Page 105 - shbh24_complete

P. 105

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – DEU

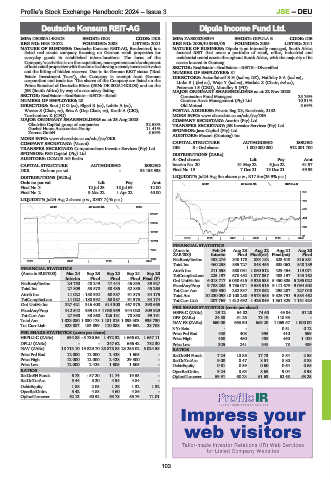

Deutsche Konsum REIT-AG Dipula Income Fund Ltd.

DEU DIP

ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR ISIN: ZAE000203394 SHORT: DIPULA B CODE: DIB

REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021 REG NO: 2005/013963/06 FOUNDED: 2005 LISTED: 2011

NATURE OF BUSINESS: Deutsche Konsum REIT-AG, Broderstorf, is a NATURE OF BUSINESS: Dipula is an internally managed, South Africa

listed real estate company focusing on German retail properties for focused REIT that owns a portfolio of retail, office, industrial and

everyday goods in established micro-locations. The focus of the residential rental assets throughout South Africa, with the majority of its

Company’s activities is on the acquisition, management and development assets located in Gauteng.

of local retail properties with the aim of achieving a steady increase in value SECTOR: RealEstate—RealEstate—REITS—Diversified

and the lifting of hidden reserves. Due to its German REIT status (‘Real NUMBER OF EMPLOYEES: 81

Estate Investment Trust’), the Company is exempt from German DIRECTORS: Azizollahoff B H (ind ne, UK), Halliday S A (ind ne),

corporation and trade tax. The shares of the Company are listed on the Links E ( (ind ne), Waja Y (ind ne), Matlala Z (Chair, ind ne),

Prime Standard of Deutsche Börse (ISIN: DE 000A14KRD3) and on the Petersen I S (CEO), Moodley S (FD)

JSE (South Africa) by way of a secondary listing. MAJOR ORDINARY SHAREHOLDERS as at 22 Nov 2023

SECTOR: RealEstate—RealEstate—REITS—Retail Coronation Fund Managers 25.76%

NUMBER OF EMPLOYEES: 20 Camissa Asset Management (Pty) Ltd. 10.31%

DIRECTORS: BootJCG(ne), Elgeti R (ne), Lubitz A (ne), Old Mutual 5.69%

Wasser S (Chair, ne), Betz A (Dep Chair, ne), Kroth A (CIO), POSTAL ADDRESS: Private Bag X3, Rosebank, 2132

Turchaninov K (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/DIB

MAJOR ORDINARY SHAREHOLDERS as at 25 Aug 2023 COMPANY SECRETARY: Acorim (Pty) Ltd.

Obotritia Capital group of companies 32.58% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Goebel Home Accessories Group 11.41% SPONSOR: Java Capital (Pty) Ltd.

Zerena GmbH 8.69%

MORE INFO: www.sharedata.co.za/sdo/jse/DKR AUDITORS: Mazars (Gauteng) Inc.

COMPANY SECRETARY: (Vacant) CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DIB B - Ord shares 1 000 000 000 912 001 700

SPONSOR: PSG Capital (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: DOMUS AG Berlin A- Ord shares Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 20 31 May 22 6 Jun 22 61.97

DKR Ords no par val - 35 155 938 Final No 19 7 Dec 21 13 Dec 21 59.93

DISTRIBUTIONS [EURc] LIQUIDITY: Jul24 Avg 5m shares p.w., R17.5m(25.9% p.a.)

Ords no par val Ldt Pay Amt REIV 40 Week MA DIPULA B

Final No 3 12 Jul 23 18 Jul 69 12.00

875

Final No 2 9 Mar 22 1 Apr 22 40.00

LIQUIDITY: Jul24 Avg 2 shares p.w., R337.7(-% p.a.) 718

REIV 40 Week MA DKR

561

31867

404

25815

248

19762

91

2019 | 2020 | 2021 | 2022 | 2023 | 2024

13710

FINANCIAL STATISTICS

7657 (Amts in Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

ZAR’000) Interim Final Final(rst) Final(rst) Final

1605 NetRent/InvInc 452 276 840 178 833 182 823 613 816 881

2021 | 2022 | 2023 | 2024

Total Inc 460 258 855 727 848 455 838 062 848 189

FINANCIAL STATISTICS Attrib Inc 211 558 588 031 1 080 512 429 454 119 071

(Amts in EUR’000) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20 TotCompIncLoss 225 197 678 452 1 077 857 483 197 143 162

Interim Final Final Final Final (P) Ord UntHs Int 6 018 717 6 050 615 5 926 588 5 450 805 5 295 022

NetRent/InvInc 24 750 48 249 47 444 45 835 39 927 FixedAss/Prop 9 788 235 9 736 071 9 586 516 9 111 679 9 094 502

Total Inc 27 809 53 570 58 435 52 885 45 263 Tot Curr Ass 389 530 282 337 275 052 298 287 227 048

Attrib Inc 11 022 - 180 992 60 387 91 373 34 175 Total Ass 10 230 098 10 108 280 9 973 558 9 526 791 9 584 462

TotCompIncLoss 11 022 - 180 992 60 387 91 373 34 174 Tot Curr Liab 207 769 1 612 692 1 426 849 1 361 829 1 131 424

Ord UntHs Int 327 421 316 400 514 300 467 975 390 665 PER SHARE STATISTICS (cents per share)

FixedAss/Prop 912 542 989 014 1 030 959 944 020 809 929 HEPS-C (ZARc) 29.12 54.82 74.60 49.84 51.28

Tot Curr Ass 27 990 33 860 126 131 78 850 99 191 DPS (ZARc) 24.58 51.26 73.19 118.95 -

Total Ass 1 023 080 1 030 178 1 181 815 1 093 303 935 730 NAV PS (ZARc) 660.00 663.50 663.20 1 069.57 1 000.00

Tot Curr Liab 323 087 183 899 110 088 59 652 28 708

3 Yr Beta - - - 0.51 0.12

PER SHARE STATISTICS (cents per share) Price Prd End 430 408 395 410 559

HEPLU-C (ZARc) 634.88 - 3 730.56 1 472.32 1 666.62 1 657.11 Price High 450 450 489 450 1 100

DPLU (ZARc) - - 247.62 666.42 732.30 Price Low 325 241 348 78 489

NAV (ZARc) 18 713.10 19 829.70 25 878.88 23 255.02 5 024.58 RATIOS

Price Prd End 12 000 12 000 2 428 1 605 - RetOnSH Funds 7.24 10.86 17.73 8.54 2.58

Price High 12 000 12 000 2 428 29 300 - RetOnTotAss 9.00 8.47 8.51 8.80 8.88

Price Low 12 000 2 428 1 605 1 605 - Debt:Equity 0.61 0.59 0.60 0.64 0.68

RATIOS OperRetOnInv 9.24 8.63 8.69 9.04 8.98

RetOnSH Funds 6.73 - 57.20 11.74 19.53 - OpInc:Turnover 59.91 60.23 61.63 62.68 63.25

RetOnTotAss 5.44 5.20 4.94 4.84 -

Debt:Equity 1.88 2.05 1.26 1.32 1.32

OperRetOnInv 5.42 4.88 4.60 4.86 -

OpInc:Turnover 62.13 60.52 63.78 65.79 71.01

103