Page 87 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 87

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - BAR

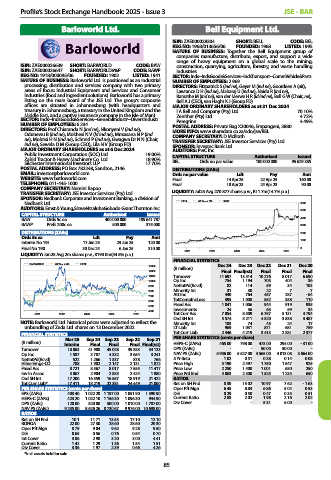

Barloworld Ltd. Bell Equipment Ltd.

ISIN: ZAE000028304 SHORT: BELL CODE: BEL

REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995

NATURE OF BUSINESS: Together the Bell Equipment group of

companies manufacture, distribute, export, and support a wide

range of heavy equipment on a global scale to the mining,

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW construction, quarrying, agriculture, forestry, and waste handling

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP industries.

REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941 SECTOR: Inds--IndsGoods&Services--IndsTransport--CommVehicle&Parts

NATURE OF BUSINESS: Barloworld Ltd. is positioned as an industrial NUMBER OF EMPLOYEES: 2 969

processing, distribution and services company with two primary DIRECTORS: Fitzpatrick S (ind ne), Geyer M (ind ne), Goordeen A (alt),

areas of focus: Industrial Equipment and Services and Consumer Lawrance D H (ind ne), Maharaj U (ind ne), Naidu R (ind ne),

Industries (food and ingredient solutions). Barloworld has a primary Ramathe M (ind ne), van der Merwe H R (ld ind ne), Bell G W (Chair, ne),

listing on the main board of the JSE Ltd. The group’s corporate Bell A J (CEO), van Haght K J (Group FD)

offices are situated in Johannesburg (with headquarters and MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

treasury in Johannesburg, a treasury in the United Kingdom and the I A Bell and Company (Pty) Ltd. 70.10%

Middle East, and a captive insurance company in the Isle of Man). Zenithar (Pty) Ltd. 4.72%

SECTOR: Inds--IndsGoods&Services--GeneralIndustr--DiversIndustr Peregrine 4.49%

NUMBER OF EMPLOYEES: 6 234 POSTAL ADDRESS: Private Bag X20046, Empangeni, 3880

DIRECTORS: Prof Chiaranda N (ind ne), Nkonyeni V (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BEL

Odunewu B (ind ne), Mokhesi N V (ld ind ne), Mnxasana N P (ind COMPANY SECRETARY: D McIlrath

ne), Molotsi H N (ind ne), Schmid P (ind ne), Gwagwa Dr N N (Chair, TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

ind ne), Sewela D M (Group CEO), Lila N V (Group FD) SPONSOR: Investec Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 6 Dec 2024 AUDITORS: PwC Inc.

Public Investment Corporation (SOC) Ltd. 19.00%

Zahid Tractor & Heavy Machinery Co. Ltd. 18.90% CAPITAL STRUCTURE Authorised Issued

Silchester International Investors LLP 17.70% BEL Ords no par value 100 000 000 95 629 385

POSTAL ADDRESS: PO Box 782248, Sandton, 2146 DISTRIBUTIONS [ZARc]

EMAIL: investor@barloworld.com Ords no par value Ldt Pay Amt

WEBSITE: www.barloworld.com Final 14 Apr 25 22 Apr 25 160.00

TELEPHONE: 011-445-1000 Final 18 Apr 23 24 Apr 23 90.00

COMPANY SECRETARY: Nomini Rapoo

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. LIQUIDITY: Jul25 Avg 270 877 shares p.w., R11.7m(14.7% p.a.)

SPONSOR: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd. BELL 40 Week MA INDT 6000

AUDITORS: Ernst & Young,SizweNtsalubaGobodo Grant Thornton Inc.

