Page 83 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 83

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - ASS

Assura plc Astoria Investment Ltd.

ISIN: GB00BVGBWW93 SHORT: ASSURA CODE: AHR ISIN: MU0499N00015 SHORT: ASTORIA CODE: ARA

REG NO: 09349441 FOUNDED: 2003 LISTED: 2024 REG NO: 1297585 C1/GBL FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Assura is a leading United Kingdom (“UK”) NATURE OF BUSINESS: Astoria is a global investment company

diversified healthcare property specialist and UK Real Estate which inward listed on the JSE in November 2015. The objective of

Investment Trust (“REIT”) listed on the Main Market of the LSE. the company is to deliver a sustained, strong compound growth in

SECTOR: RealEstate--RealEstate--REITS--Health value per share in USD. The company invests in global, high quality

NUMBER OF EMPLOYEES: 0 equities, niche funds and private equity.

DIRECTORS: Barrell Dr S (ind ne), Cariaga E (ind ne), SECTOR: Fins--FinServcs--ClosedEndInvstmnts--ClosedEndInvstmnts

Davies J (snr ind ne), Fowler L (ind ne), Gordon N (ind ne), NUMBER OF EMPLOYEES: 0

Smith E (Chair, ne), Murphy J (CEO), Cottam J (CFO) DIRECTORS: Botha C (ind ne), De Chasteigner Du Mée C J (ne, Mau),

MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2025 Jorgensen C J (ind ne), Rosevear D (alt), Viljoen P G (ne),

Blackrock Inc. 9.98% Hardy N F (Chair, ind ne, Mau), Schweizer D (CFO)

Schroders plc 5.24% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

The Goldman Sachs Group, Inc. 5.15% Calibre International Investment Holdings 9.90%

MORE INFO: www.sharedata.co.za/sdo/jse/AHR Calibre Investment Holdings (Pty) Ltd. 9.90%

COMPANY SECRETARY: Orla Ball Seneca Investments (Pty) Ltd. 6.70%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS: 3rd Floor, La Croisette, Grand Baie, Mauritius

SPONSOR: Nedbank Corporate and Investment Banking, a division of MORE INFO: www.sharedata.co.za/sdo/jse/ARA

Nedbank Ltd. COMPANY SECRETARY: Clermont Consultants (MU) Ltd.

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

AHR Ord GBP10p each - 3 250 608 887 SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: Ernst & Young Mauritius

DISTRIBUTIONS [GBPp] CAPITAL STRUCTURE Authorised Issued

Ord GBP10p each Ldt Pay Amt ARA Ords USD2.166c ea - 62 062 275

Quarterly No 3 3 Jun 25 9 Jul 25 0.84

Quarterly No 2 4 Mar 25 9 Apr 25 0.84 DISTRIBUTIONS [USDc]

LIQUIDITY: Jul25 Avg 546 399 shares p.w., R6.1m(0.9% p.a.) Ords USD2.166c ea Ldt Pay Amt

Special No 1 24 Mar 20 30 Mar 20 8.63

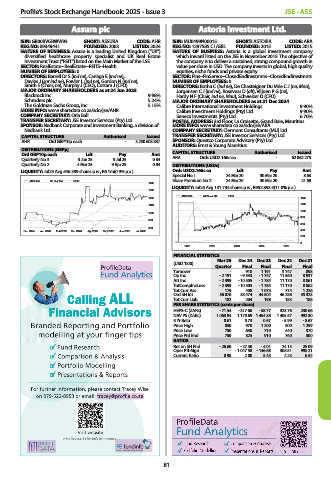

ASSURA 80 Day MA REIV Share Premium No 2 24 Mar 20 30 Mar 20 21.69

1400

LIQUIDITY: Jul25 Avg 131 734 shares p.w., R952 853.5(11.0% p.a.)

1300

ASTORIA 40 Week MA FINA

1200 1400

1200

1100

1000

1000

800

900

600

800

Dec 2024 Jan 2025 Feb 2025 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025 400

200

0

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

(USD ’000) Mar 25 Dec 24 Dec 23 Dec 22 Dec 21

Quarter Final Final Final Final

Turnover - 910 1 191 3 747 898

Op Inc - 2 191 - 9 533 - 1 747 11 560 8 937

Att Inc - 2 399 - 10 505 - 1 784 11 170 8 861

TotCompIncLoss - 2 399 - 10 505 - 1 784 11 170 8 862

Tot Curr Ass 179 408 1 075 774 1 226

Ord SH Int 36 076 38 474 44 504 46 288 35 323

Tot Curr Liab 182 204 198 183 188

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 71.54 - 317.60 - 58.77 323.76 230.66

NAV PS (ZARc) 1 068.94 1 170.69 1 454.38 1 405.57 992.30

3 Yr Beta 0.61 0.73 0.67 - 5.99 - 8.67

Price High 850 970 1 200 900 1 259

Price Low 750 630 710 440 370

Price Prd End 750 825 910 760 500

RATIOS

Ret on SH Fnd - 26.60 - 27.30 - 4.01 24.13 25.09

Oper Pft Mgn - - 1 047.58 - 146.68 308.51 995.21

Current Ratio 0.98 2.00 5.43 4.23 6.52

81