 LISTED: 1989 ISIN: ZAE000306585 SHORT: AREIT CODE: APO

NATURE OF BUSINESS: ArcelorMittal South Africa is the largest steel REG NO: 2021/837953/06 FOUNDED: 2021 LISTED: 2022

producer in sub-Saharan Africa. In 2023, ArcelorMittal South Africa made NATUREOFBUSINESS:aReitPropholdsaslightlydiversifiedportfoliooftwo

2.8 million tonnes of liquid steel. This was 14% higher than the amount hospitality properties (Cresta Grande Hotel and Fountains Hotel) and one

ArcelorMittal South Africa produced in 2022 and 10% lower than medical property (Lady Hamilton) at the Last Practicable Date. Rental income

Arcelormittal South Africa’s output of 3.1 million tonnes in 2021. is also derived from lease of a billboard on top of the Cresta Grande Hotel.

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel The acquisition of the leasehold properties is with effect from 31 December

NUMBER OF EMPLOYEES: 8 379 2021, which acquisition provides the cession of the existing lease agreements

DIRECTORS: CeleLCZ(ind ne), Davey B (ne), Earp D (ind ne), Gosa N with effect from 1 January 2022 with four tenants, namely Cresta Hotels,

P(ne), GouwsGS(ne), Karol R (ne), NicolauNF(ind ne), Thebyane A Afrirent, Suncare and Supasite.

M(ne), Mohale Prof B (Chair, ne), Verster H J (CEO), Griffiths G SECTOR: RealEstate—RealEstate—REITS—Diversified

(Interim CFO) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 DIRECTORS: Chase S (ind ne), KrugerJA(ld ind ne), Nel T (ld ind ne),

ArcelorMittal Holdings AG 67.79% Osse J (Chair, ne, Neth), Jaspers M (CEO, Neth), Ismail A (FD)

Industrial Development Corporation 8.18% MAJOR ORDINARY SHAREHOLDERS as at 01 Sep 2023

POSTAL ADDRESS: PO Box 2, Vanderbijlpark, 1900 New Line Investments 101 (Pty) Ltd. 88.71%

MORE INFO: www.sharedata.co.za/sdo/jse/ACL POSTAL ADDRESS: PO Box 325, Goodwood, 7459

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/APO

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Light Consulting (Pty) Ltd.

SPONSOR: Absa Bank Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc. SPONSOR: AcaciaCap Advisors (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: PFK (Pretoria) Inc.

ACL Ords no par value 1 200 000 000 1 138 059 825 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] APO Ords no par val 100 000 000 100 000 000

Ords no par value Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim 26 Aug 11 5 Sep 11 55.00 Ords no par val Ldt Pay Amt

Interim 27 Aug 10 6 Sep 10 150.00 Final No 6 13 Aug 24 19 Aug 24 10.99

LIQUIDITY: Jul24 Avg 4m shares p.w., R5.7m(18.9% p.a.) Final No 5 23 Apr 24 29 Apr 24 33.00

INDM 40 Week MA ARCMITTAL LIQUIDITY: Jul24 Avg 489 shares p.w., R1 468.5(-% p.a.)

1040 REIV 40 Week MA AREIT

880

837

754

634

628

432

502

229

376

26

2019 | 2020 | 2021 | 2022 | 2023 | 2024

250

2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 (Amts in ZAR’000) Jun 23 Dec 22

Final Final Final Final(rst) Final(rst) Interim Final

Turnover 41 637 40 771 39 708 24 643 41 353 NetRent/InvInc 31 517 63 602

Op Inc - 2 937 3 499 7 976 - 963 - 2 359 Total Inc 31 517 63 974

NetIntPd(Rcvd) 1 057 952 1 163 1 123 969 Attrib Inc 19 888 39 598

Att Inc - 3 920 2 634 6 625 - 1 973 - 4 604 TotCompIncLoss 19 888 39 578

TotCompIncLoss - 3 915 2 655 6 620 - 2 421 - 4 537 Ord UntHs Int 933 806 923 521

Fixed Ass 8 676 10 307 8 819 8 658 9 046 FixedAss/Prop 913 918 913 918

Inv & Loans 683 659 639 583 616 Tot Curr Ass 20 716 10 036

Tot Curr Ass 19 517 18 851 19 541 12 476 13 739 Total Ass 934 634 923 954

Ord SH Int 7 799 11 675 9 053 2 344 4 477 Tot Curr Liab 828 433

LT Liab 5 061 5 547 5 755 6 673 6 716 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 16 250 12 779 14 285 12 792 12 340

HEPLU-C (ZARc) 32.60 63.97

PER SHARE STATISTICS (cents per share) DPLU (ZARc) - 39.59

HEPS-C (ZARc) - 170.00 234.00 615.00 - 185.00 - 297.00 NAV (ZARc) 933.80 923.52

NAV PS (ZARc) 700.00 1 047.00 812.00 210.00 409.00 Price Prd End 380 600

3 Yr Beta 1.99 2.52 2.61 1.66 0.89 Price High 600 800

Price High 529 1 134 940 175 430 Price Low 349 400

Price Low 79 423 99 25 119 RATIOS

Price Prd End 164 474 888 100 119 RetOnSH Funds 4.26 4.29

RATIOS RetOnTotAss 6.74 6.92

Ret on SH Fnd - 50.26 22.56 73.18 - 84.17 - 102.84 OperRetOnInv 6.90 6.96

Oper Pft Mgn - 7.05 8.58 20.09 - 3.91 - 5.70 OpInc:Turnover 96.67 97.17

D:E 1.16 0.77 0.88 3.89 1.76

Current Ratio 1.20 1.48 1.37 0.98 1.11

78