Page 95 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 95

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - CAP

Capital Appreciation Ltd. Capitec Bank Holdings Ltd.

ISIN: ZAE000208245 SHORT: CAPPREC CODE: CTA ISIN: ZAE000035861 SHORT: CAPITEC CODE: CPI

REG NO: 2014/253277/06 FOUNDED: 2014 LISTED: 2015 ISIN: ZAE000083838 SHORT: CAPITEC-P CODE: CPIP

NATURE OF BUSINESS: Capital Appreciation is a financial REG NO: 1999/025903/06 FOUNDED: 1999 LISTED: 2002

technology company that seeks to serve and/or partner with NATURE OF BUSINESS: Capitec Bank Holdings Ltd. (Capitec or the

established and emerging financial institutions and other clients. group) is listed on the Johannesburg Stock Exchange Ltd. (JSE). It

The Company facilitates the provision of financial services and owns the operating subsidiaries Capitec Bank Ltd. (Capitec Bank or

delivers contemporary and innovative technologies and solutions. the bank), Capitec Ins (Pty) Ltd. (Capitec Ins) and Capitec Life Ltd.

SECTOR: Technology--Technology--Software & CompSer--ComputerService (Capitec Life).

NUMBER OF EMPLOYEES: 249 SECTOR: Fins--Banks--Banks--Banks

DIRECTORS: Bulo B (ind ne), Dambuza A S P (ne), Dlamini K D (ld ind ne), NUMBER OF EMPLOYEES: 15 747

Maqache R T (ne), Pimstein M (Exec Chair), Sekese V (ind ne), Shapiro M, DIRECTORS: Bhettay N (ind ne), du Plessis S A (ind ne), du Pré le Roux M S

Sacks B (CEO), Douwenga S (CFO) (ne), Fernandez C (ind ne), Ford-Hoon N (ind ne), Mahlangu V (ld ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 3 Apr 2025 Makwane K (ind ne), Malhotra R R (ind ne), Mouton P J (ne), Otto C A

Government Employees Pension Fund 26.71% (ind ne), Botha S L (Chair, ind ne), Fourie G M (CEO), Hardy G (CFO)

Public Investment Company SOC Ltd. 25.01% MAJOR ORDINARY SHAREHOLDERS as at 29 Apr 2025

Centric Capital Venture LLC 5.88% PSG Financial Services Ltd. 30.69%

POSTAL ADDRESS: PO Box 785812, Sandton, 2146 Public Investment Corporation SOC Ltd. 15.03%

MORE INFO: www.sharedata.co.za/sdo/jse/CTA Lebashe Investment Group (Pty) Ltd. 7.27%

COMPANY SECRETARY: Peter Katz (PKF Octagon) POSTAL ADDRESS: PO Box 12451, Die Boord, Stellenbosch, 7613

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/CPI

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY: Yolandé Mouton

AUDITORS: Deloitte & Touche Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc., PwC Inc.

CTA Ords no par val 10 000 000 000 1 310 000 000 CAPITAL STRUCTURE Authorised Issued

DISTRIBUTIONS [ZARc] CPI Ords 1c ea 500 000 000 116 099 843

Ords no par val Ldt Pay Amt CPIP Pref shares 1c ea 100 000 000 463 612

Final No 16 8 Jul 25 14 Jul 25 7.50

Interim No 15 30 Dec 24 6 Jan 25 4.50 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul25 Avg 6m shares p.w., R8.7m(23.0% p.a.) Ords 1c ea Ldt Pay Amt

Final No 41 13 May 25 19 May 25 4425.00

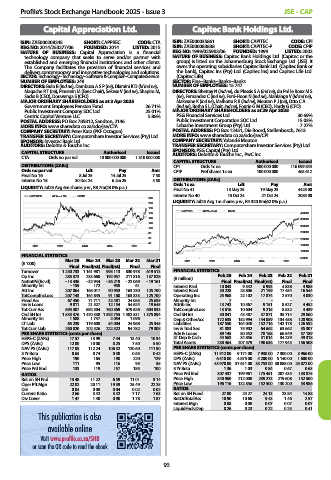

CAPPREC 40 Week MA SCOM Interim No 40 15 Oct 24 21 Oct 24 2085.00

220

200 LIQUIDITY: Jul25 Avg 1m shares p.w., R4 320.8m(62.0% p.a.)

180

CAPITEC 40 Week MA BANK

160 400000

140 350000

120

300000

100

80 250000

60 200000

40

2021 2022 2023 2024 2025 150000

100000

FINANCIAL STATISTICS 50000

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 2021 2022 2023 2024 2025

(R ’000)

