Page 94 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 94

JSE - CAF Profile’s Stock Exchange Handbook: 2025 - Issue 3

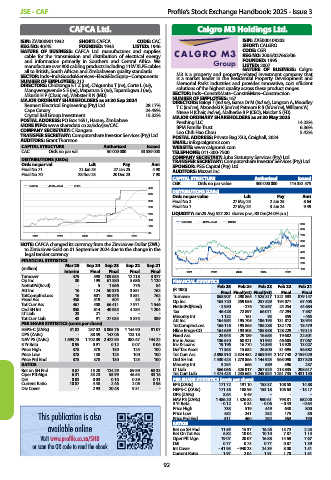

CAFCA Ltd. Calgro M3 Holdings Ltd.

ISIN: ZW0009011942 SHORT: CAFCA CODE: CAC ISIN: ZAE000109203

REG NO: 40/45 FOUNDED: 1945 LISTED: 1946 SHORT: CALGRO

NATURE OF BUSINESS: CAFCA Ltd. manufactures and supplies CODE: CGR

cable for the transmission and distribution of electrical energy REG NO: 2005/027663/06

and information primarily in Southern and Central Africa. We FOUNDED: 1995

manufacture over 900 cabling products including 11kV XLPE cables LISTED: 2007

all to British, South African and Zimbabwean quality standards. NATURE OF BUSINESS: Calgro

SECTOR: Inds--IndsGoods&Services--Elec&ElecEquip--Components M3 is a property and property-related investment company that

is a market leader in the Residential Property Development and

NUMBER OF EMPLOYEES: 212 Memorial Parks industries and provides innovative, cost efficient

DIRECTORS: Chidzonga E T Z (ne), Chigumbu T (ne), Corte L (ne), solutions of the highest quality across these product ranges.

Mangwengwende S E (ne), Maparura S (ne), Tapambgwa J (ne), SECTOR: Inds--Constr&Mats--Constr&Mats--Construction

Mkushi H P (Chair, ne), Webster R N (MD) NUMBER OF EMPLOYEES: 167

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024 DIRECTORS: Baloyi T (ind ne), Gama Dr M (ind ne), Langson A, Moodley

Reunert Electrical Engineering (Pty) Ltd. 28.17% T C (ind ne), Mzondeki K (ind ne) Patmore R B (ld ind ne), Williams W,

Cape Canary 24.49% Ntene H (Chair, ind ne), Malherbe B P (CEO), Naicker S (FD)

Crystal Ball Group Investment 15.32% MAJOR ORDINARY SHAREHOLDERS as at 30 May 2025

POSTAL ADDRESS: PO Box 1651, Harare, Zimbabwe Pershing LLC 14.23%

MORE INFO: www.sharedata.co.za/sdo/jse/CAC BPM Familie Trust 6.36%

COMPANY SECRETARY: C Kangara Leo Chih Hao Chou 5.42%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: Private Bag X33, Craighall, 2024

AUDITORS: Grant Thornton EMAIL: info@calgrom3.com

CAPITAL STRUCTURE Authorised Issued WEBSITE: www.calgrom3.com

CAC Ords no par val 50 000 000 33 389 000 TELEPHONE: 011-300-7500

COMPANY SECRETARY: Juba Statutory Services (Pty) Ltd.

DISTRIBUTIONS [USDc] TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ords no par val Ldt Pay Amt SPONSOR: PSG Capital (Pty) Ltd.

Final No 71 21 Jan 25 27 Jan 25 4.90 AUDITORS: Mazars Inc.

Final No 70 28 Nov 23 20 Dec 23 7.90 CAPITAL STRUCTURE Authorised Issued

CGR Ords no par value 500 000 000 114 381 575

CAFCA 40 Week MA ELEE

400

DISTRIBUTIONS [ZARc]

