Page 106 - shbh24_complete

P. 106

JSE – DIS Profile’s Stock Exchange Handbook: 2024 – Issue 3

Dis-Chem Pharmacies Ltd. Discovery Ltd.

DIS DIS

ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP ISIN: ZAE000022331 SHORT: DISCOVERY CODE: DSY

REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016 ISIN: ZAE000158564 SHORT: DSY B PREF CODE: DSBP

NATURE OF BUSINESS: Dis-Chem is a leading retail pharmacy group in REG NO: 1999/007789/06 FOUNDED: 1992 LISTED: 1999

South Africa with its head office based in Midrand, Gauteng. The Group NATURE OF BUSINESS: Discovery is a South African-founded diversified

was co-founded in 1978 by pharmacists husband and wife Ivan and Lynette financial services organisation that operates in health insurance, life

Saltzman and follows a “Pharmacy First” approach. insurance,long-termsavingsandinvestments,short-termandcommercial

SECTOR:CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—DrugRetailers insurance, banking and behaviour-change programmes.

NUMBER OF EMPLOYEES: 18 710 SECTOR: Fins—Insurance—Life Insurance—Life Insurance

DIRECTORS: Coovadia Dr A (ind ne), Goetsch S, Kobue K (ind ne), NUMBER OF EMPLOYEES: 12 980

Masondo H (ind ne), Mthimunye J (ind ne), Saltzman I L, Saltzman S E, DIRECTORS: Chiume L (ind ne), Farber R (ne), Hlahla M (ind ne),

SithebeAK(ind ne), Nestadt L M (Chair, ind ne), Morais R M (CEO), KhanyileFN(ne), Macready D (ind ne), MboweniTT(ind ne),

Pope J (CFO) Ramon C (ind ne), Schreuder M (ind ne), Swartzberg B,

MAJOR ORDINARY SHAREHOLDERS as at 31 Jan 2024 van Kralingen B (ind ne), Tucker M (Chair, ind ne), Gore A (CEO),

Coronation Asset Management (Pty) Ltd. 29.83% Viljoen D M (Group CFO)

Ivlyn Local Investment Holdings (Pty) Ltd. 29.31% MAJOR ORDINARY SHAREHOLDERS as at 12 Feb 2024

Public Investment Corporation (SOC) Ltd. 10.02% OUTsurance Group Ltd. 25.00%

POSTAL ADDRESS: Private Bag X21, Northriding, 2162 Remgro Ltd. 7.90%

MORE INFO: www.sharedata.co.za/sdo/jse/DCP Government Employees Pension Fund 7.87%

COMPANY SECRETARY: Nikki Lumley POSTAL ADDRESS: PO Box 786722, Sandton, 2146

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/DSY

SPONSOR: Standard Bank of South Africa Ltd. COMPANY SECRETARY: Ayanda Ceba

AUDITORS: Mazars Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

CAPITAL STRUCTURE AUTHORISED ISSUED

DCP Ords no par val 1 500 000 000 860 084 483 AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] DSY Ords 0.1c ea 1 000 000 000 676 374 092

Ords no par val Ldt Pay Amt DSBP B Prefs R100 ea 20 000 000 8 000 000

Final No 13 18 Jun 24 24 Jun 24 22.49

Interim No 12 21 Nov 23 27 Nov 23 23.24 DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt

LIQUIDITY: Jul24 Avg 5m shares p.w., R144.9m(30.7% p.a.)

Interim No 30 16 Apr 24 22 Apr 24 65.00

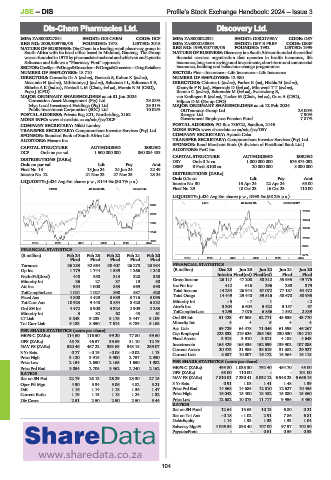

FOOR 40 Week MA DIS-CHEM Final No 29 10 Oct 23 16 Oct 23 110.00

LIQUIDITY: Jul24 Avg 8m shares p.w., R990.5m(58.2% p.a.)