Final Final(rst) Final(rst) Final Final

Turnover 1 250 733 1 161 981 995 113 830 978 619 513 FINANCIAL STATISTICS

Op Inc 285 373 233 660 192 957 211 816 137 828 (R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

NetIntPd(Rcvd) - 13 436 - 32 944 - 36 219 - 22 069 - 19 161 Final Final(rst) Final(rst) Final Final

Minority Int - 159 172 958 61 - Interest Paid 10 043 9 342 6 993 4 838 4 985

Att Inc 207 064 165 017 90 953 163 230 125 700 Interest Rcvd 30 228 25 806 21 199 17 454 16 544

TotCompIncLoss 207 143 164 845 91 160 163 333 125 700 Operating Inc 25 968 22 102 17 874 2 570 4 030

Fixed Ass 67 450 71 711 42 481 24 065 25 635 Minority Int 7 - - - -

Inv & Loans 9 811 21 527 12 154 54 624 19 645 Attrib Inc 13 742 10 567 9 151 8 527 4 452

Tot Curr Ass 693 307 692 504 760 369 679 626 604 833 TotCompIncLoss 13 616 10 604 9 215 8 532 4 439

Ord SH Int 1 533 376 1 470 338 1 392 755 1 482 531 1 375 894 Ord SH Int 50 841 43 487 37 871 35 714 29 860

Minority Int 1 588 1 747 2 054 1 096 - Dep & OtherAcc 172 635 152 994 144 059 134 458 120 908

LT Liab 65 239 119 608 54 004 24 968 25 345 Liabilities 187 550 164 048 152 716 142 178 126 592

Tot Curr Liab 260 820 202 526 222 522 94 782 79 308 Inv & Trad Sec 81 883 75 902 64 662 63 662 35 307

PER SHARE STATISTICS (cents per share) Adv & Loans 89 145 80 552 78 168 66 549 57 189

HEPS-C (ZARc) 17.57 13.99 7.44 13.40 10.34 ST Dep & Cash 44 563 34 856 31 014 34 239 49 318

DPS (ZARc) 12.00 10.00 8.25 7.50 5.50 Total Assets 238 464 207 579 190 636 177 943 156 508

NAV PS (ZARc) 117.05 112.24 106.32 120.60 111.90 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.65 0.74 0.38 0.65 0.42 HEPS-C (ZARc) 11 912.00 9 171.00 7 938.00 7 300.00 3 966.00

Price High 190 165 190 220 129 DPS (ZARc) 6 510.00 4 875.00 4 200.00 5 140.00 1 600.00

Price Low 111 95 116 95 55 NAV PS (ZARc) 43 970.00 37 611.00 33 753.00 30 888.00 25 872.00

Price Prd End 133 119 157 185 100 3 Yr Beta 1.36 1.03 0.84 0.67 0.63

RATIOS Price Prd End 307 437 199 961 175 451 207 435 133 875

Ret on SH Fnd 13.48 11.22 6.59 11.01 9.14 Price High 340 960 212 000 239 273 219 608 152 500

Oper Pft Mgn 22.82 20.11 19.39 25.49 22.25 Price Low 196 116 132 856 152 500 130 200 53 986

D:E 0.04 0.08 0.04 0.02 0.02 RATIOS

Current Ratio 2.66 3.42 3.42 7.17 7.63 Ret on SH Fund 27.00 24.27 24.13 23.84 14.88

Div Cover 1.47 1.40 0.90 1.78 1.87 RetOnTotalAss 10.90 10.68 9.43 1.46 2.57

Interest Mgn 0.08 0.08 0.07 0.07 0.07

LiquidFnds:Dep 0.26 0.23 0.22 0.25 0.41

This publication is also

available online

Visit www.profile.co.za/SHB

or scan the QR code to read the ebook

93