Page 97 - shbh24_complete

P. 97

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – CAS

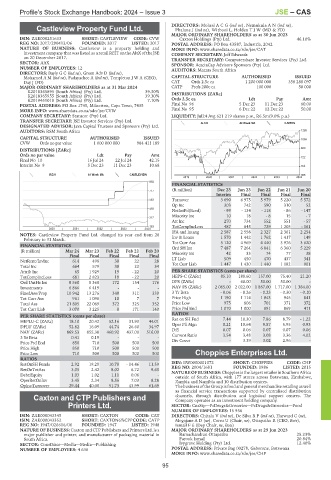

DIRECTORS: Molusi ACG(ind ne), Nemukula A N (ind ne),

Castleview Property Fund Ltd. Phalane J (ind ne), Witbooi L, Holden T J W (MD & FD)

CAS MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

ISIN: ZAE000251633 SHORT: CASTLEVIEW CODE: CVW Caxton Holdings (Pty) Ltd. 46.10%

REG NO: 2017/290413/06 FOUNDED: 2017 LISTED: 2017 POSTAL ADDRESS: PO Box 43587, Industria, 2042

NATURE OF BUSINESS: Castleview is a property holding and MORE INFO: www.sharedata.co.za/sdo/jse/CAT

investment company that was listed as a retail REIT on the AltX of the JSE COMPANY SECRETARY: Jeff Edwards

on 20 December 2017. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: AltX SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

NUMBER OF EMPLOYEES: 12 AUDITORS: Mazars South Africa

DIRECTORS: Bayly G C (ind ne), Green Adv D (ind ne),

Mohamed A M (ind ne), Padayachee A (ind ne), Templeton J W A (CEO), CAPITAL STRUCTURE AUTHORISED ISSUED

Day J (FD) CAT Ords 2.5c ea 1 200 000 000 358 288 097

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 CATP Prefs 200c ea 100 000 50 000

K2018365895 (South Africa) (Pty) Ltd. 39.30%

K2018365955 (South Africa) (Pty) Ltd. 39.30% DISTRIBUTIONS [ZARc]

K2019451018 (South Africa) (Pty) Ltd. 7.10% Ords 2.5c ea Ldt Pay Amt

POSTAL ADDRESS: PO Box 1745, Milnerton, Cape Town, 7435 Final No 96 5 Dec 23 11 Dec 23 60.00

MORE INFO: www.sharedata.co.za/sdo/jse/CVW Final No 95 6 Dec 22 12 Dec 22 50.00

COMPANY SECRETARY: Statucor (Pty) Ltd. LIQUIDITY: Jul24 Avg 621 219 shares p.w., R6.5m(9.0% p.a.)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd. ALSH 40 Week MA CAXTON

AUDITORS: RSM South Africa 1226

CAPITAL STRUCTURE AUTHORISED ISSUED 1058

CVW Ords no par value 1 000 000 000 984 411 189

890

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

722

Final No 10 16 Jul 24 22 Jul 24 42.15

Interim No 9 5 Dec 23 11 Dec 23 10.68 554

REIV 40 Week MA CASTLEVIEW 386

2019 | 2020 | 2021 | 2022 | 2023 | 2024

850

FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

717

Interim Final Final Final Final

583 Turnover 3 690 6 975 5 979 5 220 5 572

Op Inc 303 742 590 310 52

450

NetIntPd(Rcvd) - 99 - 134 - 118 - 86 - 147

Minority Int 10 18 - 8 15 - 7

317

Att Inc 270 734 552 551 - 57

183 TotCompIncLoss 487 645 729 1 203 - 161

2020 | 2021 | 2022 | 2023 | 2024

IFA and Intang 2 587 2 558 2 327 2 361 2 254

NOTES: Castleview Property Fund Ltd. changed its year end from 28

February to 31 March. Inv & Loans 1 570 1 442 1 762 1 417 149

Tot Curr Ass 5 120 4 969 4 440 3 976 3 620

FINANCIAL STATISTICS Ord SH Int 7 487 7 264 6 841 6 360 5 229

(R million) Mar 24 Mar 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final Minority Int 42 33 74 77 38

