Page 102 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 102

JSE - COM Profile’s Stock Exchange Handbook: 2025 - Issue 3

Combined Motor Holdings Ltd. Compagnie Financière

Richemont SA

ISIN: ZAE000088050 SHORT: CMH CODE: CMH

REG NO: 1965/000270/06 FOUNDED: 1977 LISTED: 1987

NATURE OF BUSINESS: The CMH Group comprises Combined Motor ISIN: CH0210483332 SHORT: RICHEMONT CODE: CFR

Holdings Ltd. and its subsidiaries, operating in the retail motor, car REG NO: CH-170.3.013.862-4 FOUNDED: 1988 LISTED: 1988

hire and financial services segments. The Group operates only in NATURE OF BUSINESS: Richemont is one of the world’s leading

South Africa, employing 2 204 people. luxury goods groups. The Group’s luxury goods interests

SECTOR: ConsDisr--Retail--Retailers--SpecialityRetaillers encompass some of the most prestigious names in the industry,

NUMBER OF EMPLOYEES: 2 204 including Cartier, Van Cleef & Arpels, Piaget, Vacheron Constantin,

DIRECTORS: Barritt B W J, Govind P M M, Jones M E (ind ne), Komane Jaeger-LeCoultre, IWC Schaffhausen and Montblanc.Each of

R T (ind ne), Mabena J A (ind ne), Nkadimeng R (ind ne), Webber C, Richemont’s Maisons represents a proud tradition of style, quality

Dixon J S (Chair, ind ne), McIntosh J D (CEO), Jackson S K (FD) and craftsmanship which Richemont is committed to preserving.

MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2025 SECTOR: ConsDiscr--ConsumerProducts&Services--PersonalGoods--Luxury

Ninety One SA (Pty) Ltd. 7.29% NUMBER OF EMPLOYEES: 35 853

POSTAL ADDRESS: PO Box 1033, Umhlanga Rocks, 4320 DIRECTORS: Arora N (ne, USA), Brendish C (ld ind ne, UK), Eckert J (ne,

MORE INFO: www.sharedata.co.za/sdo/jse/CMH Swiss), Jin Dr K (ne, China), Luhabe W (ne), Moss J (ne, USA),

COMPANY SECRETARY: Priya Govind Nevistic Dr V (ne, Swiss), Pictet G (ne, Swiss), Ramos M (ne), Rupert A (ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Saage G (ne, USA), Thomas P (ne, Fr), Whitbread J (ne),

SPONSOR: PwC Corporate Finance (Pty) Ltd. Rupert J P (Chair, ne), Malherbe J (Dep Chair, ne),

AUDITORS: KPMG Inc. Schot B (Dep Chair, ne), Bos N (CEO, Fr), Grund B (CFO, German)

CAPITAL STRUCTURE Authorised Issued MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025

CMH Ords no par value 143 590 560 74 801 998 Compagnie Financiere Rupert 51.00%

POSTAL ADDRESS: 50 Chemin de la Chênaie, CP 30, 1293 Bellevue,

DISTRIBUTIONS [ZARc] Geneva, Switzerland

Ords no par value Ldt Pay Amt MORE INFO: www.sharedata.co.za/sdo/jse/CFR

Final No 73 10 Jun 25 17 Jun 25 171.00 COMPANY SECRETARY: Swen H Grundmann

Interim No 72 10 Dec 24 17 Dec 24 102.00 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

LIQUIDITY: Jul25 Avg 331 931 shares p.w., R10.7m(23.1% p.a.) SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC SA

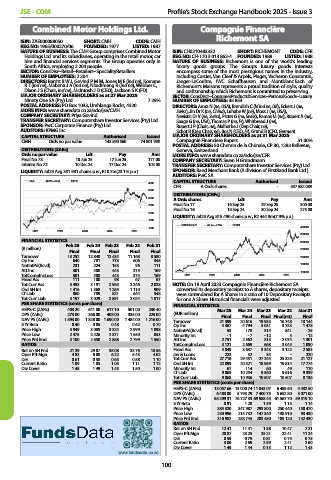

CMH 40 Week MA GERE CAPITAL STRUCTURE Authorised Issued

4000

CFR A Ords shares - 537 582 089

3500

DISTRIBUTIONS [CHFc]

3000 A Ords shares Ldt Pay Amt

2500 Final No 17 16 Sep 25 29 Sep 25 300.00

Final No 16 18 Sep 24 30 Sep 24 275.00

2000

LIQUIDITY: Jul25 Avg 815 490 shares p.w., R2 444.3m(7.9% p.a.)

