Page 112 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 112

JSE - EQU Profile’s Stock Exchange Handbook: 2025 - Issue 3

Equites Property Fund Ltd. Europa Metals Ltd.

ISIN: ZAE000188843 SHORT: EQUITES CODE: EQU ISIN: AU0000090060 SHORT: EUROMET CODE: EUZ

REG NO: 2013/080877/06 FOUNDED: 2013 LISTED: 2014 REG NO: ACN097532137 FOUNDED: 2001 LISTED: 2011

NATURE OF BUSINESS: Equites Property Fund Ltd. is a South African NATURE OF BUSINESS: Europa Metals is a lead-zinc exploration

real estate investment trust, with a definite focus on being a market company focused exclusively on European projects. The company

leader in the logistics property market by developing and acquiring believes Europe, and in particular Spain, is an unrealised region for

A-grade, modern logistics facilities in prime locations in South modern mine development and that the opportunity to create new

Africa and the United Kingdom. Equites listed on the Johannesburg mines within a best practice social and environmental framework,

Stock Exchange on 18 June 2014 with a portfolio value of R1 billion near first class infrastructure, is significant. Currently, the company

and has since grown to a portfolio value of R28.4 billion at 29 is progressing its Toral Lead, Zinc and Silver project towards the

February 2024. The group continues to grow its portfolio through mine development phase. Europa Metals is quoted/listed on AIM

a significant development pipeline and high-quality acquisitions. and AltX of the JSE under the ticker code EUZ and is an Australian

Equites is SA’s only and largest listed, exclusively logistics-focused registered company.

REIT on the JSE to provide shareholders with pure exposure to SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--Iron & Steel

prime logistics assets. NUMBER OF EMPLOYEES: 0

SECTOR: RealEstate--RealEstate--REITs--Industrial REITs DIRECTORS: Kirby Dr E (ne), Smith D (ne), Campion M (Interim CEO, Aus)

NUMBER OF EMPLOYEES: 42 MAJOR ORDINARY SHAREHOLDERS as at 16 Sep 2024

DIRECTORS: Brey M (ind ne), Cross E (ind ne), Gouws A J (ne), Lynchwood Nominees 18.87%

Mkhize N (ind ne), Murray A D (ind ne), Ntuli K (ind ne), Tonelli F (ne), Pershing Nominees Ltd. 9.60%

Campher L (Chair, ind ne), Taverna-Turisan A (CEO), Gous R (COO), Dr C W Powell 6.91%

Razack L (CFO) POSTAL ADDRESS: PO Box 877, Lonehill, 2062

MAJOR ORDINARY SHAREHOLDERS as at 8 Nov 2024 MORE INFO: www.sharedata.co.za/sdo/jse/EUZ

Government Employees Pension Fund 19.80% COMPANY SECRETARY: Daniel Smith

Coronation Fund Managers 15.00% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Old Mutual Group 4.90% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

POSTAL ADDRESS: PO Box 7391, Roggebaai, 8012 AUDITORS: BDO Audit (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/EQU CAPITAL STRUCTURE Authorised Issued

COMPANY SECRETARY: Thabo Vilakazi EUZ Ords no par value - 102 171 790

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd. LIQUIDITY: Jul25 Avg 65 634 shares p.w., R23 401.5(3.3% p.a.)

AUDITORS: PwC Inc.

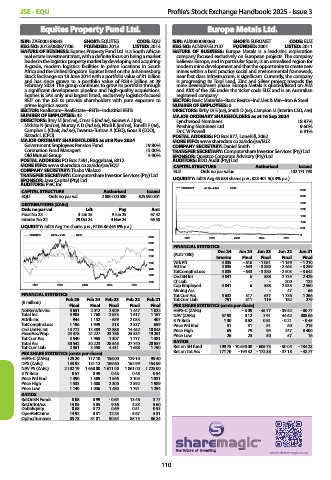

EUROMET 40 Week MA INDM

CAPITAL STRUCTURE Authorised Issued 3500

EQU Ords no par val 2 000 000 000 825 990 801 3000

DISTRIBUTIONS [ZARc] 2500

Ords no par val Ldt Pay Amt 2000

Final No 23 3 Jun 25 9 Jun 25 67.42 1500

Interim No 22 29 Oct 24 4 Nov 24 66.50 1000

LIQUIDITY: Jul25 Avg 7m shares p.w., R106.8m(46.8% p.a.) 500

EQUITES 40 Week MA REIV 0

2400 2021 2022 2023 2024 2025

2200

FINANCIAL STATISTICS

2000 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

1800 (AUD ’000) Interim Final Final Final Final

1600 Wrk Pft 4 835 - 616 - 1 051 - 1 159 - 1 210

Att Inc 4 835 - 633 - 3 380 - 2 463 - 3 259

1400

TotCompIncLoss 4 835 - 633 - 3 380 - 2 503 - 3 642

1200 Ord SH Int 4 841 6 558 2 735 2 428

1000 LT Liab - - - 200 122

2021 2022 2023 2024 2025 Cap Employed 4 841 6 558 2 935 2 550

Mining Ass - - - 47 66

FINANCIAL STATISTICS Tot Curr Ass 5 632 317 677 1 736 1 266

(R million) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21 Tot Curr Liab 791 311 119 182 279

Final Final Final Final Final PER SHARE STATISTICS (cents per share)

NetRent/InvInc 3 651 2 012 2 909 1 447 1 022 HEPS-C (ZARc) - - 8.09 - 45.77 - 39.52 - 80.77

Total Inc 3 985 1 768 2 673 1 617 1 167 NAV (ZARc) 57.93 0.12 7.91 44.62 808.66

Attrib Inc 944 1 152 - 639 2 033 407 3 Yr Beta 1.30 0.62 0.81 - 0.21 - 0.45

TotCompIncLoss 1 196 1 949 318 2 337 699 Price Prd End 51 31 51 60 215

Ord UntHs Int 13 772 13 383 12 888 14 452 10 843 Price High 69 79 94 247 8 400

FixedAss/Prop 24 478 24 227 23 786 25 534 19 261 Price Low 26 25 50 57 16

Tot Curr Ass 3 540 1 968 1 307 1 777 1 381

Total Ass 30 542 30 223 28 545 27 740 20 857 RATIOS

Tot Curr Liab 2 361 3 550 4 431 1 688 1 790 Ret on SH fund 199.75 - 10 550.00 - 605.73 - 90.05 - 134.23

PER SHARE STATISTICS (cents per share) Ret on Tot Ass 171.70 - 194.32 - 172.38 - 37.18 - 42.77

HEPS-C (ZARc) 125.20 117.10 156.00 129.10 99.40

DPS (ZARc) 133.92 131.12 169.60 162.99 154.99

NAV PS (ZARc) 2 102.19 1 668.00 1 611.00 1 861.00 1 725.00

3 Yr Beta 0.57 0.49 0.43 0.48 0.54

Price Prd End 1 390 1 309 1 546 2 105 1 831

Price High 1 533 1 600 2 300 2 392 1 989

Price Low 1 140 1 036 1 480 1 791 1 294

RATIOS

RetOnSH Funds 8.08 8.99 - 0.64 13.46 3.77

RetOnTotAss 13.05 5.85 9.36 5.83 5.60

Debt:Equity 0.68 0.72 0.69 0.51 0.53

OperRetOnInv 14.92 8.31 12.23 5.67 5.31

OpInc:Turnover 85.78 81.01 90.54 85.75 86.24

110