Page 93 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 93

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - BUR

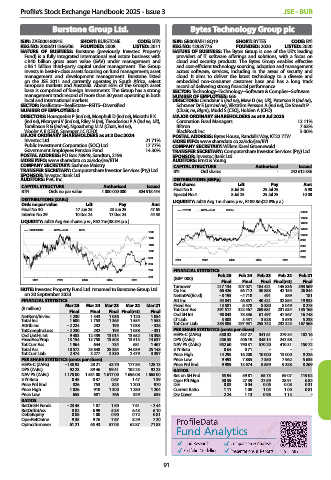

Burstone Group Ltd. Bytes Technology Group plc

ISIN: ZAE000180915 SHORT: BURSTONE CODE: BTN ISIN: GB00BMH18Q19 SHORT: BYTES CODE: BYI

REG NO: 2008/011366/06 FOUNDED: 2008 LISTED: 2011 REG NO: 12935776 FOUNDED: 2020 LISTED: 2020

NATURE OF BUSINESS: Burstone (previously Investec Property NATURE OF BUSINESS: The Bytes Group is one of the UK’s leading

Fund) is a fully integrated international real estate business with providers of IT software offerings and solutions, with a focus on

c.R40 billion gross asset value (GAV) under management and cloud and security products. The Bytes Group enables effective

c.R6.1 billion third-party capital under management. The Group and cost-efficient technology sourcing, adoption and management

invests in best-in-class assets focusing on fund management; asset across software, services, including in the areas of security and

management and development management. Burstone listed cloud. It aims to deliver the latest technology to a diverse and

on the JSE 2011 and currently operates in South Africa, select embedded non-consumer customer base and has a long track

European markets and Australia. About 55% of the Group’s asset record of delivering strong financial performance.

base is comprised of foreign investments. The Group has a strong SECTOR: Technology--Technology--Software & CompSer--Software

management track record of more than 30 years operating in both NUMBER OF EMPLOYEES: 666

local and international markets. DIRECTORS: Chindalur S (ind ne), Maw D (ne, UK), Paterson R (ind ne),

SECTOR: RealEstate--RealEstate--REITS--Diversified Schraner Dr E (snr ind ne), Vikström Persson A (ind ne), De Smedt P

NUMBER OF EMPLOYEES: 0 (Chair, ne, Blgm), Mudd S (CEO), Holden A (CFO)

DIRECTORS: Hourquebie P (ind ne), Moephuli D (ind ne), Morathi R K MAJOR ORDINARY SHAREHOLDERS as at 9 Jul 2025

(ind ne), Nkonyeni V (ind ne), Riley N (ne), Theodosiou P A (ind ne, UK), Coronation Fund Managers 12.11%

Tomlinson R G (ind ne), Ngoasheng M M (Chair, ind ne), Biltron 7.63%

Wooler A R (CEO), Sprenger J C (CFO) BlackRock Inc. 5.00%

MAJOR ORDINARY SHAREHOLDERS as at 3 Dec 2024 POSTAL ADDRESS: Bytes House, Randalls Way, KT22 7TW

Investec Ltd. 21.71% MORE INFO: www.sharedata.co.za/sdo/jse/BYI

Public Investment Corporation (SOC) Ltd. 17.77% COMPANY SECRETARY: Willem Karel Groenewald

Government Employees Pension Fund 14.30% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 78949, Sandton, 2196 SPONSOR: Investec Bank Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/BTN AUDITORS: Ernst & Young

COMPANY SECRETARY: Sashnee Maistry CAPITAL STRUCTURE Authorised Issued

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. BYI Ord shares - 242 612 536

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc. DISTRIBUTIONS [GBPp]

CAPITAL STRUCTURE Authorised Issued Ord shares Ldt Pay Amt

BTN Ords no par value 1 000 000 000 804 918 444 Final No 8 8 Jul 25 25 Jul 25 6.90

Special No 4 8 Jul 25 25 Jul 25 10.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul25 Avg 1m shares p.w., R109.8m(22.8% p.a.)

