Page 100 - shbh24_complete

P. 100

JSE – COL Profile’s Stock Exchange Handbook: 2024 – Issue 3

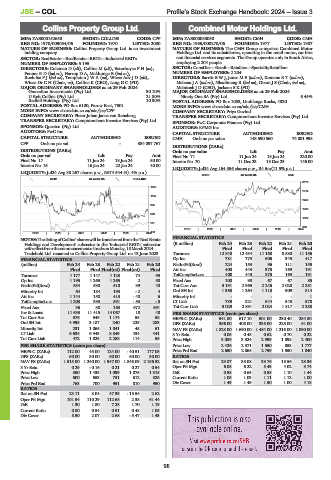

Collins Property Group Ltd. Combined Motor Holdings Ltd.

COL COM

ISIN: ZAE000152658 SHORT: COLLINS CODE: CPP ISIN: ZAE000088050 SHORT: CMH CODE: CMH

REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000 REG NO: 1965/000270/06 FOUNDED: 1977 LISTED: 1987

NATURE OF BUSINESS: Collins Property Group Ltd. is an investment NATURE OF BUSINESS: The CMH Group comprises Combined Motor

holding company. Holdings Ltd. and its subsidiaries, operating in the retail motor, car hire

SECTOR: RealEstate—RealEstate—REITs—Industrial REITs and financial services segments. The Group operates only in South Africa,

NUMBER OF EMPLOYEES: 5 195 employing 2 204 people.

DIRECTORS: Coleman D (alt), Collins M (alt), Esterhuyse F H (ne), SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

Fenner R D (ind ne), Harrop D A, Makhunga B (ind ne), NUMBER OF EMPLOYEES: 2 204

Roelofse P J (ind ne), Templeton J W A (ne), Wiese Adv J D (alt), DIRECTORS: BarrittBWJ, JonesME(ind ne), KomaneRT(ind ne),

Wiese Dr C H (Chair, ne), Collins K (CEO), Lang G C (FD) MabenaJA(ind ne), Nkadimeng R (ind ne), Dixon J S (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 McIntosh J D (CEO), Jackson S K (FD)

Granadino Investments (Pty) Ltd. 30.10% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

U Reit Collins (Pty) Ltd. 21.80% Ninety One SA (Pty) Ltd. 6.45%

Redbill Holdings (Pty) Ltd. 10.30% POSTAL ADDRESS: PO Box 1033, Umhlanga Rocks, 4320

POSTAL ADDRESS: PO Box 6100, Parow East, 7501 MORE INFO: www.sharedata.co.za/sdo/jse/CMH

MORE INFO: www.sharedata.co.za/sdo/jse/CPP COMPANY SECRETARY: Priya Govind

COMPANY SECRETARY: Pieter Johan Janse van Rensburg TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: PwC Corporate Finance (Pty) Ltd.

SPONSOR: Questco (Pty) Ltd. AUDITORS: KPMG Inc.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED CMH Ords no par value 143 590 560 74 801 998

CPP Ords no par val - 334 097 767

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords no par value Ldt Pay Amt

Ords no par val Ldt Pay Amt Final No 71 11 Jun 24 18 Jun 24 220.00

Final No 17 11 Jun 24 18 Jun 24 50.00 Interim No 70 11 Dec 23 18 Dec 23 146.00

Interim No 16 16 Jan 24 22 Jan 24 40.00

LIQUIDITY: Jul24 Avg 164 856 shares p.w., R4.5m(11.5% p.a.)

LIQUIDITY: Jul24 Avg 88 267 shares p.w., R674 544.5(1.4% p.a.)

GERE 40 Week MA CMH

REIV 40 Week MA COLLINS

3178

1369

2714

1182

2250

995

1786

808

1322

621

858

2019 | 2020 | 2021 | 2022 | 2023 | 2024

434

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: The listing of Collins’ shares will be transferred from the ‘Real Estate FINANCIAL STATISTICS

Holdings and Development’ subsector to the ‘Industrial REITs’ subsector (R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

witheffectfromthecommencementoftradeonMonday,18March2024. Final Final Final Final Final

Tradehold Ltd. renamed to Collins Property Group Ltd. on 13 June 2023. Turnover 12 840 12 434 11 168 8 580 11 156

FINANCIAL STATISTICS Op Inc 781 773 606 345 417

(million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 NetIntPd(Rcvd) 224 153 96 111 155

Final Final Final(rst) Final(rst) Final Att Inc 408 443 375 169 191

Turnover 1 177 1 147 1 123 74 95 TotCompIncLoss 408 443 375 169 191

Op Inc 1 195 1 265 1 265 2 58 Fixed Ass 100 98 67 67 85

NetIntPd(Rcvd) 634 530 510 39 40 Tot Curr Ass 3 191 2 965 2 246 2 028 2 251

Minority Int 64 184 193 - 2 4 Ord SH Int 1 368 1 264 1 110 909 814

Att Inc 1 144 158 413 - 40 6 Minority Int - - - - 1

TotCompIncLoss 1 203 393 591 - 53 - 5 LT Liab 789 821 644 548 578

Fixed Ass 36 38 163 672 691 Tot Curr Liab 3 029 2 891 2 024 1 817 2 258

Inv & Loans 11 633 11 415 14 067 18 48 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 376 549 1 174 55 58 HEPS-C (ZARc) 541.80 617.10 501.00 230.40 254.80

Ord SH Int 4 995 3 187 240 225 283 DPS (ZARc) 366.00 408.00 335.00 225.00 61.00

Minority Int 231 1 065 1 041 45 51 NAV PS (ZARc) 1 828.00 1 690.00 1 484.00 1 216.00 1 090.00

LT Liab 6 634 6 943 8 849 434 441 3 Yr Beta 0.05 0.48 0.62 0.70 0.22

Tot Curr Liab 472 1 025 2 288 114 55 Price High 3 089 3 324 2 999 1 898 2 400

PER SHARE STATISTICS (cents per share) Price Low 2 426 2 371 1 550 853 1 777

HEPS-C (ZARc) 112.00 45.00 124.00 - 40.51 177.08 Price Prd End 2 650 2 868 2 799 1 550 1 840

DPS (ZARc) 50.00 30.00 60.00 60.00 30.00 RATIOS

NAV PS (ZARc) 1 515.00 1 240.00 1 947.00 1 846.09 2 186.52 Ret on SH Fnd 29.87 35.08 33.76 18.56 23.36

3 Yr Beta 0.29 - 0.16 0.21 0.27 0.54 Oper Pft Mgn 6.08 6.22 5.43 4.02 3.74

Price High 850 1 435 1 099 1 075 1 315 D:E 0.58 0.65 0.58 1.10 1.44

Price Low 600 653 751 612 825 Current Ratio 1.05 1.03 1.11 1.12 1.00

Price Prd End 763 700 951 810 950 Div Cover 1.49 1.45 1.50 1.00 4.18

RATIOS

Ret on SH Fnd 23.11 8.04 47.35 - 15.54 2.62

Oper Pft Mgn 101.54 110.29 112.68 2.38 61.44

D:E 1.30 1.80 7.28 1.70 1.19

Current Ratio 0.80 0.54 0.51 0.48 1.05

Div Cover 8.50 2.07 2.68 - 5.47 1.43

98