Page 85 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 85

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - AVE

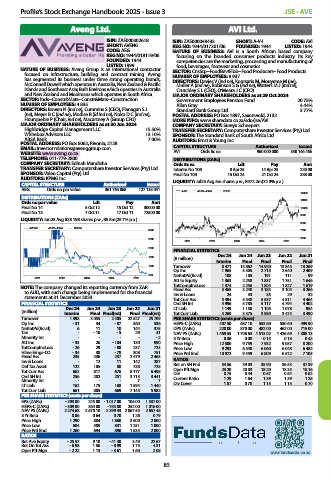

Aveng Ltd. AVI Ltd.

ISIN: ZAE000302618 ISIN: ZAE000049433 SHORT: A-V-I CODE: AVI

SHORT: AVENG REG NO: 1944/017201/06 FOUNDED: 1944 LISTED: 1944

CODE: AEG NATURE OF BUSINESS: AVI is a South African based company

REG NO: 1944/018119/06 focusing on the branded consumer products industry. Its key

FOUNDED: 1944 competencies are the marketing, processing and manufacturing of

LISTED: 1999 food, beverages, footwear and cosmetics.

NATURE OF BUSINESS: Aveng Group is an international contractor SECTOR: CnsStp--FoodBev&Tob--Food Producers--Food Products

focused on infrastructure, building and contract mining. Aveng NUMBER OF EMPLOYEES: 8 937

has segmented its business under three strong operating brands, DIRECTORS: Davies V (ind ne), Koursaris M, Mouyeme M (ne),

McConnell Dowell which operates in Australia, New Zealand & Pacific Muller A (ind ne), Robinson S G (ind ne), Watters M J (ind ne),

Islands and Southeast Asia; Built Environs which operates in Australia Crutchley S L (CEO), O’Meara J C (CFO)

and New Zealand and Moolmans which operates in South Africa. MAJOR ORDINARY SHAREHOLDERS as at 29 Oct 2024

SECTOR: Inds--Constr&Mats--Constr&Mats--Construction Government Employees Pension Fund 20.75%

NUMBER OF EMPLOYEES: 4 835 Allan Gray 4.44%

DIRECTORS: Bowen N (ind ne), Cummins S (CEO), Flanagan S J Standard Bank Group Ltd. 3.77%

(ne), Meyer B C (ind ne), Modise B (ld ind ne), Noko D C (ind ne), POSTAL ADDRESS: PO Box 1897, Saxonwold, 2132

Hourquebie P (Chair, ind ne), Macartney A (Group CFO) MORE INFO: www.sharedata.co.za/sdo/jse/AVI

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 COMPANY SECRETARY: Sureya Scheepers

Highbridge Capital Management LLC 15.50% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Whitebox Advisors LLC 13.10% SPONSOR: The Standard Bank of South Africa Ltd.

ABSA Bank 7.00% AUDITORS: Ernst & Young Inc.

POSTAL ADDRESS: PO Box 6062, Rivonia, 2128

EMAIL: Investor.relations@avenggroup.com CAPITAL STRUCTURE Authorised Issued

WEBSITE: www.aveng.co.za AVI Ords 5c ea 960 000 000 340 146 466

TELEPHONE: 011-779-2800 DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Edinah Mandizha Ords 5c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 106 8 Apr 25 14 Apr 25 220.00

SPONSOR: Valeo Capital (Pty) Ltd. Final No 104 15 Oct 24 21 Oct 24 388.00

AUDITORS: KPMG Inc.

CAPITAL STRUCTURE Authorised Issued LIQUIDITY: Jul25 Avg 5m shares p.w., R472.2m(72.9% p.a.)

AEG Ords no par value 361 764 068 127 135 041 A-V-I 40 Week MA FOOD

12000

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 11000

Final No 14 5 Oct 12 15 Oct 12 30000.00 10000

Final No 13 7 Oct 11 17 Oct 11 72500.00

9000

LIQUIDITY: Jun25 Avg 628 198 shares p.w., R5.5m(25.7% p.a.)