1500

RICHEMONT 40 Week MA PERG

1000 400000

2021 2022 2023 2024 2025

350000

FINANCIAL STATISTICS 300000

(R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Final Final Final Final Final 250000

Turnover 13 252 12 840 12 434 11 168 8 580 200000

Op Inc 640 781 773 606 345

NetIntPd(Rcvd) 231 224 153 96 111 150000

Att Inc 301 408 443 375 169

TotCompIncLoss 301 408 443 375 169 2021 2022 2023 2024 2025 100000

Fixed Ass 111 100 98 67 67

Tot Curr Ass 3 493 3 191 2 965 2 246 2 028 NOTE: On 18 April 2023 Compagnie Financière Richemont SA

Ord SH Int 1 416 1 368 1 264 1 110 909 converted its depositary receipts to A shares, depositary receipts

LT Liab 860 789 821 644 548 were surrendered for A Shares in a ratio of 10 Depositary Receipts

Tot Curr Liab 3 197 3 029 2 891 2 024 1 817 for one A Share. Historical financials were adjusted.

PER SHARE STATISTICS (cents per share) FINANCIAL STATISTICS

HEPS-C (ZARc) 403.20 541.80 617.10 501.00 230.40 Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

DPS (ZARc) 273.00 366.00 408.00 335.00 225.00 (EUR million) Final Final Final Final(rst) Final

NAV PS (ZARc) 1 893.00 1 828.00 1 690.00 1 484.00 1 216.00 Turnover 21 399 20 616 19 953 16 748 13 144

3 Yr Beta 0.40 0.05 0.48 0.62 0.70 Op Inc 4 467 4 794 5 031 3 753 1 478

Price High 3 949 3 089 3 324 2 999 1 898 NetIntPd(Rcvd) 53 178 314 841 - 25

Price Low 2 475 2 426 2 371 1 550 853 Minority Int - 1 - 7 - 12 5 - 12

Price Prd End 3 100 2 650 2 868 2 799 1 550 Att Inc 2 751 2 362 313 2 074 1 301

RATIOS TotCompIncLoss 3 121 2 669 668 3 045 1 090

Ret on SH Fnd 21.29 29.87 35.08 33.76 18.56 Fixed Ass 4 049 3 637 3 343 3 122 2 583

Oper Pft Mgn 4.83 6.08 6.22 5.43 4.02 Inv & Loans 222 32 34 - 220

D:E 0.61 0.58 0.65 0.58 1.10 Tot Curr Ass 27 716 29 451 27 244 25 325 21 127

Current Ratio 1.09 1.05 1.03 1.11 1.12 Ord SH Int 22 099 20 521 18 959 19 814 17 774

Div Cover 1.48 1.49 1.45 1.50 1.00 Minority Int 67 114 60 49 110

LT Liab 9 065 10 254 9 560 9 616 9 339

Tot Curr Liab 9 068 10 936 10 507 10 507 8 136

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 13 057.66 13 000.74 11 843.07 6 489.50 4 432.50

DPS (ZARc) 6 483.00 5 793.29 7 400.75 5 652.80 3 071.00

NAV PS (ZARc) 85 299.31 76 727.33 69 988.45 61 567.70 59 519.10

3 Yr Beta 0.91 1.28 1.39 1.13 1.14

Price High 384 320 347 987 293 800 250 440 150 470

Price Low 230 996 215 732 147 340 138 910 93 430

Price Prd End 316 982 288 745 283 450 189 120 142 430

RATIOS

Ret on SH Fnd 12.41 11.41 1.58 10.47 7.21

Oper Pft Mgn 20.87 23.25 25.21 22.41 11.24

D:E 0.59 0.79 0.81 0.75 0.75

Current Ratio 3.06 2.69 2.59 2.41 2.60

Div Cover 1.49 1.44 0.13 1.12 1.43

www.fundsdata.co.za

100