Page 111 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 111

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - ENX

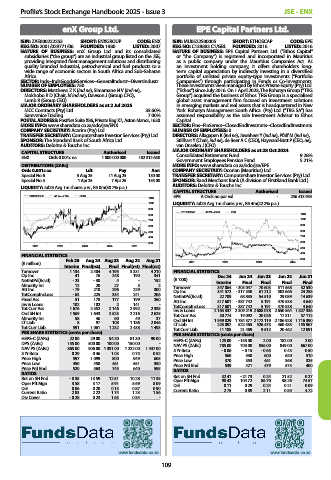

enX Group Ltd. EPE Capital Partners Ltd.

ISIN: ZAE000222253 SHORT: ENXGROUP CODE: ENX ISIN: MU0522S00005 SHORT: ETHOSCAP CODE: EPE

REG NO: 2001/029771/06 FOUNDED: 1980 LISTED: 2007 REG NO: C138883 C1/GBL FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: enX Group Ltd. and its consolidated NATURE OF BUSINESS: EPE Capital Partners Ltd. (“Ethos Capital”

subsidiaries (“the group”) are an industrial group listed on the JSE, or “the Company”) is registered and incorporated in Mauritius

providing integrated fleet management solutions and distributing as a public company under the Mauritius Companies Act. As

quality branded industrial, petrochemical and fuel products to a an investment holding company, it offers shareholders long-

wide range of economic sectors in South Africa and Sub-Saharan term capital appreciation by indirectly investing in a diversified

Africa. portfolio of unlisted private equity-type investments (“Portfolio

SECTOR: Inds--IndsGoods&Services--GeneralIndustr--DiversIndustr Companies”) through participating in Funds or Co-Investments.

NUMBER OF EMPLOYEES: 750 These investments were managed by Ethos Private Equity (Pty) Ltd.

DIRECTORS: Matthews Z K (ind ne), Simamane N V (ind ne), (“Ethos”) since July 2016. On 1 April 2023, The Rohatyn Group (“TRG

Mokhobo R D (Chair, ld ind ne), Dawson J (Group CFO), Group”) acquired the business of Ethos. TRG Group is a specialised

Lumb R (Group CEO) global asset management firm focused on investment solutions

MAJOR ORDINARY SHAREHOLDERS as at 2 Jul 2025 in emerging markets and real assets that is headquartered in New

MCC Contracts (Pty) Ltd. 33.60% York. Rohatyn Management South Africa (Pty) Ltd. (“TRG SA”) has

Samvenice Trading 7.00% assumed responsibility as the sole Investment Advisor to Ethos

POSTAL ADDRESS: PostNet Suite X86, Private Bag X7, Aston Manor, 1630 Capital.

MORE INFO: www.sharedata.co.za/sdo/jse/ENX SECTOR: Fins--FinServcs--ClosedEndInvstmnts--ClosedEndInvstmnts

COMPANY SECRETARY: Acorim (Pty) Ltd. NUMBER OF EMPLOYEES: 0

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DIRECTORS: Allagapen K (ind ne), Juwaheer Y (ind ne), Pfaff M (ind ne),

SPONSOR: The Standard Bank of South Africa Ltd. Stillhart Y (Chair, ind ne), de Beer A C (CEO), Hayward-Butt P (CEO, ne),

AUDITORS: Deloitte & Touche Inc. van Onselen J (CFO)

CAPITAL STRUCTURE Authorised Issued MAJOR ORDINARY SHAREHOLDERS as at 28 Oct 2024

ENX Ords 0.001c ea 1 000 000 000 182 312 650 Consolidated Retirement Fund 9.28%

Government Employees Pension Fund 5.21%

DISTRIBUTIONS [ZARc] MORE INFO: www.sharedata.co.za/sdo/jse/EPE

Ords 0.001c ea Ldt Pay Amt COMPANY SECRETARY: Ocorian (Mauritius) Ltd.

