Page 84 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 84

JSE - AST Profile’s Stock Exchange Handbook: 2025 - Issue 3

Astral Foods Ltd. Attacq Ltd.

ISIN: ZAE000029757 SHORT: ASTRAL CODE: ARL

REG NO: 1978/003194/06 FOUNDED: 2001 LISTED: 2001

NATURE OF BUSINESS: The Group holds investments in

companies, with their primary activities in animal feed pre-mixes,

manufacturing of animal feeds, broiler genetics, the production

and sale of day-old broiler chicks and hatching eggs, integrated

breeder and broiler production operations, abattoirs and the sale ISIN: ZAE000177218 SHORT: ATTACQ CODE: ATT

and distribution of various key brands. REG NO: 1997/000543/06 FOUNDED: 2005 LISTED: 2013

SECTOR: ConsStaples--Food,Beverage&Tobacco--Food Producers--Farmers NATURE OF BUSINESS: Attacq is a South African Real Estate Investment

NUMBER OF EMPLOYEES: 12 293 Trust (REIT), listed on the JSE Ltd. (JSE) and A2X Markets. Attacq is

DIRECTORS: Fouché D (ld ind ne), Mayet S (ind ne), Potgieter W F (ind ne), committed to its strategic focus of creating sustainable and thriving

Shabangu T M (ind ne), van Heerden F G, Eloff Dr T (Chair, ind ne), spaces that drive economic growth, enhance communities, and deliver

Arnold G D (CEO), Ferreira D D (CFO) long-term value for all stakeholders. As a forward-thinking precinct

MAJOR ORDINARY SHAREHOLDERS as at 8 Apr 2025 developer and owner, the company leverages innovation to transform

Government Employees Pension Fund 26.97% spaces into vibrant, high-performing hubs that elevate the client

Astral Operations Ltd. 9.53% experience. Attacq’s client-focused approach ensures that satisfaction,

Allan Gray (Pty) Ltd. 5.07% trust, and excellence remain at the core of everything they do.

POSTAL ADDRESS: Postnet Suite #78, Private Bag X153, Bryanston, 2021 SECTOR: RealEstate--RealEstate--REITS--Diversified

MORE INFO: www.sharedata.co.za/sdo/jse/ARL NUMBER OF EMPLOYEES: 173

COMPANY SECRETARY: Leonie Marupen DIRECTORS: Tredoux P (Chair, ind ne), El Haimer H R (ld ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. van Niekerk J R (CEO), Nana R (CFO), De Buck F F T (ind ne), Joubert

SPONSOR: Nedbank Corporate and Investment Banking K (ind ne), Leeuw T P (ind ne), Mkhari I N (ind ne), Rohde Dr G

AUDITORS: PwC Inc. (ind ne), Swiegers A E (ind ne), van der Merwe J H P (ind ne)

CAPITAL STRUCTURE Authorised Issued MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025

ARL Ords 1c ea 75 000 000 42 922 235 Coronation Fund Managers 20.85%

Government Employees Pension Fund 17.51%

DISTRIBUTIONS [ZARc] Old Mutual Group 4.30%

Ords 1c ea Ldt Pay Amt POSTAL ADDRESS: PostNet Suite 016, Private Bag X81, Halfway House,

Interim No 44 10 Jun 25 17 Jun 25 220.00 1685

Final No 43 14 Jan 25 20 Jan 25 520.00 EMAIL: brenda@attacq.co.za

LIQUIDITY: Jul25 Avg 621 086 shares p.w., R109.7m(75.2% p.a.) WEBSITE: www.attacq.co.za

TELEPHONE: 010-549-1050

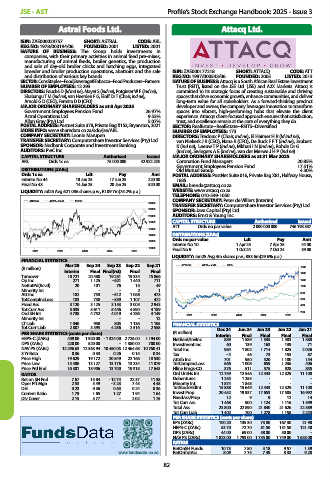

ASTRAL 40 Week MA FOOD COMPANY SECRETARY: Peter de Villiers (interim)

