Page 84 - shbh24_complete

P. 84

JSE – AVE Profile’s Stock Exchange Handbook: 2024 – Issue 3

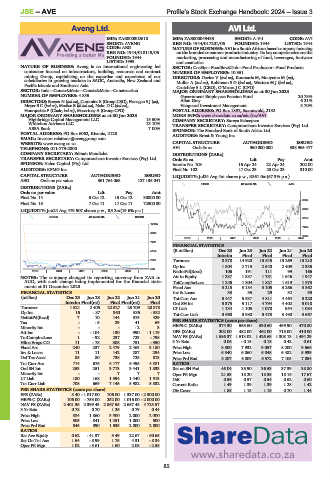

Aveng Ltd. AVI Ltd.

AVE AVI

ISIN: ZAE000302618 ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI

SHORT: AVENG REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944

CODE: AEG NATURE OF BUSINESS: AVI is a South African based company focusing

REG NO: 1944/018119/06 on the branded consumer products industry. Its key competencies are the

FOUNDED: 1944 marketing, processing and manufacturing of food, beverages, footwear

LISTED: 1999 and cosmetics.

NATURE OF BUSINESS: Aveng is an international engineering led SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products

contractor focused on infrastructure, building, resources and contract NUMBER OF EMPLOYEES: 10 351

mining Group, capitalising on the expertise and experience of our DIRECTORS: Davies V (ind ne), Koursaris M, Mouyeme M (ne),

subsidiaries in growing markets in SADC, Australia, New Zealand and Muller A (ind ne), RobinsonSG(ind ne), WattersMJ(ind ne),

Pacific Islands and Southeast Asia. Crutchley S L (CEO), O’Meara J C (CFO)

SECTOR: Inds—Constr&Mats—Constr&Mats—Construction MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

NUMBER OF EMPLOYEES: 4 835 Government Employees Pension Fund 20.75%

DIRECTORS: Bowen N (ind ne), Cummins S (Group CEO), Flanagan S J (ne), Allan Gray 6.21%

Meyer B C (ind ne), Modise B (ld ind ne), NokoDC(ind ne), Vanguard Investment Management 3.70%

Hourquebie P (Chair, ind ne), Macartney A (Group CFO) POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 MORE INFO: www.sharedata.co.za/sdo/jse/AVI

Highbridge Capital Management LLC 15.50% COMPANY SECRETARY: Sureya Scheepers

Whitebox Advisors LLC 13.10% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ABSA Bank 7.00%

POSTAL ADDRESS: PO Box 6062, Rivonia, 2128 SPONSOR: The Standard Bank of South Africa Ltd.

AUDITORS: Ernst & Young Inc.

EMAIL: Investor.relations@avenggroup.com

WEBSITE: www.aveng.co.za CAPITAL STRUCTURE AUTHORISED ISSUED

TELEPHONE: 011-779-2800 AVI Ords 5c ea 960 000 000 338 965 477

COMPANY SECRETARY: Edinah Mandizha DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 5c ea Ldt Pay Amt

SPONSOR: Valeo Capital (Pty) Ltd. Interim No 103 16 Apr 24 22 Apr 24 202.00

AUDITORS: KPMG Inc. Final No 102 17 Oct 23 23 Oct 23 310.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul24 Avg 4m shares p.w., R361.0m(67.3% p.a.)

AEG Ords no par value 361 764 068 127 135 041

FOOD 40 Week MA A-V-I

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 14 5 Oct 12 15 Oct 12 30000.00

Final No 13 7 Oct 11 17 Oct 11 72500.00 9967

LIQUIDITY: Jun24 Avg 479 507 shares p.w., R3.2m(19.6% p.a.) 9063

CONM 40 Week MA AVENG 8159

12135

7254

9808

6350

2019 | 2020 | 2021 | 2022 | 2023 | 2024

7481

FINANCIAL STATISTICS

5154 (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final Final Final

2827 Turnover 8 378 14 920 13 845 13 269 13 210

Op Inc 1 804 2 715 2 540 2 409 2 335

500

2019 | 2020 | 2021 | 2022 | 2023 | NetIntPd(Rcvd) 106 191 111 99 166

NOTES: The company changed its reporting currency from ZAR to Att to Equity 1 237 1 837 1 751 1 646 1 947

AUD, with such change being implemented for the financial state- TotCompIncLoss 1 245 1 804 1 827 1 619 1 973

ments at 31 December 2023. Fixed Ass 3 215 3 184 3 105 3 266 3 362

FINANCIAL STATISTICS Inv & Loans 33 35 29 32 35

(million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Tot Curr Ass 5 447 5 537 4 811 4 464 5 220

Interim Final(rst) Final Final(rst) Final Ord SH Int 5 375 5 117 4 794 4 402 5 018

Turnover 1 521 2 405 22 527 25 709 20 878 LT Liab 1 134 1 105 1 078 954 1 084

Op Inc 16 - 87 360 536 - 532 Tot Curr Liab 3 660 3 980 3 473 3 490 3 667

NetIntPd(Rcvd) 7 10 144 375 429

Tax - - 5 29 41 69 PER SHARE STATISTICS (cents per share)

Minority Int - - - - 2 3 HEPS-C (ZARc) 374.30 553.60 530.60 499.90 470.80

Att Inc - - 104 130 990 - 1 119 DPS (ZARc) 202.00 482.00 462.00 715.00 410.00

TotCompIncLoss 1 - 92 237 723 - 798 NAV PS (ZARc) 1 586.37 1 513.02 1 426.69 1 308.13 1 494.29

Hline Erngs-CO 11 - 78 308 751 - 950 3 Yr Beta 0.06 - 0.15 0.18 0.42 0.61

Fixed Ass 240 237 2 479 2 463 3 180 Price High 8 500 7 932 9 057 8 200 9 666

Inv & Loans 11 11 142 287 294 Price Low 6 540 6 060 6 048 6 482 5 939

Def Tax Asset 85 80 738 725 813 Price Prd End 8 207 6 809 6 572 7 105 7 054

Tot Curr Ass 714 676 8 177 6 495 4 881 RATIOS

Ord SH Int 253 251 3 713 3 441 1 833 Ret on SH Fnd 46.04 35.90 36.53 37.39 38.80

Minority Int - - 7 7 7 Oper Pft Mgn 21.53 18.20 18.35 18.16 17.67

LT Liab 180 168 1 594 1 440 1 913 D:E 0.56 0.57 0.54 0.62 0.60

Tot Curr Liab 708 669 7 145 5 982 5 832

Current Ratio 1.49 1.39 1.39 1.28 1.42

PER SHARE STATISTICS (cents per share) Div Cover 1.85 1.15 1.15 0.70 1.44

EPS (ZARc) 8.40 - 1 017.00 106.00 1 337.00 - 2 300.00

HEPS-C (ZARc) 106.00 - 753.00 252.00 1 016.00 - 2 000.00

NAV PS (ZARc) 2 401.35 2 399.43 2 867.55 2 657.48 4 725.57

3 Yr Beta 0.78 0.70 1.26 0.79 0.44

Price High 884 1 860 3 500 2 000 2 000

Price Low 505 841 1 251 1 000 500

Price Prd End 845 890 1 535 2 000 2 000

RATIOS

Ret Ave Equity 0.62 - 41.37 3.49 22.67 - 60.65

Ret On Tot Ass 1.54 - 8.99 1.75 4.31 - 8.34

Oper Pft Mgn 1.02 - 3.61 1.60 2.08 - 2.55

82