350

Ords no par value Ldt Pay Amt

300 Final No 2 27 May 25 2 Jun 25 8.64

250 Final No 1 27 May 24 3 Jun 24 9.49

200 LIQUIDITY: Jun25 Avg 527 281 shares p.w., R3.0m(24.0% p.a.)

150

CALGRO 40 Week MA CONM

900

100

800

50

2021 2022 2023 2024 2025 700

600

NOTE: CAFCA changed its currency from the Zimbabwe Dollar (ZWL)

to Zimbabwe Gold on 01 September 2024 due to the change in the 500

legal tender currency. 400

300

FINANCIAL STATISTICS

Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 200

(million) 100

Interim Final Final Final Final 2021 2022 2023 2024 2025

Turnover 479 598 109 635 12 218 3 377

Op Inc 30 199 61 380 5 686 1 120 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 5 1 656 776 84 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Att Inc 16 124 50 876 3 851 762 (R ’000) Final Final(rst) Final(rst) Final Final

TotCompIncLoss 16 601 50 876 3 851 762 Turnover 868 907 1 290 865 1 525 317 1 321 593 879 147

Fixed Ass 458 519 504 33 3 Op Inc 165 720 259 056 257 529 194 077 67 405

Tot Curr Ass 467 408 66 411 7 971 1 546 NetIntPd(Rcvd) - 3 950 - 276 10 557 24 254 44 684

Ord SH Int 858 814 40 935 4 284 1 204 Tax 46 428 72 897 66 071 47 294 7 587

LT Liab 23 21 - - - Minority Int 1 132 161 93 359 - 465

Tot Curr Liab 43 91 27 033 3 875 389 Att Inc 164 984 195 705 186 195 131 812 18 944

PER SHARE STATISTICS (cents per share) TotCompIncLoss 166 116 195 865 186 288 132 170 18 479

HEPS-C (ZARc) 31.82 257.02 3 005.76 1 144.90 91.07 Hline Erngs-CO 164 639 193 505 185 958 128 229 - 19 314

DPS (ZARc) - 88.59 147.06 123.18 - Fixed Ass 25 945 29 189 16 685 19 682 22 501

NAV PS (ZARc) 1 693.75 1 702.89 2 422.95 382.67 144.22 Inv in Assoc 136 610 68 321 51 992 46 605 37 067

3 Yr Beta 0.95 0.91 0.12 0.07 0.06 Inv & Loans 19 196 16 770 14 895 13 928 13 027

Price High 378 378 130 125 100 Def Tax Asset 11 363 15 682 26 500 31 695 56 582

Price Low 378 130 125 100 100 Tot Curr Ass 2 898 910 2 524 452 2 369 394 2 147 748 2 159 029

Price Prd End 378 378 130 125 100 Ord SH Int 1 430 423 1 273 866 1 144 925 963 090 827 820

RATIOS Minority Int 3 254 666 689 596 237

Ret on SH Fnd 3.67 15.20 124.29 89.89 63.33 LT Liab 366 066 326 017 267 525 213 835 208 617

Oper Pft Mgn 6.31 33.23 55.99 46.53 33.16 Tot Curr Liab 1 474 425 1 235 662 1 245 924 1 261 735 1 431 130

D:E 0.03 0.03 0.10 0.39 0.11 PER SHARE STATISTICS (cents per share)

Current Ratio 10.87 4.48 2.46 2.06 3.98 EPS (ZARc) 171.72 191.10 153.37 108.58 14.88

Div Cover - 2.93 20.48 9.31 - HEPS-C (ZARc) 171.36 188.95 153.18 105.63 - 15.17

DPS (ZARc) 8.64 9.49 - - -

NAV PS (ZARc) 1 486.20 1 326.82 950.61 793.81 682.00

3 Yr Beta - 0.12 0.34 - 0.06 - 0.43 - 0.64

Price High 738 519 449 640 800

This publication is also Price Low 452 241 252 175 190

80

511

460

363

262

Price Prd End

available online RATIOS 11.59 15.37 16.26 13.72 2.23

Ret on SH Fnd

Ret On Tot Ass 6.82 10.04 10.10 7.87 1.13

Visit www.profile.co.za/SHB Oper Pft Mgn 19.07 20.07 16.88 14.69 7.67

0.73

0.77

0.77

or scan the QR code to read the ebook D:E - 41.95 - 940.23 24.39 0.87 1.39

1.51

Int Cover

8.00

Current Ratio 1.97 2.04 1.91 1.70 1.51

92