Page 86 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 86

JSE - AYO Profile’s Stock Exchange Handbook: 2025 - Issue 3

AYO Technology Solutions Ltd. Balwin Properties Ltd.

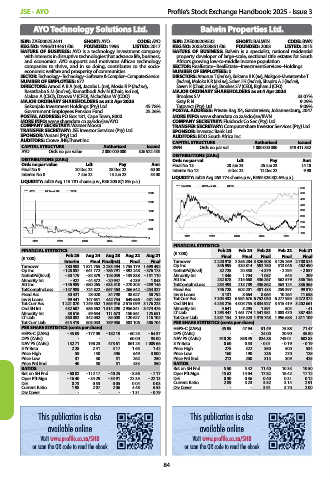

ISIN: ZAE000252441 SHORT: AYO CODE: AYO ISIN: ZAE000209532 SHORT: BALWIN CODE: BWN

REG NO: 1996/014461/06 FOUNDED: 1996 LISTED: 2017 REG NO: 2003/028851/06 FOUNDED: 2003 LISTED: 2015

NATURE OF BUSINESS: AYO is a technology investment company NATURE OF BUSINESS: Balwin is a specialist, national residential

with interests in disruptive technologies that advance life, business, property developer of large-scale, sectional title estates for South

and economics. AYO supports and motivates African technology Africa’s growing low-to-middle income population.

companies to thrive, and in so doing, contributes to the socio- SECTOR: RealEstate--RealEstate--InvestmentServices--Holdings

economic welfare and prosperity of communities. NUMBER OF EMPLOYEES: 0

SECTOR: Technology--Technology--Software & CompSer--ComputerService DIRECTORS: Amosun T (ind ne), Kukama R K (ne), Mokgosi-Mwantembe T

NUMBER OF EMPLOYEES: 677 (ind ne), Moloko K R (ind ne), Scher J H (ind ne), Shapiro A J (ind ne),

DIRECTORS: Amod A B A (ne), Jacobs L (ne), Mosia R P (ind ne), Saven H (Chair, ind ne), Brookes S V (CEO), Bigham J (CFO)

Rasethaba S M (ind ne), Ramatlhodi Adv N (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 4 Apr 2025

Makan A (CEO), Dzvova V (CFO), Mclachlan W (COO) Brookes S V 33.07%

MAJOR ORDINARY SHAREHOLDERS as at 3 Apr 2025 Gray R N 9.29%

Sekunjalo Investment Holdings (Pty) Ltd. 45.78% Tatovect (Pty) Ltd. 9.09%

Government Employees Pension Fund 25.26% POSTAL ADDRESS: Private Bag X4, Gardenview, Johannesburg, 2047

POSTAL ADDRESS: PO Box 181, Cape Town, 8000 MORE INFO: www.sharedata.co.za/sdo/jse/BWN

MORE INFO: www.sharedata.co.za/sdo/jse/AYO COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd.

COMPANY SECRETARY: Wazeer Moosa TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. SPONSOR: Investec Bank Ltd.

SPONSOR: Vunani (Pty) Ltd. AUDITORS: BDO South Africa Inc.

AUDITORS: Crowe JHB,Thawt Inc. CAPITAL STRUCTURE Authorised Issued

CAPITAL STRUCTURE Authorised Issued BWN Ords no par val 1 000 000 000 519 411 852

AYO Ords no par value 2 000 000 000 326 922 438

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords no par val Ldt Pay Amt

Ords no par value Ldt Pay Amt Final No 13 20 Jun 23 26 Jun 23 14.10

Final No 9 20 Dec 22 28 Dec 22 60.00 Interim No 12 6 Dec 22 12 Dec 22 9.90

Interim No 8 7 Jun 22 13 Jun 22 35.00 LIQUIDITY: Jul25 Avg 263 774 shares p.w., R559 325.5(2.6% p.a.)

LIQUIDITY: Jul25 Avg 115 781 shares p.w., R56 205.8(1.8% p.a.)

