Page 98 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 98

JSE - CAS Profile’s Stock Exchange Handbook: 2025 - Issue 3

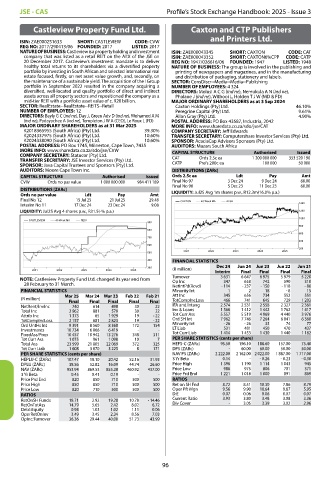

Castleview Property Fund Ltd. Caxton and CTP Publishers

and Printers Ltd.

ISIN: ZAE000251633 SHORT: CASTLEVIEW CODE: CVW

REG NO: 2017/290413/06 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: Castleview is a property holding and investment ISIN: ZAE000043345 SHORT: CAXTON CODE: CAT

company that was listed as a retail REIT on the AltX of the JSE on ISIN: ZAE000043352 SHORT: CAXTON6%CPP CODE: CATP

20 December 2017. Castleview’s investment mandate is to deliver REG NO: 1947/026616/06 FOUNDED: 1947 LISTED: 1948

healthy total returns to its shareholders via a diversified property NATURE OF BUSINESS: The group is involved in the publishing and

portfolio by investing in South African and selected international real printing of newspapers and magazines, and in the manufacturing

estate focused, firstly, on net asset value growth, and, secondly, on and distribution of packaging, stationery and labels.

the maintenance of a sustainable yield. The acquisition of the I Group SECTOR: ConsDiscr--Media--Media--Publishing

portfolio in September 2022 resulted in the company acquiring a NUMBER OF EMPLOYEES: 4 324

diversified, well-located and quality portfolio of direct and indirect DIRECTORS: Molusi A C G (ind ne), Nemukula A N (ind ne),

assets across all property sectors and repositioned the company as a Phalane J (ind ne), Witbooi L, Holden T J W (MD & FD)

mid-tier REIT with a portfolio asset value of c. R20 billion. MAJOR ORDINARY SHAREHOLDERS as at 3 Sep 2024

SECTOR: RealEstate--RealEstate--REITS--Retail Caxton Holdings (Pty) Ltd. 46.10%

NUMBER OF EMPLOYEES: 12 Peregrine Capital (Pty) Ltd. 9.61%

DIRECTORS: Bayly G C (ind ne), Day J, Green Adv D (ind ne), Mohamed A M Allan Gray (Pty) Ltd. 4.90%

(ind ne), Padayachee A (ind ne), Templeton J W A (CEO), Le Roux L (FD) POSTAL ADDRESS: PO Box 43587, Industria, 2042

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 MORE INFO: www.sharedata.co.za/sdo/jse/CAT

K2018365955 (South Africa) (Pty) Ltd. 39.30% COMPANY SECRETARY: Jeff Edwards

K2024337975 (South Africa) (Pty) Ltd. 10.60% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

K2024338090 (South Africa) (Pty) Ltd. 10.60% SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

POSTAL ADDRESS: PO Box 1745, Milnerton, Cape Town, 7435 AUDITORS: Mazars South Africa

MORE INFO: www.sharedata.co.za/sdo/jse/CVW CAPITAL STRUCTURE Authorised Issued

COMPANY SECRETARY: Statucor (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. CAT Ords 2.5c ea 1 200 000 000 353 520 190

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. CATP Prefs 200c ea 100 000 50 000

AUDITORS: Moore Cape Town Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE Authorised Issued Ords 2.5c ea Ldt Pay Amt

CVW Ords no par value 1 000 000 000 984 411 189 Final No 97 3 Dec 24 9 Dec 24 60.00

Final No 96 5 Dec 23 11 Dec 23 60.00

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt LIQUIDITY: Jul25 Avg 1m shares p.w., R12.3m(16.0% p.a.)

