Page 90 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 90

JSE - BOW Profile’s Stock Exchange Handbook: 2025 - Issue 3

Bowler Metcalf Ltd. Boxer Retail Ltd.

ISIN: ZAE000030797 SHORT: BOWCALF CODE: BCF ISIN: ZAE000339891 SHORT: BOXER CODE: BOX

REG NO: 1972/005921/06 FOUNDED: 1972 LISTED: 1987 REG NO: 2024/392006/06 FOUNDED: 1977 LISTED: 2024

NATURE OF BUSINESS: The group carries on the business of NATURE OF BUSINESS: The Group has a 47-year history and is South

manufacturing plastics, plastic mouldings and carbonated soft drinks. Africa’s fastest growing supermarket chain over the past few years,

SECTOR: Inds--IndsGoods&Services--GeneralIndustr--Cont&Pckgng with leading market share of the discount market. Boxer provides

NUMBER OF EMPLOYEES: 804 a focused range of quality affordable products and services to

DIRECTORS: Gillett Sonnenberg S J (ld ind ne), MacGillivray F C (ind ne), customers in the lower- to-middle-income urban, peri-urban and

van Duyn D (ne), Brain M (Chair, ld ind ne), Sass P F (CEO), rural South African and Eswatini communities.

Böhler G A (CFO) SECTOR: CnsStp--PcDrugs&Groceries--PcDrugs&Groceries--Food

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 NUMBER OF EMPLOYEES: 0

Camissa Asset Management (Pty) Ltd. 16.50% DIRECTORS: Boggenpoel J (ind ne), Formby J (ne), Lourens L (ind ne),

Aylett & Co 14.00% Maponya C M (ld ind ne), Molefe D (ind ne), Robertson C H (ind ne),

Old Mutual 8.31% Summers S (ne), Masojada M A (CEO), Wayne D (CFO)

POSTAL ADDRESS: PO Box 92, Ottery, 7808 MAJOR ORDINARY SHAREHOLDERS as at 11 Mar 2025

MORE INFO: www.sharedata.co.za/sdo/jse/BCF Public Investment Company SOC Ltd. 5.23%

COMPANY SECRETARY: Andre C September POSTAL ADDRESS: 41 Boulevard, Westway Office Park, Westville,

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Kwa-Zulu Natal, 2630

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/BOX

AUDITORS: Mazars Inc. COMPANY SECRETARY: Vaughan Ian Pierce

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

BCF Ords no par value 189 850 000 74 703 569 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA))

AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE Authorised Issued

Ords no par value Ldt Pay Amt BOX Ords no par value - 457 407 408

Interim No 71 25 Mar 25 31 Mar 25 25.00

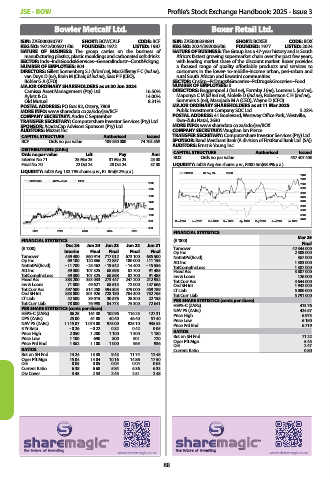

Final No 70 22 Oct 24 28 Oct 24 37.80 LIQUIDITY: Jul25 Avg 6m shares p.w., R400.5m(68.4% p.a.)

LIQUIDITY: Jul25 Avg 132 795 shares p.w., R1.8m(9.2% p.a.) BOXER 80 Day MA FOOR

7400

7200

BOWCALF 40 Week MA GENI

2000 7000

1800 6800

6600

1600 6400

1400 6200

6000

1200

5800

1000 5600

5400

800 Dec 2024 Jan 2025 Feb 2025 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025

600

2021 2022 2023 2024 2025 FINANCIAL STATISTICS

Mar 25

FINANCIAL STATISTICS (R ‘000) Final

(R ’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Turnover 42 344 000

Interim Final Final Final Final Op Inc 2 308 000

Turnover 459 400 860 914 717 012 673 100 635 500 NetIntPd(Rcvd) 367 000

Op Inc 69 100 120 866 72 837 100 000 111 195 Att Inc 1 383 000

NetIntPd(Rcvd) - 11 700 - 25 462 - 19 542 - 14 400 - 15 556 TotCompIncLoss 1 387 000

Att Inc 59 300 107 325 68 698 82 700 91 485 Fixed Ass 3 807 000

TotCompIncLoss 59 300 107 325 68 698 82 700 91 485 Inv & Loans 126 000

Fixed Ass 383 200 353 033 273 447 247 200 212 952 Tot Curr Ass 4 644 000

Inv & Loans 71 800 49 621 68 615 72 000 147 666 Ord SH Int 1 942 000

Tot Curr Ass 497 500 514 258 494 803 479 000 459 789 LT Liab 5 000 000

Ord SH Int 833 000 801 926 728 180 704 300 732 765 Tot Curr Liab 5 791 000

LT Liab 42 500 39 015 30 576 28 300 22 158 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 78 000 76 998 84 773 75 300 72 641 HEPS-C (ZARc) 413.76

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 424.57

HEPS-C (ZARc) 86.25 161.38 102.96 116.25 127.31 Price High 6 975

DPS (ZARc) 25.00 61.80 40.40 46.40 51.40 Price Low 6 150

NAV PS (ZARc) 1 115.07 1 074.00 975.00 925.10 935.53 Price Prd End 6 719

3 Yr Beta - 0.26 - 0.22 0.32 0.42 0.05 RATIOS

Price High 2 050 1 200 1 100 1 300 1 180

Price Low 1 100 690 800 901 720 Ret on SH Fnd 71.22

Price Prd End 1 362 1 100 1 000 965 936 Oper Pft Mgn 5.45

D:E

2.47

RATIOS Current Ratio 0.80

Ret on SH Fnd 14.24 13.38 9.43 11.74 12.48

Oper Pft Mgn 15.04 14.04 10.16 14.86 17.50

D:E 0.05 0.05 0.04 0.04 0.03

Current Ratio 6.38 6.68 5.84 6.36 6.33

Div Cover 3.45 2.53 2.45 2.51 2.48

88