Page 99 - shbh24_complete

P. 99

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – CLI

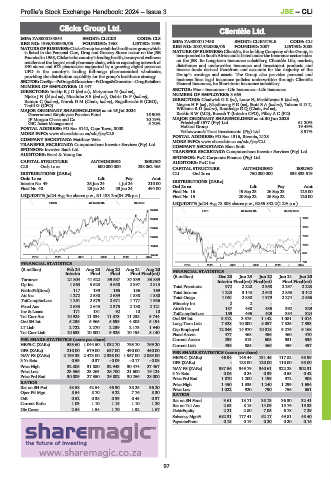

Clicks Group Ltd. Clientèle Ltd.

CLI

ISIN: ZAE000134854 SHORT: CLICKS CODE: CLS CLI

REG NO: 1996/000645/06 FOUNDED: 1968 LISTED: 1996 ISIN: ZAE000117438 SHORT: CLIENTELE CODE: CLI

NATUREOFBUSINESS: ClicksGroupisaretail-ledhealthcaregroupwhich REG NO: 2007/023806/06 FOUNDED: 2007 LISTED: 2008

is listed in the Personal Care, Drug and Grocery Stores sector on the JSE. NATURE OF BUSINESS: Clientèle, the holding Company of the Group, is

Foundedin1968,Clicksisthecountry’sleadinghealth,beautyandwellness incorporated in South Africa and is listed under the Insurance sector index

retailer and the largest retail pharmacy chain, with an expanding network of on the JSE. Its Long-term insurance subsidiary, Clientèle Life, markets,

840 stores and 673 pharmacies supported by a growing digital presence. distributes and underwrites insurance and investment products and

UPD is the country’s leading full-range pharmaceutical wholesaler, invests funds derived therefrom and accounts for the majority of the

providing the distribution capability for the group’s healthcare strategy. Group’s earnings and assets. The Group also provides personal and

SECTOR:CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—DrugRetailers business lines legal insurance policies underwritten through Clientèle

General Insurance, its Short-term insurance subsidiary.

NUMBER OF EMPLOYEES: 18 447 SECTOR: Fins—Insurance—Life Insurance—Life Insurance

DIRECTORS: Inskip R J D (ind ne), Matyumza N (ind ne), NUMBER OF EMPLOYEES: 3 663

Njeke J N (ld ind ne), NtsalubaSS(ind ne), Osiris Dr P (ind ne),

Ramon C (ind ne), Nurek D M (Chair, ind ne), Engelbrecht B (CEO), DIRECTORS: ChadwickGK(ne), Louw H, Mashilwane E (ind ne),

Traill G (CFO) MayersHP(ne), NkadimengPG(ne), StottBA(ind ne), TabaneRDT,

MAJOR ORDINARY SHAREHOLDERS as at 15 Jul 2024 WilliamsRD(ind ne), Routledge G Q (Chair, ind ne),

Government Employees Pension Fund 16.90% Reekie B W (MD), Boesch T (Interim CFO), Pillay A C (FD)

JP Morgan Chase and Co 10.19% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

GIC Asset Management 5.70% Friedshelf 1577 (Pty) Ltd. 61.20%

POSTAL ADDRESS: PO Box 5142, Cape Town, 8000 Hollard Group 19.49%

8.97%

Yellowwoods Trust Investments (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/CLS POSTAL ADDRESS: PO Box 1316, Rivonia, 2128

COMPANY SECRETARY: Matthew Welz MORE INFO: www.sharedata.co.za/sdo/jse/CLI

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Eben Smit

SPONSOR: Investec Bank Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc.

SPONSOR: PwC Corporate Finance (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: PwC Inc.

CLS Ords 1c ea 600 000 000 238 062 465

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] CLI Ord 2c ea 750 000 000 335 333 619

Ords 1c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim No 49 25 Jun 24 1 Jul 24 210.00 Ord2cea Ldt Pay Amt

Final No 48 23 Jan 24 29 Jan 24 494.00

Final No 16 19 Sep 23 26 Sep 23 125.00

LIQUIDITY: Jul24 Avg 4m shares p.w., R1 133.7m(84.2% p.a.) Final No 15 20 Sep 22 26 Sep 22 120.00

FOOR 40 Week MA CLICKS LIQUIDITY: Jul24 Avg 78 808 shares p.w., R855 842.2(1.2% p.a.)

