Page 107 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 107

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - DIP

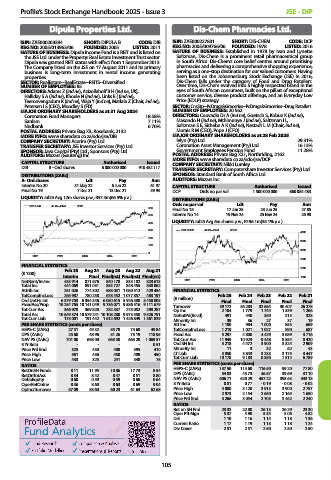

Dipula Properties Ltd. Dis-Chem Pharmacies Ltd.

ISIN: ZAE000203394 SHORT: DIPULA B CODE: DIB ISIN: ZAE000227831 SHORT: DIS-CHEM CODE: DCP

REG NO: 2005/013963/06 FOUNDED: 2005 LISTED: 2011 REG NO: 2005/009766/06 FOUNDED: 1978 LISTED: 2016

NATURE OF BUSINESS: Dipula Income Fund is a REIT and is listed on NATURE OF BUSINESS: Established in 1978 by Ivan and Lynette

the JSE Ltd. under the Property: Real Estate Investment Trust sector. Saltzman, Dis-Chem is a prominent retail pharmaceutical group

Dipula was granted REIT status with effect from 1 September 2013. in South Africa. Dis-Chem’s core belief centres around prioritising

The Company listed on the JSE on 17 August 2011 and its primary pharmacies and delivering a comprehensive shopping experience,

business is long-term investment in rental income generating serving as a one-stop destination for our valued customers. Having

properties. been listed on the Johannesburg Stock Exchange (JSE) in 2016,

SECTOR: RealEstate--RealEstate--REITS--Diversified Dis-Chem falls under the category of Food and Drug Retailers.

NUMBER OF EMPLOYEES: 85 Over time, Dis-Chem evolved into a highly respected brand in the

DIRECTORS: Adams Z (ind ne), Azizollahoff B H (ind ne, UK), eyes of South African consumers, built on the pillars of exceptional

Halliday S A (ind ne), Khoele N (ind ne), Links E ( (ind ne), customer service, diverse product offerings, and an Everyday Low

Teeroovengadum K (ind ne), Waja Y (ind ne), Matlala Z (Chair, ind ne), Price (EDLP) strategy.

Petersen I S (CEO), Moodley S (FD) SECTOR: CnsStp--PcDrugs&Groceries--PcDrugs&Groceries--Drug Retailers

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024 NUMBER OF EMPLOYEES: 20 562

Coronation Fund Managers 18.58% DIRECTORS: Coovadia Dr A (ind ne), Goetsch S, Kobue K (ind ne),

Sanlam 7.11% Masondo H (ind ne), Mthimunye J (ind ne), Saltzman I L,

Nedbank 6.70% Saltzman S E, Sithebe A K (ind ne), Nestadt L M (Chair, ind ne),

POSTAL ADDRESS: Private Bag X3, Rosebank, 2132 Morais R M (CEO), Pope J (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/DIB MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

COMPANY SECRETARY: Acorim (Pty) Ltd. Ivlyn (Pty) Ltd. 29.31%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Coronation Asset Management (Pty) Ltd. 16.13%

SPONSOR: Java Capital (Pty) Ltd., Sponsors (Pty) Ltd. Government Employees Pension Fund 11.28%

AUDITORS: Mazars (Gauteng) Inc. POSTAL ADDRESS: Private Bag X21, Northriding, 2162

CAPITAL STRUCTURE Authorised Issued MORE INFO: www.sharedata.co.za/sdo/jse/DCP

COMPANY SECRETARY: Nikki Lumley

DIB B - Ord shares 6 000 000 000 910 452 117 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSOR: Standard Bank of South Africa Ltd.

A- Ord shares Ldt Pay Amt AUDITORS: Mazars Inc.