BALWIN 40 Week MA REDS

550

AYO 40 Week MA TECH

2500 500

450

2000

400

1500 350

300

1000

250

200

500

150

2021 2022 2023 2024 2025

0

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R ’000) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R ’000) Feb 25 Aug 24 Aug 23 Aug 22 Aug 21 Final Final Final Final Final

Interim Final Final(rst) Final Final Turnover 2 220 918 2 356 284 3 326 908 3 125 269 2 700 574

Turnover 780 983 1 871 765 2 253 494 1 755 179 1 699 492 Op Inc 346 995 330 814 592 750 513 046 462 450

Op Inc - 128 057 - 641 772 - 786 791 - 392 248 - 376 173 NetIntPd(Rcvd) 32 725 20 558 - 4 379 - 2 294 - 2 857

NetIntPd(Rcvd) - 30 179 - 82 579 - 128 059 - 133 838 - 151 110 Minority Int 1 346 1 704 1 087 545 209

Minority Int - 427 - 44 572 - 20 947 4 239 1 043 Att Inc 232 678 215 668 436 267 362 579 336 156

Att Inc - 146 989 - 680 265 - 633 510 - 270 303 - 259 146 TotCompIncLoss 234 493 218 789 436 862 363 124 336 365

TotCompIncLoss - 147 989 - 724 822 - 657 463 - 266 542 - 254 327 Fixed Ass 746 728 602 201 481 433 259 397 99 810

Fixed Ass 30 421 28 020 34 798 38 627 50 792 Inv & Loans 3 131 8 664 8 664 10 264 11 658

Inv & Loans 99 441 147 651 442 754 649 656 431 749 Tot Curr Ass 7 304 432 6 984 676 6 752 030 6 277 985 5 272 372

Tot Curr Ass 1 221 070 1 249 362 1 565 916 2 615 099 3 176 223 Ord SH Int 4 253 216 4 005 755 3 834 927 3 515 419 3 202 661

Ord SH Int 432 607 586 562 1 514 298 2 956 841 3 474 476 Minority Int 4 641 3 295 1 591 504 - 41

Minority Int 58 616 59 634 111 673 150 561 125 651 LT Liab 1 295 447 1 461 774 1 541 981 1 083 470 387 434

LT Liab 360 082 342 082 85 008 120 627 116 102 Tot Curr Liab 2 531 154 2 159 523 1 919 748 1 996 588 1 811 109

Tot Curr Liab 615 419 603 033 759 986 583 106 486 704 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 45.95 47.94 91.49 75.88 71.47

HEPS-C (ZARc) - 45.09 - 177.09 - 182.19 - 60.25 - 64.37 DPS (ZARc) - - 24.00 20.90 35.80

DPS (ZARc) - - - 60.00 95.00 NAV PS (ZARc) 910.20 858.49 824.38 749.01 682.83

NAV PS (ZARc) 132.71 198.23 473.61 861.25 1 009.66 3 Yr Beta 0.60 0.53 - 0.01 - 0.19 - 0.19

3 Yr Beta 2.28 2.41 4.17 1.65 1.42 Price High 275 322 350 500 534

Price High 59 150 496 649 3 000 Price Low 160 190 236 270 128

Price Low 37 30 51 262 250 Price Prd End 212 200 315 309 425

Price Prd End 40 50 51 433 350 RATIOS

RATIOS Ret on SH Fnd 5.50 5.42 11.40 10.33 10.50

Ret on SH Fnd - 60.02 - 112.17 - 40.25 - 8.56 - 7.17 Oper Pft Mgn 15.62 14.04 17.82 16.42 17.12

Oper Pft Mgn - 16.40 - 34.29 - 34.91 - 22.35 - 22.13 D:E 0.30 0.36 0.40 0.31 0.12

D:E 0.73 0.53 0.05 0.04 0.03 Current Ratio 2.89 3.23 3.52 3.14 2.91

Current Ratio 1.98 2.07 2.06 4.48 6.53 Div Cover - - 3.91 3.70 2.00

Div Cover - - - - 1.31 - 0.79

This publication is also This publication is also

available online available online

Visit www.profile.co.za/SHB Visit www.profile.co.za/SHB

or scan the QR code to read the ebook or scan the QR code to read the ebook

84