Page 82 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 82

JSE - ASC Profile’s Stock Exchange Handbook: 2025 - Issue 3

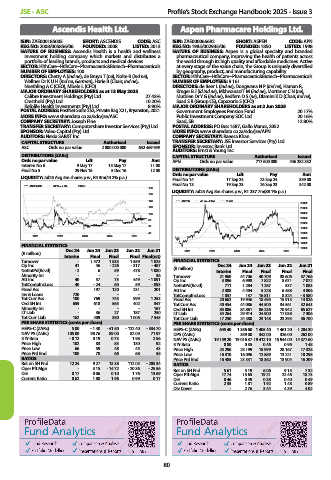

Ascendis Health Ltd. Aspen Pharmacare Holdings Ltd.

ISIN: ZAE000185005 SHORT: ASCENDIS CODE: ASC ISIN: ZAE000066692 SHORT: ASPEN CODE: APN

REG NO: 2008/005856/06 FOUNDED: 2008 LISTED: 2013 REG NO: 1985/002935/06 FOUNDED: 1850 LISTED: 1998

NATURE OF BUSINESS: Ascendis Health is a health and wellness NATURE OF BUSINESS: Aspen is a global specialty and branded

investment holding company which markets and distributes a pharmaceutical company, improving the health of patients across

portfolio of leading brands, products and medical devices. the world through its high quality and affordable medicines. Active

SECTOR: HlthCare--HtlhCare--Pharmaceutic&Biotech--Pharmaceuticals at every stage of the value chain, the Group is uniquely diversified

NUMBER OF EMPLOYEES: 100 by geography, product, and manufacturing capability.

DIRECTORS: Chetty A (ind ne), de Bruyn T (ne), Nolte R (ind ne), SECTOR: HlthCare--HtlhCare--Pharmaceutic&Biotech--Pharmaceuticals

Wellner Dr K U H (ind ne, German), Harie B (Chair, ind ne), NUMBER OF EMPLOYEES: 9 161

Neethling A C (CEO), Mbele L (CFO) DIRECTORS: de Beer L (ind ne), Dongwana N P (ind ne), Haman R,

MAJOR ORDINARY SHAREHOLDERS as at 13 May 2025 Kruger B J (ld ind ne), Mkhwanazi T M (ind ne), Mortimer C N (ne),

Calibre Investment Holdings (Pty) Ltd. 27.43% Muthien Dr Y G (ind ne), Redfern D S (ne), Dlamini K D (Chair, ind ne),

Cresthold (Pty) Ltd. 10.20% Saad S B (Group CE), Capazorio S (CFO)

Kefolile Health Investments (Pty) Ltd. 8.90% MAJOR ORDINARY SHAREHOLDERS as at 2 Jun 2025

POSTAL ADDRESS: PostNet Suite 252, Private Bag X21, Bryanston, 2021 Government Employees Pension Fund 20.17%

MORE INFO: www.sharedata.co.za/sdo/jse/ASC Public Investment Company SOC Ltd. 20.16%

COMPANY SECRETARY: Joseph Fine Saad, SB 12.80%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 1587, Gallo Manor, 2052

SPONSOR: Valeo Capital (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/APN

AUDITORS: Nexia SAB&T Inc. COMPANY SECRETARY: Raeesa Khan

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

ASC Ords no par value 2 000 000 000 632 469 959 SPONSOR: Investec Bank Ltd.

AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE Authorised Issued

Ords no par value Ldt Pay Amt APN Ords no par value 717 600 000 446 252 332

Interim No 6 9 May 17 15 May 17 11.00

Final No 5 29 Nov 16 5 Dec 16 12.00 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul25 Avg 5m shares p.w., R4.3m(44.2% p.a.) Ords no par value Ldt Pay Amt

Final No 14 17 Sep 24 23 Sep 24 359.00

ASCENDIS 40 Week MA PHAR Final No 13 19 Sep 23 26 Sep 23 342.00

180

LIQUIDITY: Jul25 Avg 8m shares p.w., R1 237.7m(88.1% p.a.)

160

140 ASPEN 40 Week MA PHAR

28000

120 26000

24000

100

22000

80

20000

60

18000

40 16000

2021 2022 2023 2024 2025

14000

12000

FINANCIAL STATISTICS 10000

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 2021 2022 2023 2024 2025

Interim Final Final Final Final(rst)

Turnover - 1 472 1 535 1 559 1 825 FINANCIAL STATISTICS

Op Inc 41 46 - 226 - 317 - 467 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

NetIntPd(Rcvd) - 2 6 59 478 1 080 Interim Final Final Final Final

Minority Int - - - - 36 Turnover 21 960 44 706 40 709 38 606 37 766

Att Inc 40 57 75 449 - 1 091 Op Inc 3 896 6 998 7 822 8 671 7 072

TotCompIncLoss 40 - 24 60 59 - 893 NetIntPd(Rcvd) 711 1 284 1 267 537 1 083

Fixed Ass - 197 120 231 201 Att Inc 2 388 4 404 5 228 6 488 4 806

Inv & Loans 720 - - - - TotCompIncLoss 1 857 137 16 811 8 324 - 3 580

Tot Curr Ass 100 769 745 999 1 253 Fixed Ass 20 662 19 946 18 495 15 913 14 826

Ord SH Int 659 618 563 402 347 Tot Curr Ass 40 454 44 086 44 500 34 561 32 643

Minority Int - - - - 167 Ord SH Int 85 086 84 861 86 236 70 942 65 627

LT Liab - 36 27 187 250 LT Liab 34 264 29 914 24 900 17 038 7 306

Tot Curr Liab 162 409 380 1 006 7 545 Tot Curr Liab 17 250 24 380 23 148 23 395 36 700

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 5.00 - 1.40 - 41.50 - 122.40 - 334.70 HEPS-C (ZARc) 645.40 1 356.60 1 405.40 1 461.20 1 204.30

NAV PS (ZARc) 105.00 98.76 89.00 82.09 71.97 DPS (ZARc) - 359.00 342.00 326.00 262.00

3 Yr Beta - 0.12 0.19 0.73 1.98 2.56 NAV PS (ZARc) 19 159.20 19 016.37 19 412.10 15 944.00 14 377.60

Price High 102 83 83 130 92 3 Yr Beta 0.80 0.35 0.46 0.96 1.48

Price Low 66 59 48 45 43 Price High 25 296 25 199 18 999 28 167 17 328

Price Prd End 100 78 66 68 58 Price Low 16 310 16 096 12 889 13 221 10 298

RATIOS Price Prd End 16 485 23 331 18 362 13 904 16 209

Ret on SH Fnd 12.24 9.27 13.38 112.03 - 205.34 RATIOS

Oper Pft Mgn - 3.15 - 14.72 - 20.36 - 25.56 Ret on SH Fnd 5.61 5.19 6.06 9.15 7.32

D:E 0.17 0.06 0.10 1.76 13.69 Oper Pft Mgn 17.74 15.65 19.21 22.46 18.73

Current Ratio 0.62 1.88 1.96 0.99 0.17 D:E 0.46 0.49 0.38 0.40 0.49

Current Ratio 2.35 1.81 1.92 1.48 0.89

Div Cover - 2.76 3.44 4.39 4.02

80