Interim No 20 31 May 22 6 Jun 22 61.97 CAPITAL STRUCTURE Authorised Issued

Final No 19 7 Dec 21 13 Dec 21 59.93 DCP Ords no par val 1 500 000 000 860 084 483

LIQUIDITY: Jul25 Avg 12m shares p.w., R57.4m(66.5% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

DIPULA B 40 Week MA REIV

600 Final No 15 17 Jun 25 23 Jun 25 27.85

500 Interim No 14 19 Nov 24 25 Nov 24 26.98

LIQUIDITY: Jul25 Avg 6m shares p.w., R196.1m(35.1% p.a.)

400

300 DIS-CHEM 40 Week MA FOOR

4000

200

3500

100

3000

0

2021 2022 2023 2024 2025

2500

FINANCIAL STATISTICS

Feb 25 Aug 24 Aug 23 Aug 22 Aug 21 2000

(R ’000)

Interim Final Final(rst) Final(rst) Final(rst) 1500

NetRent/InvInc 433 914 871 676 840 178 833 182 823 613 2021 2022 2023 2024 2025

Total Inc 444 069 891 031 855 727 848 455 838 062

Attrib Inc 251 026 774 302 588 031 1 080 512 429 454 FINANCIAL STATISTICS

TotCompIncLoss 265 987 780 258 678 452 1 077 857 483 197 (R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Ord UntHs Int 6 379 703 6 354 346 6 050 615 5 926 588 5 450 805 Final Final Final Final Final

FixedAss/Prop 10 254 765 10 141 049 9 736 071 9 586 516 9 111 679 Turnover 39 172 36 283 32 664 30 407 26 278

Tot Curr Ass 366 978 369 828 282 337 275 052 298 287 Op Inc 2 104 1 779 1 744 1 539 1 266

Total Ass 10 649 374 10 579 241 10 108 280 9 973 558 9 526 791 NetIntPd(Rcvd) 491 440 350 313 328

Tot Curr Liab 173 001 191 442 1 612 692 1 426 849 1 361 829 Minority Int 39 36 27 37 19

PER SHARE STATISTICS (cents per share) Att Inc 1 180 984 1 000 853 669

HEPS-C (ZARc) 27.51 49.32 55.78 74.60 49.84 TotCompIncLoss 1 219 1 021 1 027 890 687

DPS (ZARc) 25.60 48.96 51.26 73.19 118.95 Fixed Ass 5 297 4 800 4 429 3 689 3 716

NAV PS (ZARc) 701.00 698.00 663.50 663.20 1 069.57 Tot Curr Ass 11 945 10 923 9 448 8 854 8 420

3 Yr Beta - - - - 0.51 Ord SH Int 5 218 4 472 3 900 3 324 2 909

Price Prd End 525 450 408 395 410 Minority Int 11 3 32 62 43

3 850

Price High 561 456 450 489 450 LT Liab 10 178 3 843 3 233 3 175 3 447

9 183

Tot Curr Liab

6 789

7 514

8 350

Price Low 433 325 241 348 78 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 137.50 114.60 116.50 99.20 77.80

RetOnSH Funds 8.11 11.95 10.86 17.73 8.54

RetOnTotAss 8.34 8.42 8.47 8.51 8.80 DPS (ZARc) 54.83 45.73 46.57 39.69 31.10

Debt:Equity 0.60 0.59 0.59 0.60 0.64 NAV PS (ZARc) 606.71 520.29 457.22 393.63 343.18

OperRetOnInv 8.46 8.60 8.63 8.69 9.04 3 Yr Beta 0.81 0.77 - 0.19 - 0.08 - 0.02

OpInc:Turnover 57.09 58.60 60.23 61.63 62.68 Price High 4 000 3 120 3 915 3 900 2 757

Price Low 2 973 2 154 2 650 2 165 1 650

Price Prd End 3 266 3 054 2 705 3 462 2 240

RATIOS

Ret on SH Fnd 23.32 22.80 26.13 26.29 23.30

Oper Pft Mgn 5.37 4.90 5.34 5.06 4.82

D:E 1.10 1.16 1.14 1.18 1.36

Current Ratio 1.17 1.19 1.13 1.18 1.24

Div Cover 2.51 2.51 2.50 2.50 2.50

105