LIFE 40 Week MA DISCOVERY

3537

18149

3072

15874

2607

13599

2142

11325

1677

2019 | 2020 | 2021 | 2022 | 2023 | 2024

9050

FINANCIAL STATISTICS

(R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 6775

Final Final Final Final Final 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Turnover 36 283 32 664 30 407 26 278 23 984 FINANCIAL STATISTICS

Op Inc 1 779 1 744 1 539 1 266 1 248 (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

NetIntPd(Rcvd) 440 350 313 328 380 Interim Final(rst) Final(rst) Final Final

Minority Int 36 27 37 19 30 Gross Income 26 117 47 208 58 312 55 935 49 775

Att Inc 984 1 000 853 669 598 Inc Fm Inv 412 616 296 280 379

TotCompIncLoss 1 021 1 027 890 687 628 Total Income 14 234 26 944 67 072 77 187 64 472

Fixed Ass 4 800 4 429 3 689 3 716 3 095 Total Outgo 14 449 29 440 59 516 58 670 50 935

Tot Curr Ass 10 923 9 448 8 854 8 420 6 832 Minority Int - 5 - 7 1 - - 2

Ord SH Int 4 472 3 900 3 324 2 909 2 253 Attrib Inc 3 304 6 604 5 422 3 157 97

Minority Int 3 32 62 43 61 TotCompIncLoss 4 295 7 076 6 856 1 592 2 839

LT Liab 3 843 3 233 3 175 3 447 3 109 Ord SH Int 51 423 47 605 52 771 45 636 43 770

Tot Curr Liab 9 183 8 350 7 514 6 789 5 163 Minority Int 4 4 5 4 4

Act. Liab 59 729 64 478 71 046 61 595 46 267

PER SHARE STATISTICS (cents per share) Cap Employed 223 833 219 626 255 195 230 330 194 210

HEPS-C (ZARc) 114.60 116.50 99.20 77.80 69.60 Fixed Assets 3 918 3 910 3 811 4 188 4 643

DPS (ZARc) 45.73 46.57 39.69 31.10 12.79 Investments 165 429 165 336 152 599 139 902 107 085

NAV PS (ZARc) 520.46 457.22 393.63 343.18 269.07 Current Assets 20 473 21 985 33 619 31 382 29 927

3 Yr Beta 0.77 - 0.19 - 0.08 - 0.02 1.13 Current Liab 8 387 10 007 16 172 16 364 16 118

Price High 3 120 3 915 3 900 2 757 2 930

Price Low 2 154 2 650 2 165 1 650 1 982 PER SHARE STATISTICS (cents per share)

Price Prd End 3 054 2 705 3 462 2 240 2 162 HEPS-C (ZARc) 493.80 1 035.30 792.40 454.70 45.00

RATIOS DPS (ZARc) 65.00 110.00 - - 101.00

Ret on SH Fnd 22.79 26.13 26.29 23.30 27.15 NAV PS (ZARc) 7 810.01 7 230.41 8 032.12 6 948.23 6 666.16

3 Yr Beta 0.91 1.08 1.41 1.48 1.39

Oper Pft Mgn 4.90 5.34 5.06 4.82 5.21

D:E 1.16 1.14 1.18 1.36 1.47 Price Prd End 14 368 14 585 12 810 12 627 10 455

Current Ratio 1.19 1.13 1.18 1.24 1.32 Price High 16 042 15 400 18 482 15 880 15 360

Div Cover 2.51 2.50 2.50 2.50 5.44 Price Low 12 682 10 073 11 717 9 956 5 450

RATIOS

Ret on SH Fund 12.64 13.63 10.13 6.80 0.21

Ret on Tot Ass - 0.18 - 1.02 2.91 7.86 6.81

Debt:Equity 1.14 1.33 1.33 1.33 1.04

Solvency Mgn% 4 086.58 898.40 107.00 97.97 102.50

Payouts:Prem - - 0.61 0.59 0.53

104