Special No 6 5 Aug 25 11 Aug 25 130.00 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Special No 5 1 Apr 25 7 Apr 25 155.00 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

LIQUIDITY: Jul25 Avg 1m shares p.w., R5.0m(30.7% p.a.) AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE Authorised Issued

ENXGROUP 40 Week MA GENI EPE A Ords no par val - 256 413 954

1100

1000 LIQUIDITY: Jul25 Avg 1m shares p.w., R5.4m(22.2% p.a.)

900

ETHOSCAP 40 Week MA EQII

800 1100

700 1000

600 900

500 800

400 700

300 600

2021 2022 2023 2024 2025

500

FINANCIAL STATISTICS 400

(R million) Feb 25 Aug 24 Aug 23 Aug 22 Aug 21 2021 2022 2023 2024 300

Interim Final(rst) Final Final(rst) Final(rst)

Turnover 1 134 2 404 4 195 3 331 4 210 FINANCIAL STATISTICS

Op Inc 41 76 248 190 341 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

NetIntPd(Rcvd) - 23 - 30 4 - 152 (R ’000)

Minority Int 12 20 27 3 2 Interim Final Final Final Final

Att Inc - 79 210 296 229 300 Turnover 347 064 - 303 047 70 603 511 568 32 530

Op Inc

24 258

502 666

61 212

341 572 - 317 350

TotCompIncLoss - 63 225 334 241 206

29 089

68 835

22 709

Fixed Ass 51 178 177 199 260 NetIntPd(Rcvd) 317 601 - 387 742 54 510 470 538 14 639

Att Inc

5 191

4 640

Inv & Loans 102 102 2 141 - TotCompIncLoss 317 601 - 387 742 5 191 470 538 4 640

Tot Curr Ass 1 676 2 352 2 146 2 992 2 335

Ord SH Int 1 569 1 643 2 523 2 216 2 625 Inv & Loans 2 163 337 2 309 219 2 688 078 2 650 564 1 827 336

20 026

57 112

30 774

19 092

17 311

Minority Int 58 46 60 49 37 Tot Curr Ass 1 959 829 1 784 377 2 172 119 2 186 928 1 716 390

Ord SH Int

LT Liab 8 97 108 1 186 2 046

Tot Curr Liab 591 1 061 1 232 2 438 1 493 LT Liab 223 097 522 465 526 473 460 485 155 967

21 469

11 185

9 512

12 091

Tot Curr Liab

20 462

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 22.00 29.00 94.20 81.30 90.00

DPS (ZARc) 155.00 500.00 100.00 150.00 - HEPS-C (ZARc) 125.00 - 153.00 2.00 182.00 2.00

NAV PS (ZARc) 865.00 906.00 1 391.00 1 222.00 1 447.00 NAV PS (ZARc) 785.00 703.00 856.00 849.00 667.00

3 Yr Beta 0.29 0.46 1.03 0.75 0.52 3 Yr Beta - 0.06 - 0.15 - 0.65 0.43 0.50

Price High 597 1 099 800 949 605 Price High 560 530 600 620 510

Price Low 450 450 461 551 350 Price Low 370 353 461 368 325

479

421

575

400

539

Price Prd End

Price Prd End 520 563 745 640 595

RATIOS RATIOS 32.41 - 21.73 0.24 21.52 0.27

Ret on SH Fnd

Ret on SH Fnd - 8.35 13.59 12.51 10.28 11.35 Oper Pft Mgn 98.42 104.72 86.70 98.26 74.57

Oper Pft Mgn 3.58 3.17 5.91 5.69 8.09

D:E 0.06 0.20 0.13 0.87 0.90 D:E 0.11 0.29 0.24 0.21 0.09

4.72

0.85

2.75

0.89

2.11

Current Ratio

Current Ratio 2.83 2.22 1.74 1.23 1.56

Div Cover - 0.28 0.23 1.63 0.84 -

www.fundsdata.co.za www.fundsdata.co.za

109