Page 104 - shbh24_complete

P. 104

JSE – DEL Profile’s Stock Exchange Handbook: 2024 – Issue 3

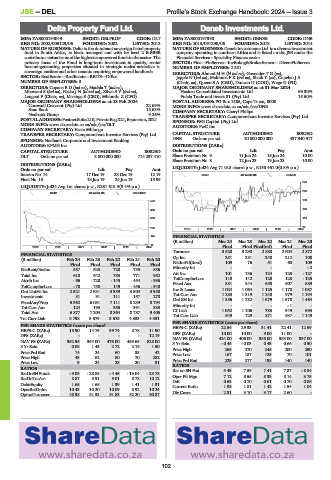

Delta Property Fund Ltd. Deneb Investments Ltd.

DEL DEN

ISIN: ZAE000194049 SHORT: DELPROP CODE: DLT ISIN: ZAE000197398 SHORT: DENEB CODE: DNB

REG NO: 2002/005129/06 FOUNDED: 2002 LISTED: 2012 REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014

NATURE OF BUSINESS: Delta is the dominant sovereign listed property NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment

fund in South Africa, is black managed and with its level 2 B-BBEE company operating in southern Africa and is listed on the JSE under the

contributor statusisoneofthe highest empoweredfundsinthe sector.The Financial Services - Speciality Finance sector.

primary focus of the Fund is long-term investment in quality, rental SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

income-generating properties situated in strategic nodes attractive to NUMBER OF EMPLOYEES: 2 581

sovereign entities and other tenants requiring empowered landlords. DIRECTORS: AhmedMH(ld ind ne), GovenderTG(ne),

SECTOR: RealEstate—RealEstate—REITS—Office Jappie N (ind ne), MahlomaFK(ind ne), Shaik Y (ne), Copelyn J A

NUMBER OF EMPLOYEES: 0 (Chair, ne), Queen S A (CEO), Duncan D (COO), Wege G (FD)

DIRECTORS: CopansBD(ind ne), Matlala T (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

Mboweni S (ind ne), NjekeJN(ld ind ne), ZilwaSV(ind ne), Hosken Consolidated Investments Ltd. 69.30%

Langeni P (Chair, ne), Masinga S (CEO), Mhlontlo Z (CFO) Fulela Trade and Invest 81 (Pty) Ltd. 15.50%

MAJOR ORDINARY SHAREHOLDERS as at 23 Feb 2024 POSTAL ADDRESS: PO Box 1585, Cape Town, 8000

Cornwall Crescent (Pty) Ltd. 22.69% MORE INFO: www.sharedata.co.za/sdo/jse/DNB

Saxo Bank 15.63% COMPANY SECRETARY: Cheryl Philips

Nedbank Group 9.26% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS:PostnetSuite210, PrivateBagX21,Bryanston,2021 SPONSOR: PSG Capital (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/DLT AUDITORS: PwC Inc.

COMPANY SECRETARY: Vasta Mhlongo

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Nedbank Corporate and Investment Banking DNB Ords no par val 10 000 000 000 437 940 917

AUDITORS: KPMG Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords no par val Ldt Pay Amt

DLT Ords no par val 3 000 000 000 714 237 410 Share Premium No 9 11 Jun 24 18 Jun 24 10.00

Share Premium No 8 12 Jun 23 19 Jun 23 10.00

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt LIQUIDITY: Jul24 Avg 71 018 shares p.w., R158 461.0(0.8% p.a.)

Interim No 14 17 Dec 19 23 Dec 19 12.19 GENF 40 Week MA DENEB

Final No 13 18 Jun 19 24 Jun 19 15.99

270

LIQUIDITY: Jul24 Avg 1m shares p.w., R261 618.9(9.4% p.a.)

230

REIV 40 Week MA DELPROP

576 190

463 150

350 110

238 70

2019 | 2020 | 2021 | 2022 | 2023 | 2024

125 FINANCIAL STATISTICS

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

12 Final Final Final(rst) Final Final

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Turnover 3 528 3 290 2 880 2 604 2 872

FINANCIAL STATISTICS Op Inc 251 281 240 212 108

(R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 NetIntPd(Rcvd) 109 76 51 60 109

Final Final Final Final Final

NetRent/InvInc 557 625 720 735 886 Minority Int - - - - - 2

Total Inc 610 642 753 771 952 Att Inc 101 136 124 125 - 127

Attrib Inc - 66 - 728 - 145 - 454 - 936 TotCompIncLoss 118 142 128 128 - 125

TotCompIncLoss - 78 - 750 149 - 456 - 940 Fixed Ass 881 844 658 607 689

Ord UntHs Int 2 521 2 631 3 359 3 504 3 958 Inv & Loans 1 024 1 064 1 125 1 178 1 087

979

Investments 81 91 111 157 278 Tot Curr Ass 1 283 1 319 1 240 1 578 1 194

1 679

1 782

1 464

Ord SH Int

1 856

FixedAss/Prop 5 362 6 081 7 111 8 239 8 794

Tot Curr Ass 124 193 355 391 333 Minority Int - - - - 1 -

Total Ass 6 877 7 204 8 364 8 787 9 405 LT Liab 1 052 1 106 783 949 693

Tot Curr Liab 3 798 3 579 3 575 4 333 4 331 Tot Curr Liab 649 729 871 637 1 149

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 22.54 29.33 31.41 22.41 12.69

HEPS-C (ZARc) 15.90 14.75 39.74 8.78 11.90

DPS (ZARc) - - - - 12.19 DPS (ZARc) 10.00 10.00 9.00 11.00 -

NAV PS (ZARc) 352.96 364.00 476.00 489.65 828.00 NAV PS (ZARc) 424.00 406.00 385.00 363.00 337.00

3 Yr Beta 0.08 1.43 2.72 2.16 1.50 3 Yr Beta - 0.45 - 0.03 0.43 0.66 0.50

Price Prd End 14 24 60 35 42 Price High 265 270 245 200 250

101

167

70

125

Price Low

187

Price High 43 62 80 70 282

Price Low 9 24 28 20 31 Price Prd End 229 217 198 140 140

RATIOS RATIOS

RetOnSH Funds - 3.08 - 28.85 - 4.45 - 13.04 - 23.78 Ret on SH Fnd 5.43 7.59 7.41 7.87 - 8.84

RetOnTotAss 8.87 8.91 9.01 8.78 10.12 Oper Pft Mgn 7.12 8.55 8.33 8.14 3.75

0.70

0.63

D:E

0.70

0.86

0.61

Debt:Equity 1.65 1.66 1.39 1.41 1.31

OperRetOnInv 10.43 10.20 10.09 8.92 10.24 Current Ratio 1.98 1.81 1.42 1.54 1.04

OpInc:Turnover 48.98 51.33 51.83 52.20 60.87 Div Cover 2.31 3.10 3.17 2.60 -

102