NetRent/InvInc 614 498 30 22 28 LT Liab 509 450 470 437 341

Total Inc 664 579 30 22 34 Tot Curr Liab 1 447 1 430 1 440 1 182 901

Attrib Inc 65 1 929 19 - 22 20 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 681 2 823 19 - 22 20 HEPS-C (ZARc) 85.10 188.60 157.00 75.40 21.20

Ord UntHs Int 8 560 8 368 172 154 176 DPS (ZARc) - 60.00 50.00 50.00 -

Investments 6 866 6 419 - - - NAV PS (ZARc) 2 065.00 2 022.00 1 887.00 1 717.00 1 384.00

FixedAss/Prop 10 942 13 276 348 311 339 3 Yr Beta - 0.06 - 0.26 - 0.23 - 0.30 - 0.10

Tot Curr Ass 961 1 098 10 7 7 Price High 1 190 1 114 1 043 945 841

Total Ass 21 805 22 069 372 325 352 Price Low 975 806 701 371 372

Tot Curr Liab 3 070 3 225 8 171 140 Price Prd End 1 070 1 000 891 869 411

RATIOS

PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 18.10 20.42 52.16 31.93 44.01 Ret on SH Fnd 7.44 10.30 7.86 8.79 - 1.22

Oper Pft Mgn 8.21 10.64 9.87 5.95 0.93

DPLU (ZARc) 52.82 16.09 44.74 26.60 34.97

NAV (ZARc) 869.53 855.38 460.92 437.00 516.00 D:E 0.07 0.06 0.07 0.07 0.06

3.08

3.48

3.36

Current Ratio

4.02

3.54

3 Yr Beta 0.41 0.19 - - -

Price Prd End 850 710 500 500 500 Div Cover - 3.39 3.02 2.96 -

Price High 850 710 500 500 500

Price Low 710 500 500 500 500 Choppies Enterprises Ltd.

RATIOS CHO

RetOnSH Funds 2.92 19.28 10.78 - 14.46 11.59 ISIN: BW0000001072 SHORT: CHOPPIES CODE: CHP

RetOnTotAss 3.05 2.42 8.02 6.72 9.63 REG NO: 2004/1681 FOUNDED: 1986 LISTED: 2015

NATUREOF BUSINESS:Choppies isthelargestretailerinSouthernAfrica

Debt:Equity 1.03 1.02 1.11 0.06 - outside of South Africa, with 177 stores across Botswana, Zimbabwe,

OperRetOnInv 3.45 2.34 8.56 7.03 8.28 Zambia and Namibia and 10 distribution centres.

OpInc:Turnover 29.44 40.00 51.73 43.99 61.69 The businessofthe Groupisfoodandgeneralmerchandiseretailing aswell

as financial service transactions supported by centralised distribution

Caxton and CTP Publishers and channels, through distribution and logistical support centres. The

Company operates as an investment holding company.

Printers Ltd. SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

NUMBER OF EMPLOYEES: 15 956

CAX

ISIN: ZAE000043345 SHORT: CAXTON CODE: CAT DIRECTORS: Chitalu V (ind ne), De SilvaRP(ind ne), Harward C (ne),

ISIN: ZAE000043352 SHORT: CAXTON6%CPPCODE: CATP MogajaneAD(ne), Corea U (Chair, ne), Ottapathu R (CEO, Bots),

REG NO: 1947/026616/06 FOUNDED: 1947 LISTED: 1948 Ismail F E (Dep Chair, ne, Bots)

NATURE OF BUSINESS: Caxton and CTP Publishers and Printers Ltd. is a MAJOR ORDINARY SHAREHOLDERS as at 29 Jun 2023

major publisher and printer, and manufacturer of packaging material in Ramachandran Ottapathu 25.23%

South Africa. Farouk Ismail 20.84%

SECTOR: ConsDiscr—Media—Media—Publishing Ivygrove Holding (Pty) Ltd. 12.40%

NUMBER OF EMPLOYEES: 4 636 POSTAL ADDRESS: Private Bag 00278, Gaborone, Botswana

MORE INFO: www.sharedata.co.za/sdo/jse/CHP

95