8000

AVENG 40 Week MA CONM

3000 7000

6000

2500

2021 2022 2023 2024 2025

2000

FINANCIAL STATISTICS

1500 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Interim Final Final Final Final

1000 Turnover 8 471 15 862 14 920 13 845 13 269

Op Inc 1 965 3 305 2 715 2 540 2 409

500 NetIntPd(Rcvd) 108 185 191 111 99

2021 2022 2023 2024 2025

Att to Equity 1 363 2 258 1 837 1 751 1 646

NOTE: The company changed its reporting currency from ZAR TotCompIncLoss 1 374 2 256 1 804 1 827 1 619

to AUD, with such change being implemented for the financial Fixed Ass 3 465 3 248 3 184 3 105 3 266

29

35

Inv & Loans

32

33

24

statements at 31 December 2023. Tot Curr Ass 5 494 5 548 5 537 4 811 4 464

FINANCIAL STATISTICS Ord SH Int 4 996 5 785 5 117 4 794 4 402

(million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 LT Liab 1 149 1 150 1 105 1 078 954

Interim Final Final(rst) Final Final(rst) Tot Curr Liab 4 269 3 375 3 980 3 473 3 490

Turnover 1 398 3 055 2 405 22 527 25 709 PER SHARE STATISTICS (cents per share)

Op Inc - 31 34 - 87 360 536 HEPS-C (ZARc) 407.50 687.10 553.60 530.60 499.90

NetIntPd(Rcvd) 6 11 10 144 375 DPS (ZARc) 220.00 870.00 482.00 462.00 715.00

Tax - - 10 - 5 29 41 NAV PS (ZARc) 1 469.55 1 706.63 1 513.02 1 426.69 1 308.13

Minority Int - - - - - 2 3 Yr Beta 0.36 0.08 - 0.15 0.18 0.42

Att Inc - 33 26 - 104 130 990 Price High 12 500 9 759 7 932 9 057 8 200

TotCompIncLoss - 26 29 - 80 237 723 Price Low 9 293 6 540 6 060 6 048 6 482

Hline Erngs-CO - 34 38 - 78 308 751 Price Prd End 10 972 9 459 6 809 6 572 7 105

Fixed Ass 235 236 237 2 479 2 463 RATIOS

Inv & Loans - 12 11 142 287

Def Tax Asset 122 105 80 738 725 Ret on SH Fnd 54.56 39.03 35.90 36.53 37.39

18.16

18.35

18.20

23.20

Oper Pft Mgn

20.83

Tot Curr Ass 662 817 676 8 177 6 495 D:E 0.75 0.44 0.57 0.54 0.62

Ord SH Int 256 282 251 3 713 3 441 Current Ratio 1.29 1.64 1.39 1.39 1.28

Minority Int - - - 7 7 Div Cover 1.87 0.78 1.15 1.15 0.70

LT Liab 162 175 168 1 594 1 440

Tot Curr Liab 661 805 669 7 145 5 982

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 293.00 245.00 - 1 017.00 106.00 1 337.00

HEPS-C (ZARc) - 309.00 364.00 - 753.00 252.00 1 016.00

NAV PS (ZARc) 2 274.68 2 670.10 2 399.43 2 867.55 2 657.48

3 Yr Beta 0.86 0.64 0.70 1.26 0.79

Price High 1 290 884 1 860 3 500 2 000

Price Low 684 505 841 1 251 1 000

Price Prd End 1 260 694 890 1 535 2 000

RATIOS

Ret Ave Equity - 25.57 9.10 - 41.40 3.49 22.67

Ret On Tot Ass - 6.98 1.86 - 8.99 1.75 4.31

Oper Pft Mgn - 2.22 1.13 - 3.61 1.60 2.08 www.fundsdata.co.za

83