34456 LIFE 40 Week MA CLIENTELE

1885

30466

1658

26475

1432

22485

1206

18494

979

14504

2019 | 2020 | 2021 | 2022 | 2023 | 2024

753

FINANCIAL STATISTICS 2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20 FINANCIAL STATISTICS

Interim Final Final Final Final(rst)

Jun 23

Jun 22

Dec 23

Turnover 21 804 41 622 39 587 37 339 33 889 (R million) Interim Final(rst) Final(rst) Jun 21 Jun 20

Final Final(rst)

Op Inc 1 863 3 623 3 650 2 897 2 813

Total Premiums 972 2 220 2 358 2 297 2 223

NetIntPd(Rcvd) 117 139 165 186 169 Total Income 1 223 3 143 2 640 2 853 3 142

Att Inc 1 272 2 538 2 639 1 838 1 880 Total Outgo 1 061 2 888 1 979 2 274 2 686

TotCompIncLoss 1 291 2 579 2 671 1 777 1 936 Minority Int 2 2 - - -

Fixed Ass 2 633 2 643 2 375 2 138 2 121 Attrib Inc 157 488 435 392 329

Inv & Loans 171 131 92 10 10 TotCompIncLoss 159 495 429 384 324

Tot Curr Ass 10 924 11 834 11 373 11 238 9 744 Ord SH Int 3 312 3 575 1 142 1 081 1 014

Ord SH Int 5 236 5 965 5 699 4 805 5 194 Long-Term Liab 7 328 10 000 8 057 7 325 7 393

LT Liab 2 722 2 270 2 239 2 173 1 940 Cap Employed 12 046 14 970 10 018 9 276 9 168

Tot Curr Liab 10 633 10 800 9 926 10 195 8 140

Fixed Assets 477 468 456 460 470

PER SHARE STATISTICS (cents per share) Current Assets 299 313 605 531 536

HEPS-C (ZARc) 533.60 1 044.50 1 032.70 793.70 769.20 Current Liab 436 585 460 459 457

DPS (ZARc) 210.00 679.00 637.00 490.00 450.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 2 199.33 2 473.00 2 336.00 1 957.00 2 089.00 HEPS-C (ZARc) 46.94 145.44 131.45 117.82 98.99

3 Yr Beta 0.59 0.37 - 0.09 - 0.17 - 0.08 DPS (ZARc) - 125.00 120.00 110.00 95.00

Price High 32 805 31 880 32 943 30 474 27 467 NAV PS (ZARc) 987.56 349.79 340.61 322.28 302.31

Price Low 23 556 23 263 26 700 21 600 19 124 3 Yr Beta 0.06 0.24 0.39 0.55 0.42

Price Prd End 30 009 27 350 29 802 30 256 23 000 Price Prd End 1 070 1 200 1 199 972 908

RATIOS Price High 1 450 1 335 1 240 1 299 1 694

Ret on SH Fnd 48.58 42.54 46.30 38.25 36.20 Price Low 1 022 920 790 756 651

Oper Pft Mgn 8.54 8.70 9.22 7.76 8.30 RATIOS

D:E 0.52 0.38 0.39 0.45 0.37 Ret on SH Fund 9.61 13.71 38.13 36.30 32.41

Current Ratio 1.03 1.10 1.15 1.10 1.20

Ret on Tot Ass 2.63 8.15 14.09 15.76 19.33

Div Cover 2.54 1.54 1.70 1.52 1.67

Debt:Equity 2.21 2.80 7.05 6.78 7.29

Solvency Mgn% 682.31 177.41 52.17 49.81 48.40

Payouts:Prem 0.15 0.19 0.20 0.20 0.16

97