Ords no par value Ldt Pay Amt

Final No 30 17 Jun 25 23 Jun 25 47.65 BYTES 40 Week MA SCOM

Interim No 29 10 Dec 24 17 Dec 24 44.58 18000

16000

LIQUIDITY: Jul25 Avg 6m shares p.w., R52.7m(38.3% p.a.)

14000

BURSTONE 40 Week MA REIV 12000

1300

10000

1200

8000

1100 6000

1000 4000

900 2000

2021 2022 2023 2024 2025

800

700 FINANCIAL STATISTICS

600 (GBP ’000) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

2021 2022 2023 2024 2025 Final Final Final Final(rst) Final

Turnover 217 134 207 021 184 421 145 836 393 569

NOTE: Investec Property Fund Ltd. renamed to Burstone Group Ltd. Op Inc 66 426 56 712 50 883 42 155 26 844

on 20 September 2023. NetIntPd(Rcvd) - 8 195 - 4 718 491 589 181

FINANCIAL STATISTICS Att Inc 54 841 46 851 40 421 32 854 19 933

8 049

13 581

8 275

8 478

8 380

(R million) Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Fixed Ass 391 517 322 467 269 681 231 634 135 168

Tot Curr Ass

Final Final Final Final(rst) Final

NetRent/InvInc 1 230 1 343 1 036 1 120 1 054 Ord SH Int 98 043 78 336 61 497 47 567 16 748

3 528

3 676

3 303

5 238

3 451

Total Inc 1 600 1 753 1 365 1 554 1 553 LT Liab 353 885 297 931 255 742 232 325 167 568

Tot Curr Liab

Attrib Inc - 2 224 232 195 1 038 - 328

TotCompIncLoss - 2 230 232 195 1 038 - 331 PER SHARE STATISTICS (cents per share)

Ord UntHs Int 9 483 12 439 13 014 13 652 13 398 HEPS-C (ZARc) 530.32 457.27 341.61 279.34 182.16

FixedAss/Prop 13 154 13 750 13 503 13 515 14 637 DPS (ZARc) 236.53 406.19 348.14 247.58 -

Tot Curr Ass 1 964 644 734 681 1 467 NAV PS (ZARc) 952.60 790.31 570.20 410.31 150.72

Total Ass 18 572 25 848 25 384 24 039 25 148 3 Yr Beta 0.64 0.71 - - -

Tot Curr Liab 2 474 3 277 2 330 2 479 3 397 Price High 14 295 16 200 10 000 13 000 9 226

PER SHARE STATISTICS (cents per share) Price Low 9 493 7 885 7 350 7 962 5 635

HEPS-C (ZARc) - 138.93 28.21 43.70 177.85 128.13 Price Prd End 9 989 13 674 8 859 9 388 8 269

DPS (ZARc) 92.23 89.46 99.41 102.23 92.23 RATIOS

NAV PS (ZARc) 1 178.00 1 551.00 1 617.00 1 696.08 1 665.00 Ret on SH Fnd 55.94 59.81 65.73 69.07 119.02

3 Yr Beta 0.45 0.37 0.67 1.47 1.39 Oper Pft Mgn 30.59 27.39 27.59 28.91 6.82

Price Prd End 826 753 825 1 200 970 D:E 0.03 0.04 0.06 0.08 0.31

Price High 1 026 910 1 300 1 280 1 204 Current Ratio 1.11 1.08 1.05 1.00 0.81

Price Low 655 681 766 929 635 Div Cover 2.24 1.13 0.98 1.13 -

RATIOS

RetOnSH Funds - 23.45 1.87 1.50 7.61 - 2.44

RetOnTotAss 8.82 6.99 5.35 6.43 6.10

Debt:Equity 0.88 1.00 0.90 0.72 0.81

OperRetOnInv 9.35 9.76 7.67 8.29 7.20

OpInc:Turnover 61.21 65.43 57.05 62.87 71.83

91