5000

CAPITAL STRUCTURE Authorised Issued

BAW Ords 5c ea 400 000 000 189 641 787 4000

BAWP Prefs 200c ea 500 000 375 000 3000

DISTRIBUTIONS [ZARc] 2000

Ords 5c ea Ldt Pay Amt 1000

Interim No 191 17 Jun 25 23 Jun 25 120.00

Final No 190 30 Dec 24 6 Jan 25 310.00 0

2021 2022 2023 2024 2025

LIQUIDITY: Jun25 Avg 2m shares p.w., R193.0m(54.5% p.a.)

FINANCIAL STATISTICS

BARWORLD 40 Week MA GENI

13000 (R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

12000 Final Final(rst) Final Final Final

11000 Turnover 11 697 13 514 10 276 8 017 6 690

10000 Op Inc 754 1 194 705 404 36

9000 NetIntPd(Rcvd) 82 114 59 34 103

8000 Minority Int 31 30 22 7 7

7000 Att Inc 440 764 457 287 - 64

6000 TotCompIncLoss 395 1 008 552 358 110

5000 Fixed Ass 1 041 1 006 944 919 935

4000 Investments 24 36 63 59 34

2021 2022 2023 2024 2025 Tot Curr Ass 7 054 8 509 6 757 5 131 4 794

Ord SH Int 5 574 5 211 4 320 3 838 3 487

NOTE: Barloworld Ltd. historical prices were adjusted to reflect the Minority Int 103 74 45 24 17

unbundling of Zeda Ltd. shares on 13 December 2022. LT Liab 969 1 031 871 681 759

FINANCIAL STATISTICS Tot Curr Liab 2 446 4 219 3 415 2 381 2 377

PER SHARE STATISTICS (cents per share)

(R million) Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 HEPS-C (ZARc) 465.00 798.00 473.00 294.00 - 31.00

Interim Final Final Final Final(rst)

Turnover 18 063 41 908 45 028 39 383 34 123 DPS (ZARc) - - 90.00 50.00 -

Op Inc 1 587 3 787 4 332 3 654 3 241 NAV PS (ZARc) 5 936.00 5 527.00 4 565.00 4 013.08 3 664.00

NetIntPd(Rcvd) 522 1 266 1 337 878 766 3 Yr Beta 1.02 0.51 0.38 0.14 0.08

Hline Erngs-CO 788 1 902 2 147 2 131 1 872 Price High 5 190 2 497 1 750 1 547 925

Fixed Ass 8 721 8 567 8 017 7 555 11 417 Price Low 2 250 1 400 1 001 630 250

Inv in Assoc 3 067 2 904 2 835 2 424 1 880 Price Prd End 4 063 2 300 1 525 1 235 650

Ord SH Int 17 200 16 359 16 557 18 919 21 422 RATIOS

Tot Curr Liab* 17 411 18 219 22 381 24 449 21 000 Ret on SH Fnd 8.30 15.02 10.97 7.62 - 1.63

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 6.45 8.83 6.86 5.04 0.53

EPS (ZARc) 403.40 1 022.20 1 197.00 1 051.90 1 390.90 D:E 0.29 0.50 0.47 0.35 0.51

HEPS-C (ZARc) 423.20 1 022.10 1 156.30 1 096.30 944.90 Current Ratio 2.88 2.02 1.98 2.16 2.02

DPS (ZARc) 120.00 520.00 500.00 1 010.00 1 787.00 Div Cover - - 5.31 6.00 -

NAV PS (ZARc) 9 235.00 8 626.26 8 730.67 9 976.00 10 698.00

RATIOS

Ret on SH Fnd 10.1 11.71 13.53 17.10 12.10

RONOA 22.00 27.30 28.60 28.60 20.30

Oper Pft Mgn 8.79 9.04 9.62 9.28 9.50

D:E 0.65 0.56 0.76 0.54 0.70

Int Cover 3.06 2.98 3.20 3.00 4.41

Current Ratio 1.42 1.29 1.36 1.54 1.51

Div Cover 3.36 1.97 2.39 0.66 4.26

*incl. assets held for sale

85