Final No 12 15 Jul 25 21 Jul 25 29.48 CAXTON 40 Week MA ALSH

Interim No 11 17 Dec 24 23 Dec 24 9.08 1400

LIQUIDITY: Jul25 Avg 4 shares p.w., R31.5(-% p.a.) 1200

1000

CASTLEVIEW 40 Week MA REIV

900

800

800

600

700

400

600

200

2021 2022 2023 2024 2025

500

400 FINANCIAL STATISTICS

300 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

2021 2022 2023 2024 2025 Interim Final Final Final Final

NOTE: Castleview Property Fund Ltd. changed its year end from Turnover 3 631 6 647 6 975 5 979 5 220

347

Op Inc

658

590

742

310

28 February to 31 March. NetIntPd(Rcvd) - 114 - 237 - 150 - 118 - 86

FINANCIAL STATISTICS Minority Int 1 2 18 - 8 15

551

(R million) Mar 25 Mar 24 Mar 23 Feb 22 Feb 21 Att Inc 345 656 734 552 1 203

741

645

729

TotCompIncLoss

466

Final Final Final Final Final

NetRent/InvInc 740 614 498 30 22 IFA and Intang 2 574 2 531 2 558 2 327 2 361

Total Inc 2 962 881 579 30 22 Inv & Loans 1 566 1 412 1 442 1 762 1 417

Attrib Inc 1 373 65 1 929 19 - 22 Tot Curr Ass 5 557 5 519 4 969 4 440 3 976

TotCompIncLoss 2 157 681 2 823 19 - 22 Ord SH Int 7 962 7 746 7 264 6 841 6 360

Ord UntHs Int 9 391 8 560 8 368 172 154 Minority Int - 26 - 26 33 74 77

Investments 10 734 6 866 6 419 - - LT Liab 531 481 450 470 437

FixedAss/Prop 10 457 10 942 13 276 348 311 Tot Curr Liab 1 414 1 453 1 430 1 440 1 182

Tot Curr Ass 1 075 961 1 098 10 7 PER SHARE STATISTICS (cents per share)

Total Ass 23 599 21 805 22 069 372 325 HEPS-C (ZARc) 95.50 196.10 188.60 157.00 75.40

Tot Curr Liab 1 608 3 070 3 225 8 171 DPS (ZARc) - 60.00 60.00 50.00 50.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 2 222.00 2 162.00 2 022.00 1 887.00 1 717.00

HEPLU-C (ZARc) 107.47 18.10 20.42 52.16 31.93 3 Yr Beta 0.14 - - 0.26 - 0.23 - 0.30

DPLU (ZARc) 38.56 52.82 16.09 44.74 26.60 Price High 1 396 1 190 1 114 1 043 945

NAV (ZARc) 953.94 869.53 855.38 460.92 437.00 Price Low 986 975 806 701 371

3 Yr Beta 0.45 0.41 0.19 - - Price Prd End 1 221 1 018 1 000 891 869

Price Prd End 820 850 710 500 500 RATIOS

Price High 850 850 710 500 500 Ret on SH Fnd 8.72 8.51 10.30 7.86 8.79

Price Low 820 710 500 500 500 Oper Pft Mgn 9.56 9.90 10.64 9.87 5.95

RATIOS D:E 0.07 0.06 0.06 0.07 0.07

RetOnSH Funds 18.71 2.92 19.28 10.78 - 14.46 Current Ratio 3.93 3.80 3.48 3.08 3.36

RetOnTotAss 14.79 5.65 2.42 8.02 6.72 Div Cover - 3.05 3.39 3.02 2.96

Debt:Equity 0.94 1.03 1.02 1.11 0.06

OperRetOnInv 3.49 3.45 2.34 8.56 7.03

OpInc:Turnover 36.36 29.44 40.00 51.73 43.99

96