Page 91 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 91

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - BRA

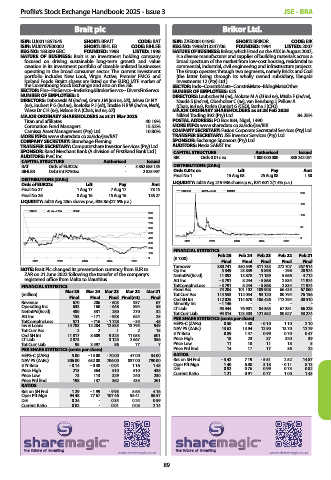

Brait plc Brikor Ltd.

ISIN: LU0011857645 SHORT: BRAIT CODE: BAT ISIN: ZAE000101945 SHORT: BRIKOR CODE: BIK

ISIN: MU0707E00002 SHORT: BIHL EB CODE: BIHLEB REG NO: 1998/013247/06 FOUNDED: 1994 LISTED: 2007

REG NO: 183309 GBC FOUNDED: 1998 LISTED: 1998 NATURE OF BUSINESS: Brikor, which listed on the AltX in August 2007,

NATURE OF BUSINESS: Brait is an investment holding company is a diverse manufacturer and supplier of building materials across a

focused on driving sustainable long-term growth and value broad spectrum of the market from low-cost housing, residential to

creation in its investment portfolio of sizeable unlisted businesses commercial, industrial, civil engineering and infrastructure projects.

operating in the broad consumer sector. The current investment The Group operates through two segments, namely Bricks and Coal

portfolio includes New Look, Virgin Active, Premier FMCG and (the latter being through its wholly owned subsidiary, Ilangabi

Iceland Foods. Brait’s shares are listed on the EURO MTF market of Investments 12 (Pty) Ltd.)

the Luxembourg Stock Exchange and also on the JSE. SECTOR: Inds--Constr&Mats--Constr&Mats--BldngMats:Other

SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs-- DiversFinServcs NUMBER OF EMPLOYEES: 625

NUMBER OF EMPLOYEES: 0 DIRECTORS: Laubscher M (ne), Mokate M A (ld ind ne), Mtsila F (ind ne),

DIRECTORS: Dabrowski M (ind ne), Grant J M (ind ne, UK), Jekwa Dr N Y Naudè S (ind ne), Oberholzer C (ne), van Rensburg J, Pellow A

(ne), Joubert P G (ind ne), Roelofse P J (alt), Troskie H R W (ind ne, Neth), (Chair, ind ne), Parkin (Junior) G (CEO), Botha J (CFO)

Wiese Dr C H (ne), Nelson R A (Chair, ind ne, UK) MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 Nikkel Trading 392 (Pty) Ltd. 84.25%

Titan and affiliates 40.19% POSTAL ADDRESS: PO Box 884, Nigel, 1490

Coronation Fund Managers 15.52% MORE INFO: www.sharedata.co.za/sdo/jse/BIK

Camissa Asset Management (Pty) Ltd. 10.80% COMPANY SECRETARY: Fusion Corporate Secretarial Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/BAT TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

COMPANY SECRETARY: Stonehage Fleming SPONSOR: Exchange Sponsors (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Nexia SAB&T Inc.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) CAPITAL STRUCTURE Authorised Issued

AUDITORS: PwC Inc. BIK Ords 0.01c ea 1 000 000 000 838 242 031

CAPITAL STRUCTURE Authorised Issued

BAT Ords of EUR22c - 3 862 685 135 DISTRIBUTIONS [ZARc]

BIHLEB Debt int R750ea - 2 825 997 Ords 0.01c ea Ldt Pay Amt

Final No 1 15 Aug 08 25 Aug 08 1.50

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul25 Avg 219 936 shares p.w., R31 601.2(1.4% p.a.)

Ords of EUR22c Ldt Pay Amt

Final No 27 1 Aug 17 7 Aug 17 78.15 BRIKOR 40 Week MA CONM

Final No 26 8 Aug 16 15 Aug 16 136.27 200

LIQUIDITY: Jul25 Avg 20m shares p.w., R35.8m(27.5% p.a.)

150

BRAIT 40 Week MA GENF

900

100

800

700

50

600

500

400 0

2021 2022 2023 2024 2025

300

200 FINANCIAL STATISTICS

100 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

0 (R ’000)

2021 2022 2023 2024 2025 Final Final Final Final Final

Turnover 380 741 350 549 311 733 272 707 257 914

NOTE: Brait Plc changed its presentation currency from EUR to Op Inc 5 349 23 839 9 898 - 298 20 974

ZAR on 21 June 2022 following the transfer of the company’s NetIntPd(Rcvd) 11 892 13 878 11 189 5 656 4 712

registered office from Malta to Mauritius. Att Inc - 3 791 8 244 - 5 868 2 834 11 974

FINANCIAL STATISTICS TotCompIncLoss - 3 791 8 244 - 5 868 2 834 11 974

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Fixed Ass 74 204 101 102 109 908 66 435 67 060

(million) Tot Curr Ass 114 553 112 054 93 120 80 794 76 156

Final Final Final Final(rst) Final Ord SH Int 112 025 114 670 106 426 112 294 80 510

Revenue 670 206 - 603 937 67 Minority Int - 1 146 - - - -

Operating Inc 633 160 - 648 894 58 LT Liab 93 444 76 901 84 365 67 381 66 228

NetIntPd(Rcvd) 480 331 280 270 32 Tot Curr Liab 94 314 123 503 121 552 80 627 53 274

Att Inc 153 - 171 - 928 624 25 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 571 - 716 - 1 728 - 35 48

Inv & Loans 14 783 12 204 12 535 13 795 949 HEPS-C (ZARc) 0.50 1.30 - 0.10 1.10 2.10

Tot Curr Ass 2 2 1 2 15 NAV PS (ZARc) 13.62 13.94 12.90 13.70 12.79

Ord SH Int 11 817 8 609 9 325 11 053 601 3 Yr Beta 0.89 1.47 0.99 0.70 0.47

LT Liab 2 873 - 3 125 2 667 356 Price High 18 23 37 320 39

Tot Curr Liab 95 3 597 86 77 7 Price Low 11 10 11 18 5

PER SHARE STATISTICS (cents per share) Price Prd End 14 17 17 36 22

HEPS-C (ZARc) 5.00 - 13.00 - 70.00 47.00 34.00 RATIOS

NAV PS (ZARc) 306.00 652.00 706.00 837.00 790.00 Ret on SH Fnd - 3.42 7.19 - 5.51 2.52 14.87

3 Yr Beta - 0.14 - 0.38 - 0.04 1.16 1.48 Oper Pft Mgn 1.40 6.80 3.18 - 0.11 8.13

Price High 215 364 510 510 438 D:E 0.92 0.76 0.99 0.73 0.82

Price Low 73 113 329 240 230 Current Ratio 1.21 0.91 0.77 1.00 1.43

Price Prd End 198 137 362 435 261

RATIOS

Ret on SH Fnd 1.29 - 1.99 - 9.95 5.65 4.16

Oper Pft Mgn 94.48 77.67 107.46 95.41 86.57

D:E 0.24 - 0.34 0.24 0.59

Current Ratio 0.02 - 0.01 0.03 2.14

89