24000

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

22000 SPONSOR: Java Capital (Pty) Ltd.

20000 AUDITORS: Ernst & Young Inc.

18000 CAPITAL STRUCTURE Authorised Issued

ATT Ords no par value 2 000 000 000 746 198 337

16000

14000 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

12000

Interim No 10 1 Apr 25 7 Apr 25 44.00

10000

2021 2022 2023 2024 2025 Final No 9 1 Oct 24 7 Oct 24 39.00

LIQUIDITY: Jun25 Avg 4m shares p.w., R53.6m(29.6% p.a.)

FINANCIAL STATISTICS

(R million) Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 ATTACQ 40 Week MA REIV 1600

Interim Final Final(rst) Final Final

Turnover 10 721 20 480 19 251 19 334 15 866 1400

Op Inc 271 1 125 - 621 1 440 711 1200

NetIntPd(Rcvd) 20 101 76 15 49 1000

Minority Int - - - 2 1

Att Inc 182 753 - 512 1 068 473 800

TotCompIncLoss 183 738 - 539 1 107 472 600

Fixed Ass 3 120 3 125 3 153 3 003 2 943 400

Tot Curr Ass 5 035 5 611 5 446 4 890 4 189

Ord SH Int 4 738 4 752 4 019 4 786 4 149 2021 2022 2023 2024 2025 200

Minority Int - - - - 12

LT Liab 1 040 950 805 1 136 1 105 FINANCIAL STATISTICS

Tot Curr Liab 2 807 3 395 4 286 2 516 2 558 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

PER SHARE STATISTICS (cents per share) (R million) Interim Final Final Final Final

HEPS-C (ZARc) 409.00 1 920.00 - 1 324.00 2 726.00 1 194.00 NetRent/InvInc 889 1 589 1 535 1 483 1 588

DPS (ZARc) 220.00 520.00 - 1 380.00 700.00 Investment inc 60 139 163 139 71

NAV PS (ZARc) 12 296.63 12 363.94 10 450.05 12 464.68 10 760.41 Total Inc 964 1 802 1 714 1 825 2 026

3 Yr Beta 0.36 0.33 0.26 0.15 0.34 Tax - 4 46 73 153 87

Price High 19 629 19 172 20 549 22 166 18 530 Attrib Inc 701 950 520 1 180 154

Price Low 15 400 13 127 13 176 13 234 11 079 TotCompIncLoss 666 1 008 659 1 236 406

Price Prd End 16 301 18 906 13 700 19 318 17 643 Hline Erngs-CO 376 511 575 928 855

RATIOS Ord UntHs Int 12 759 12 546 12 443 12 329 11 108

Ret on SH Fnd 7.67 15.84 - 12.74 22.37 11.38 Debentures 1 255 1 255 - - -

Oper Pft Mgn 2.53 5.49 - 3.23 7.45 4.48 Minority Int 1 874 1 848 - - -

D:E 0.23 0.36 0.63 0.24 0.36 TotStockHldInt 15 888 15 649 12 443 12 329 11 108

Current Ratio 1.79 1.65 1.27 1.94 1.64 Invest Prop 20 452 19 937 17 653 17 585 16 992

Div Cover 2.15 3.77 - 2.02 1.75 FixedAss/Prop 12 9 9 12 14

Tot Curr Ass 1 468 900 1 124 1 116 1 599

Total Ass 23 800 22 890 21 840 21 626 22 589

Tot Curr Liab 1 402 700 1 278 1 158 2 223

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 100.20 135.30 73.80 167.30 21.90

HEPS-C (ZARc) 53.70 72.70 81.50 131.50 121.40

DPS (ZARc) 44.00 69.00 58.00 50.00 -

NAV PS (ZARc) 1 823.00 1 793.00 1 735.00 1 749.00 1 628.00

RATIOS

RetOnSH Funds 10.73 7.80 4.18 9.57 1.39

www.fundsdata.co.za RetOnTotAss 8.09 7.75 7.49 8.33 9.28

82